DXP Enterprises, Inc. (DXPE)

Are Industrial Products Stocks Lagging DXP Enterprises (DXPE) This Year?

Here is how DXP Enterprises (DXPE) and RBC Bearings (RBC) have performed compared to their sector so far this year.

DXP Enterprises (DXPE) Outperforms Broader Market: What You Need to Know

In the most recent trading session, DXP Enterprises (DXPE) closed at $99.71, indicating a +1.38% shift from the previous trading day.

DXP Enterprises (DXPE) Stock Dips While Market Gains: Key Facts

In the most recent trading session, DXP Enterprises (DXPE) closed at $97.23, indicating a -2.13% shift from the previous trading day.

Here's Why Momentum in DXP Enterprises (DXPE) Should Keep going

If you are looking for stocks that are well positioned to maintain their recent uptrend, DXP Enterprises (DXPE) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

DXP Enterprises (DXPE) Exceeds Market Returns: Some Facts to Consider

DXP Enterprises (DXPE) closed the most recent trading day at $93.73, moving +1.18% from the previous trading session.

Is DXP Enterprises (DXPE) Stock Outpacing Its Industrial Products Peers This Year?

Here is how DXP Enterprises (DXPE) and Ardagh Metal Packaging S.A. (AMBP) have performed compared to their sector so far this year.

Are You Looking for a Top Momentum Pick? Why DXP Enterprises (DXPE) is a Great Choice

Does DXP Enterprises (DXPE) have what it takes to be a top stock pick for momentum investors? Let's find out.

3 Reasons Why Growth Investors Shouldn't Overlook DXP Enterprises (DXPE)

DXP Enterprises (DXPE) possesses solid growth attributes, which could help it handily outperform the market.

Here's Why DXP Enterprises (DXPE) is Poised for a Turnaround After Losing 11.4% in 4 Weeks

DXP Enterprises (DXPE) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

Is DXP Enterprises (DXPE) a Solid Growth Stock? 3 Reasons to Think "Yes"

DXP Enterprises (DXPE) could produce exceptional returns because of its solid growth attributes.

Solid Cash Flow Growth Makes These 4 Stocks Worth Buying Now

Cash indicates a company's true financial health. So, companies with rising cash flows like NOMD, DXPE, GLDD and KINS are worth buying.

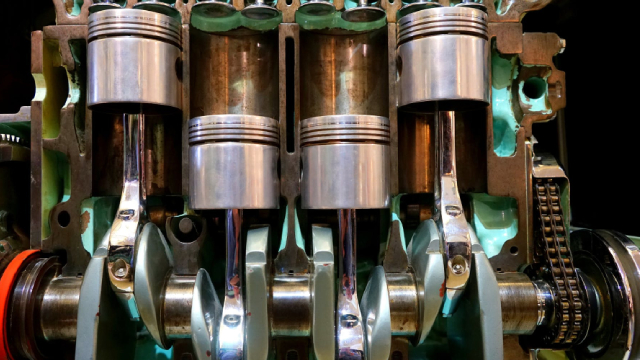

DXP Enterprises: Margin Momentum And Diversification Set The Stage For Growth

DXP Enterprises's strong IPS segment growth and solid service center performance are driving double-digit topline expansion, with momentum expected to continue in 2025. Operational efficiency and high-margin backlog should support margin expansion in 2025 and beyond. Despite recent volatility and tariff-related risks, the Company remains attractively valued versus historical averages, with a forward P/E of 16.96 and solid growth prospects.