Trees Corporation (CANN)

Seeing the Tech Forest Through Trees of Volatility

The Nasdaq-100 Index (NDX) is lower by 3.36% over the past month, and plenty of growth stocks across all market capitalization segments performing significantly worse than that. Some retail investors are worried the once easy money tech trade is evaporating.

B2Gold: Don't Miss The Forest For The Trees

B2Gold delivered strong Q2'25 operational and financial results, with all mines outperforming their budget and the company hitting its free cash flow inflection point. The company continues to lay the foundation for an improved production profile at Otjikoto (Springbok), a potential 5th mine in Gramalote, and a possible expansion at Goose (4k-->6k TPD). Given BTG's strong long-term track record, room for multiple expansions with a new Tier-1 jurisdiction asset in production, and deep discount to peers, sharp pullbacks should offer buying opportunities.

Golden Entertainment: Downgrade Misses The Forest For The Trees

Golden Entertainment's deleveraging and strong cash flow support robust buybacks and dividends, offering at least 7% annual shareholder returns even in conservative scenarios. Despite a downgrade from Truist Securities citing Strat weakness and muted M&A prospects, I maintain my $32 price target and 'Buy' rating, seeing the downgrade as an opportunity. Q2 headwinds are real but manageable; room occupancy and slot performance show resilience, and FCF coverage for dividends and buybacks remains solid under all scenarios.

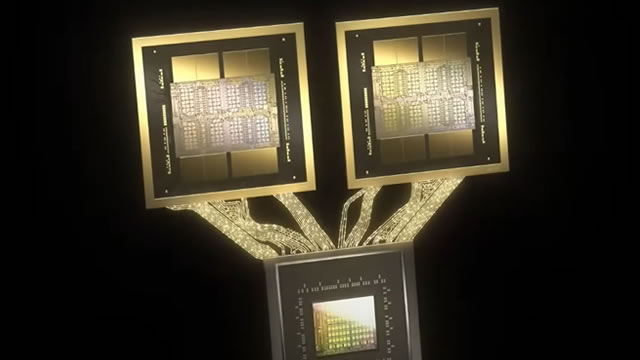

Trees Don't Grow To The Sky, But Nvidia Does

Nvidia Corporation delivered strong Q1 revenue growth and outperformed expectations, despite a significant gross margin hit from China export restrictions. Data Center and Gaming segments remain robust growth engines, with AI demand and new product launches driving results. Valuation is elevated but justified by Nvidia's market leadership, high earnings growth, and strong free cash flow generation.

Trees Always Grow, But Weyerhaeuser Doesn't

Weyerhaeuser Company is best assessed for total returns over time, but long-term returns are not attractive, leading to a Hold rating. Historical returns over the past decade were 44%, underperforming simpler investments like the 10Y Treasury Note, highlighting the cyclicality of the timber business. WY's business model involves timberlands, real estate, and wood products, with earnings primarily distributed as dividends due to REIT status.

Super Micro CEO Pledged $20M for Forests. Years Later, There Are 100 Trees.

Charles Liang and his wife made a $20 million commitment to the environment. Their forestry work appears limited to 100 trees in San Francisco.

Nvidia Stock: Would You Believe Trees Don't Grow To The Sky

Despite Nvidia Corporation's strong financial performance, we maintain a cautious stance due to potential overinvestment in AI data centers and historical precedents of market saturation. Nvidia's recent rally is driven by data center revenue, with significant revenue concentration from three major customers, posing a risk. AI hardware spending may stabilize by 2025, and Nvidia's current valuation seems to have most future growth priced in, reducing the margin of safety.

Verizon: The Market Is Missing The Forest For The Trees

Verizon is down by more than 6% after reporting a somewhat mixed quarter. The stock is nearly flat year-to-date, which goes against the meaningful progress being made in certain areas. The dividend appears safe, and we are likely to witness a notable improvement in profitability and free cash flow through the rest of 2024.