Quest Diagnostics Inc. (DGX)

Here's How Quest Diagnostics Is Placed Ahead of Q3 Earnings

DGX is poised for solid Q3 2025 results, backed by strong DIS growth, strategic M&A and robust test demand across key health segments.

Quest Diagnostics: Investing In Healthcare's Future Today

Quest Diagnostics (DGX) remains a buy, which is also what the consensus today said too. Quest can benefit from continued demand for specific diagnostic testing across a broad range of clinical areas. It has proven itself as a cashflow and dividend grower, achieving strong margins among peers and similar competitor Labcorp, and making progress on FDA approvals.

Why Quest Diagnostics (DGX) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Quest Diagnostics Joins Forces With Epic to Improve Laboratory Testing

DGX teams up with Epic on Project Nova to streamline lab testing, boost efficiency, and enhance patient and provider experiences.

DGX's Haystack Oncology Teams Up With Rutgers Cancer Institute

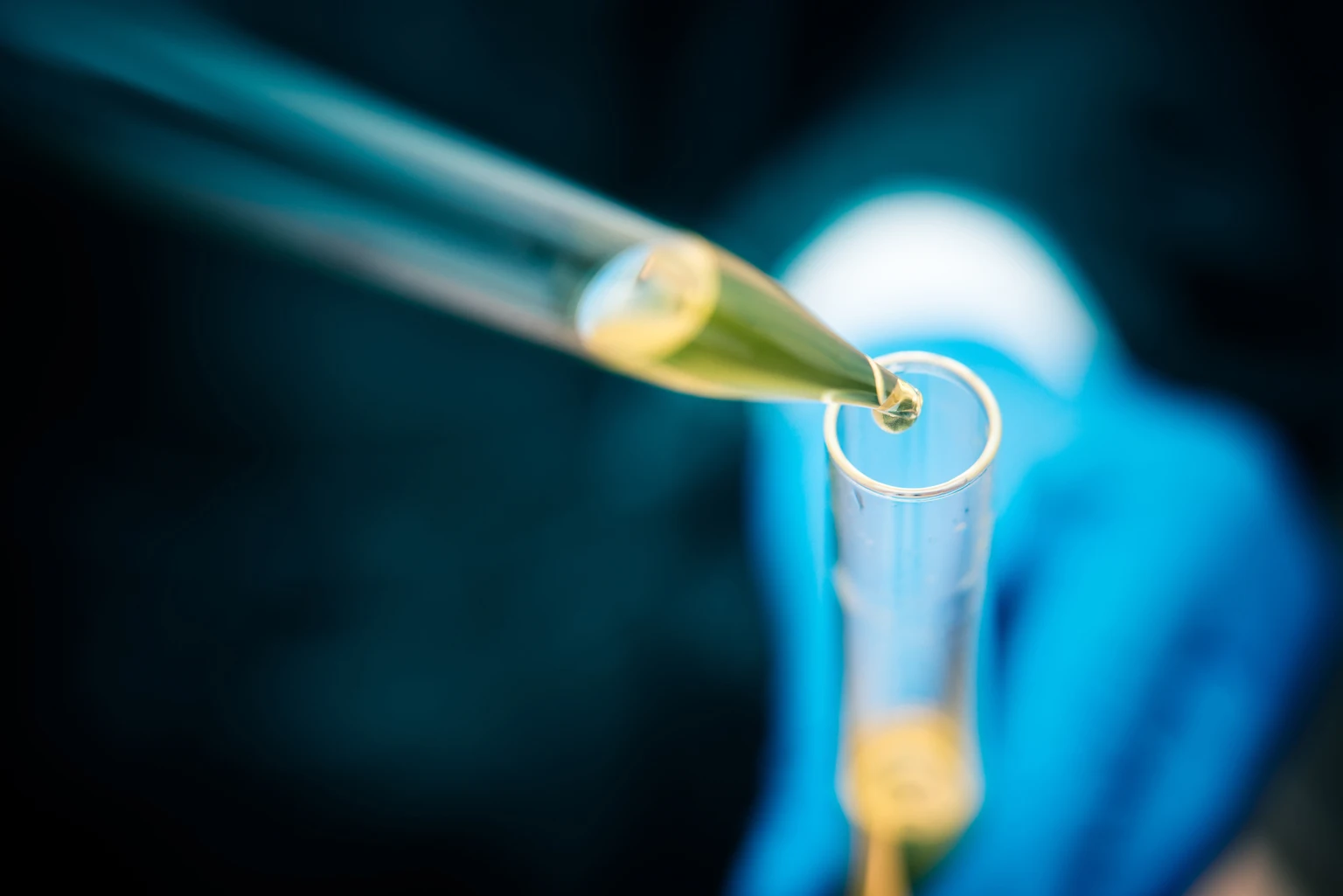

Quest Diagnostics' Haystack Oncology joins Rutgers Cancer Institute to study how its ctDNA MRD test can guide therapy for stage II/III lung cancer.

DGX Stock Gains Following a New Joint Venture With Corewell Health

Quest Diagnostics shares rise after forming a joint venture with Corewell Health to expand advanced lab services across Michigan.

Why Is Quest Diagnostics (DGX) Up 8.2% Since Last Earnings Report?

Quest Diagnostics (DGX) reported earnings 30 days ago. What's next for the stock?

Should Quest Diagnostics Stock Be in Your Portfolio Right Now?

DGX drives growth with advanced diagnostics, acquisitions and cost savings, but rising debt and macro risks weigh on its outlook.

Here's Why Quest Diagnostics (DGX) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Why Quest Diagnostics (DGX) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Quest Diagnostics Incorporated (DGX) Q2 2025 Earnings Call Transcript

Quest Diagnostics Incorporated (NYSE:DGX ) Q2 2025 Earnings Conference Call July 22, 2025 8:30 AM ET Company Participants James E. Davis - Chairman, CEO & President Sam A.

Quest Diagnostics Beats Q2 Earnings & Revenue Estimates, Stock Rises

DGX tops Q2 estimates with 15.2% revenue growth and a strong EPS beat, lifting the stock 3.2% in pre-market trading.