Dover Corporation (DOV)

Dover Corporation (DOV) Q2 2025 Earnings Call Transcript

Dover Corporation (NYSE:DOV ) Q2 2025 Earnings Conference Call July 24, 2025 9:30 AM ET Company Participants o - Corporate Participant p - Corporate Participant a - Corporate Participant R - Corporate Participant i - Corporate Participant h - Corporate Participant e - Corporate Participant Christopher B. Woenker - Senior VP & CFO Jack Dickens - Vice President of Investor Relations Richard Joseph Tobin - President, CEO & Chairman of the Board Conference Call Participants Andrew Burris Obin - BofA Securities, Research Division Brett Logan Linzey - Mizuho Securities USA LLC, Research Division Charles Stephen Tusa - JPMorgan Chase & Co, Research Division Christopher M.

Dover Corporation (DOV) Q2 Earnings and Revenues Beat Estimates

Dover Corporation (DOV) came out with quarterly earnings of $2.44 per share, beating the Zacks Consensus Estimate of $2.39 per share. This compares to earnings of $2.36 per share a year ago.

Countdown to Dover (DOV) Q2 Earnings: A Look at Estimates Beyond Revenue and EPS

Beyond analysts' top-and-bottom-line estimates for Dover (DOV), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended June 2025.

Dover Ready to Report Q2 Earnings: What to Expect From the Stock?

DOV's Q2 earnings are likely to have risen despite revenue dips, with strong segment demand and acquisitions aiding performance.

Dover Corporation (DOV) Earnings Expected to Grow: Should You Buy?

Dover (DOV) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Will Dover (DOV) Beat Estimates Again in Its Next Earnings Report?

Dover (DOV) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Dover: An Industrial Conglomerate That Is Firing On All Cylinders

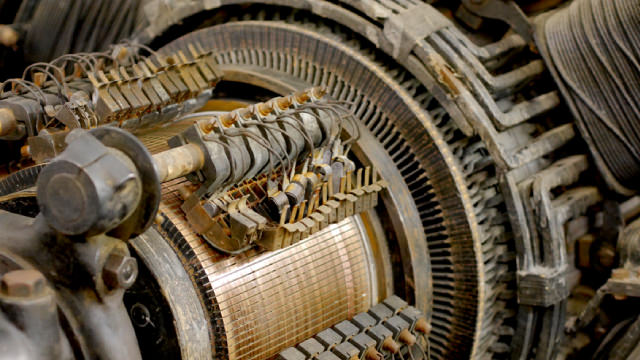

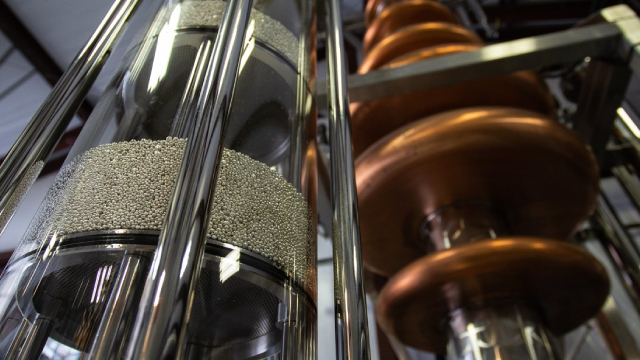

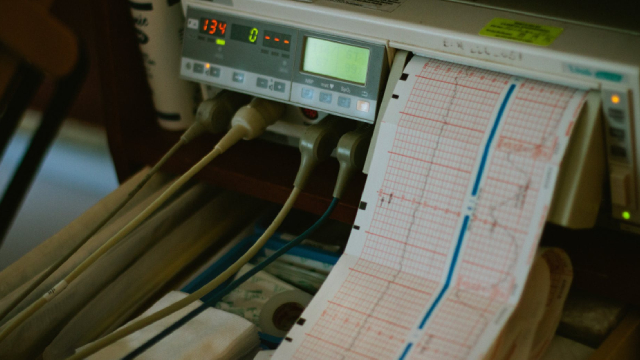

Dover's Engineering Products segment is rebounding as tariff headwinds ease and new government spending boosts aerospace and defense prospects. Clean Energy & Fueling is positioned for strong growth, leveraging recent acquisitions and restructuring to realize synergies and double-digit expansion in cryogenics. Pumps & Solutions is a key growth engine, driven by secular trends in data centers and biopharma, with high-margin thermal connectors and precision components.

Illinois Tool Works: Superior Capital Allocation Compared To Dover

Illinois Tool Works boasts strong ROIC, efficient capital allocation, and a shareholder-friendly approach, making it attractive for dividend investors seeking stability. Programmatic acquisitions and strategic divestitures have enhanced ITW's portfolio, but growth opportunities are less visible compared to peers like Dover. ITW's manageable debt and robust free cash flow support its dividend, though higher leverage poses a risk in a deep recession scenario.

Dover Boosts Pumps & Process Solutions Portfolio With ipp Acquisition

DOV expands its hygienic pump offerings with ipp acquisition, deepening its Pumps & Process Solutions portfolio.

Dover Boosts Pumps & Process Solutions Portfolio With SIKORA Buyout

DOV acquires SIKORA to strengthen its MAAG business and expand into high-growth precision processing markets.

Dover Gains From Solid Bookings Despite Low Aerospace Volumes

DOV gains from strong bookings and acquisitions while grappling with lower aerospace volumes and margin pressure from supply-chain issues.

Deciphering Dover (DOV) International Revenue Trends

Evaluate Dover's (DOV) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.