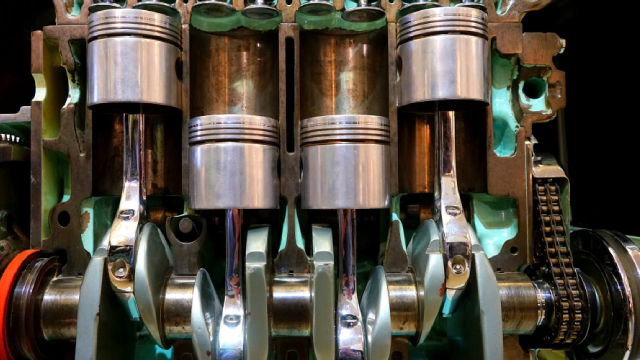

Cummins Inc. (CMI)

This is Why Cummins (CMI) is a Great Dividend Stock

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Cummins (CMI) have what it takes?

Cummins: A Blue-Chip Dividend Stock To Buy Now

Shares of Cummins have rallied in the last three months as the S&P 500 has been flat. The company's revenue climbed to a record in the second quarter, and diluted EPS grew as well. CMI's balance sheet strength remains sufficient to support an A credit rating from S&P.

Insider Selling at Cummins (CMI): Time to Exit the Stock?

Sharon Barner's recent share sale doesn't necessarily signal doubt in Cummins' (CMI) future. With solid fundamentals and a focus on long-term growth, we recommend holding CMI stock.

Cummins: Dividend Strength In A Challenging Economy

Cummins Inc. achieves record revenues and solid profitability in Q2 2024 despite a challenging economic environment. Strategic partnerships and expansion into electric mobility position Cummins for long-term growth. Consistent dividend growth and a healthy balance sheet make Cummins a standout choice for dividend investors seeking industrial exposure.

3 Hydrogen Stocks Poised for Explosive Growth by 2025

Hydrogen energy has become a leading alternative energy source, especially with growing concerns about climate change and rising energy costs. While the developments on efficiently converting hydrogen to energy have been ongoing, we've seen companies continue to push to make this a leading energy alternative to combat carbon footprint and energy costs.

Cummins (CMI) Q2 Earnings & Sales Top Estimates, Increase Y/Y

Cummins (CMI) raises its full-year 2024 sales forecast on stronger-than-expected demand across several markets, notably in North America's on-highway and power generation sectors.

Cummins Inc. (CMI) Q2 2024 Earnings Call Transcript

Cummins Inc. (NYSE:CMI ) Q2 2024 Earnings Conference Call August 1, 2024 10:00 AM ET Company Participants Chris Clulow - Vice President, Investor Relations Jennifer Rumsey - Chair & Chief Executive Officer Mark Smith - Chief Financial Officer Conference Call Participants Steven Fisher - UBS Jamie Cook - Truist Securities Steve Volkmann - Jefferies Jerry Revich - Goldman Sachs Angel Castillo - Morgan Stanley David Raso - Evercore ISI Tami Zakaria - JPMorgan Tim Thein - Raymond James Noah Kaye - Oppenheimer Jeff Kauffman - Vertical Research Partners Kyle Menges - Citigroup Operator Greetings and welcome to Cummins, Inc. Second Quarter 2024 Earnings Call. On our call today is Jen Rumsey, Chair and CEO; Mark Smith, Vice President and CFO; and Chris Clulow, Vice President of Investor Relations.

Cummins (CMI) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Cummins (CMI) give insight into how the company performed in the quarter ended June 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Cummins (CMI) Q2 Earnings and Revenues Surpass Estimates

Cummins (CMI) came out with quarterly earnings of $5.26 per share, beating the Zacks Consensus Estimate of $4.85 per share. This compares to earnings of $5.18 per share a year ago.

Cummins raises full-year outlook as demand picks up steam

U.S. truck engine maker Cummins Inc on Thursday beat second-quarter estimates and forecast improved revenue margins boosted by demand in the power generation market, sending its shares up 4.6% in early trading.

Unveiling Cummins (CMI) Q2 Outlook: Wall Street Estimates for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Cummins (CMI), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2024.

Cummins (CMI) Expected to Beat Earnings Estimates: What to Know Ahead of Q2 Release

Cummins (CMI) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.