Dominion Energy, Inc. (D)

2 Monthly Dividends, Up To A 7% Yield

Realty Income Corp. stands out with a 55-year track record, diversified properties and solid financials, offering a 5% yield and growth potential. Cohen & Steers Infrastructure Fund provides diversified exposure to utilities, energy, and real estate with a 7.2% yield and benefits from rising electrification and data center demand. Both investments offer strong fundamentals and reliable monthly dividends, making them attractive choices for income-focused investors.

Dominion Energy: A Favorable Risk-To-Reward Prospect

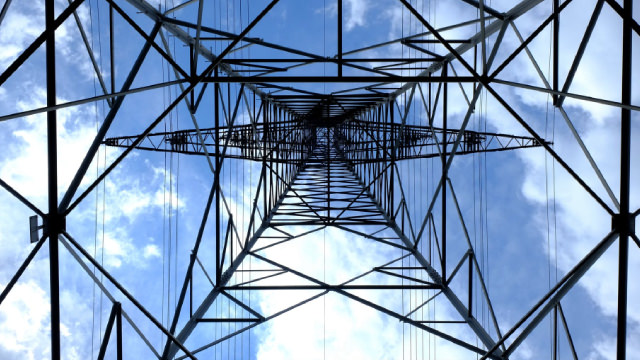

Dominion Energy's recent asset sales and debt reduction have improved its financial outlook, warranting an upgrade from 'hold' to a 'soft buy'. The company has significant infrastructure, including 29.5 gigawatts of electric capacity and extensive transmission and distribution networks. Management's guidance for 2024 suggests strong EBITDA and operating cash flow growth, positioning Dominion Energy as undervalued compared to peers.

Dominion Energy (D) Stock Sinks As Market Gains: Here's Why

Dominion Energy (D) reachead $57.13 at the closing of the latest trading day, reflecting a -0.16% change compared to its last close.

Dominion Energy (D) Ascends While Market Falls: Some Facts to Note

The latest trading day saw Dominion Energy (D) settling at $57.93, representing a +0.78% change from its previous close.

The Fed Just Cut Interest Rates: 3 Stocks to Buy Hand Over Fist

Dominion Energy isn't a boring utility stock. D.R. Horton is poised to benefit from rate cuts and a major U.S. housing shortage.

Dominion Energy (D) Outperforms Broader Market: What You Need to Know

In the most recent trading session, Dominion Energy (D) closed at $58.53, indicating a +0.64% shift from the previous trading day.

3 High-Yield Stocks to Buy Hand Over Fist in September

Dominion Energy should benefit if the Fed cuts interest rates. Pfizer is poised to return to growth thanks to business development deals and a strong pipeline.

Dominion Energy (D) Rises But Trails Market: What Investors Should Know

In the closing of the recent trading day, Dominion Energy (D) stood at $57.37, denoting a +0.46% change from the preceding trading day.

The Comeback Kid: Why Dominion Energy Remains One Of My Favorite Utilities

Dominion Energy is rebounding with strong EPS growth, debt reduction, and benefits from rising power demand, especially from data centers. Despite past challenges like dividend cuts and investments in wind power, Dominion's fundamentals are improving, supporting a positive outlook. With an attractive valuation, strategic investments, and a solid growth trajectory, Dominion Energy offers compelling value for long-term investors.

Dominion Energy Hits 52-Week High: What's Driving the Stock?

D hits a new 52-week high owing to the company's consistent strong performance and approval from the NRC to extend its North Anna power station's operations.

All It Takes Is $800 Invested in Each of These 3 High-Yield Dividend Stocks to Generate Over $100 in Passive Income Per Year

Kinder Morgan is keeping its balance sheet in check while exploring new growth opportunities. Dominion Energy has cleared some major hurdles that have been holding it back.

NextEra vs. Dominion: What Do You Want, Dividend Yield or Dividend Growth?

NextEra Energy has a long track record of increasing its dividend annually. NextEra Energy's dividend growth rate of around 10% has attracted a loyal following on Wall Street, but left the stock with a premium price.