Coinbase Global, Inc. (COIN)

3 ‘Little Tech' Stocks That Could Get a Huge Trump Boost

U.S. technology equities appear to be approaching troubled waters. Wednesday marked a $1 trillion market rout for the tech-heavy Nasdaq Composite, one of the index's worst since 2022.

Get Your Money Out of These 3 Growth Stocks Before the End of July

As we approach the end of July, the allure of high-flying growth stocks may be wearing thin for some investors. While these stocks have been the darlings of Wall Street during periods of bullish market sentiments, not all growth narratives continue upward indefinitely.

Shareholder Rights Advocates at Levi & Korsinsky Investigate Coinbase Global, Inc. (COIN) Regarding Possible Securities Fraud Violations

NEW YORK, NY / ACCESSWIRE / July 27, 2024 / Levi & Korsinsky notifies investors that it has commenced an investigation of Coinbase Global, Inc. ("Coinbase") (NASDAQ:COIN) concerning possible violations of federal securities laws. The Financial Conduct Authority ("FCA"), a U.K. financial regulator, issued a press release on July 25, 2024, announcing that it had fined Coinbase's U.K. unit CB Payments Limited ("CBPL") approximately $4.5 million "for repeatedly breaching a requirement that prevented the firm from offering services to high-risk customers.

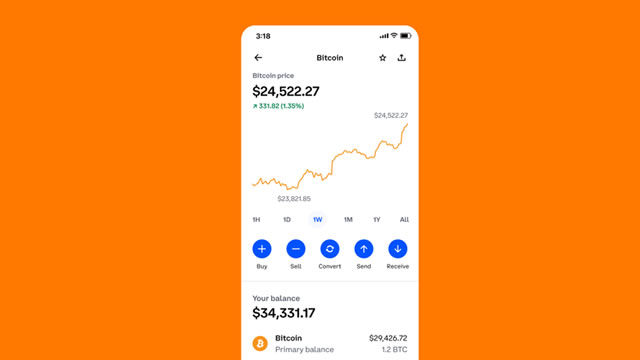

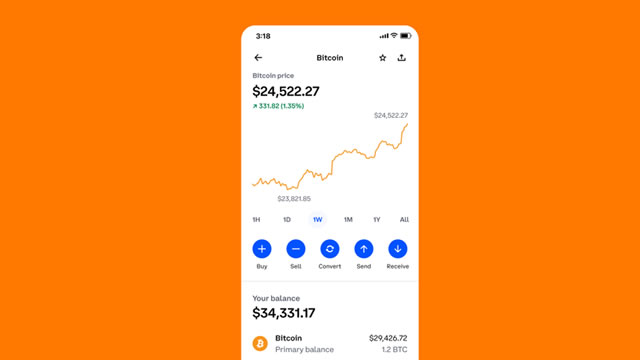

Can Coinbase Reach a $1 Trillion Market Cap?

Coinbase would need to increase its current valuation by 1,400% to hit a $1 trillion market cap. The company's growth has been impressive, with user activity and revenue surging significantly since 2019.

COIN Stock: OpenAI Exec Joins Coinbase's Board of Directors

Coinbase (NASDAQ: COIN ) stock is in the news Friday after an executive of OpenAI joined the crypto exchange company's board of directors. Coinbase has added Chris Lehane to its board of directors.

3 Overvalued Growth Stocks to Sell Before They Correct by 30%

Even after some recent correction, the S&P 500 index is not far from all-time highs. With the possibility of rate cuts, there is a reason to remain bullish on equities.

U.S. crypto exchange Coinbase adds three board members, including OpenAI executive

U.S. cryptocurrency exchange Coinbase has added three new members to its board of directors, including an executive from ChatGPT-maker OpenAI, as the company steps up its efforts to sway U.S. crypto policy, Coinbase told Reuters on Thursday.

Coinbase Global, Inc. (COIN) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Coinbase Global (COIN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

UK watchdog fines Coinbase's CB Payments for poor controls

Britain's Financial Conduct Authority (FCA) has fined Coinbase business CB Payments Limited (CPBL) 3.5 million pounds ($4.5 million) for poor anti-money laundering controls, the watchdog's first enforcement action against a company involved in cryptoassets trading.

Coinbase UK unit fined $4.5 million by British regulator over 'high-risk' customer breaches

U.K. regulators fined Coinbase's U.K. arm £3.5 million ($4.5 million) on Thursday over breaches of a voluntary agreement designed to stop the cryptocurrency exchange onboarding "high-risk customers." Coinbase Global shares were just under 2% lower in U.S. pre-market trade.

Report: Coinbase Asset Management Creating Tokenized Money Market Fund

Coinbase Asset Management is reportedly creating a tokenized money market fund. The company, which is an arm of cryptocurrency exchange Coinbase, is working on the project with Bermuda-based Apex Group, CoinDesk reported Wednesday (July 24).

7 Blockchain Stocks to Buy Before July 27

Investors should have a growing appreciation for the importance of blockchain stocks and the subsequent returns on investment that can come from them. I believe there are a few tailwinds to consider, prompting swift investor action before July 27.