Edison International (EIX)

Here's Why Edison International (EIX) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Does Edison International (EIX) Have the Potential to Rally 27.5% as Wall Street Analysts Expect?

The mean of analysts' price targets for Edison International (EIX) points to a 27.5% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

Here's Why Edison International (EIX) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

What Recession? I Demand To Be Paid

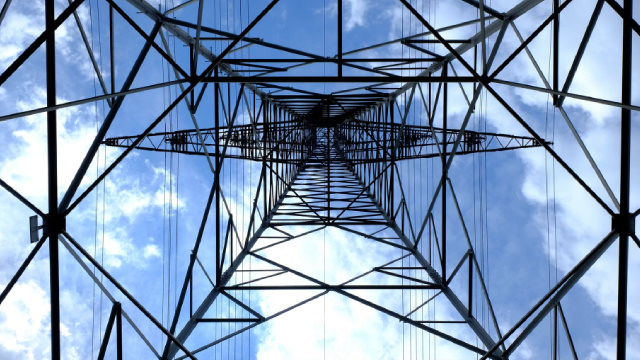

Investing in utilities and infrastructure ensures steady returns through market fluctuations. Have you examined your utility bill? You get charged for a lot more than just your energy consumption. We discuss our top utility picks with yields of up to 8%.

Here's Why Edison International (EIX) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Edison International Q1 Earnings Beat Estimates, Revenues Miss

EIX's first-quarter earnings top estimates, while revenues decrease during the same period. The company affirms its 2025 EPS outlook.

Are Investors Undervaluing Edison International (EIX) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Edison International (EIX) Q1 2025 Earnings Conference Call Transcript

Edison International (NYSE:EIX ) Q1 2025 Earnings Conference Call April 29, 2025 4:30 PM ET Company Participants Sam Ramraj - VP, IR Pedro Pizarro - President, CEO & Director Maria Rigatti - EVP & CFO Steve Powell - President, CEO & Director, Southern California Edison Conference Call Participants Nick Campanella - Barclays Michael Lonegan - Evercore Carly Davenport - Goldman Sachs Paul Zimbardo - Jefferies Richard Sunderland - JPMorgan Gregg Orrill - UBS Anthony Crowdell - Mizuho David Arcaro - Morgan Stanley Ryan Levine - Citi Operator Good afternoon and welcome to the Edison International First Quarter 2025 Financial Teleconference Conference. My name is Michelle and I will be your operator today.

Edison International (EIX) Tops Q1 Earnings Estimates

Edison International (EIX) came out with quarterly earnings of $1.37 per share, beating the Zacks Consensus Estimate of $1.21 per share. This compares to earnings of $1.13 per share a year ago.

Edison International's SCE Preferreds: High Yields From A Special Situation

Southern California Edison and Edison International preferreds are undervalued due to wildfire liability uncertainties, but offer upside as issues resolve. Liability for the LA wildfires is likely capped at $1B due to AB 1054, with the wildfire fund covering additional costs. SCE preferreds are structurally senior to EIX preferreds, offering safer investment options with attractive yields and potential for full recovery in bankruptcy.

Edison International (EIX) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Edison International (EIX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Edison International: Earn Up To 6% Yield From The Top Utility Pick Until It Gets Spicy

The utility sector could offer an attractive dividend yield amid rising recession fears. Utility operators face strong prospects in light of growing energy consumption and capital investment projects. Along the utilities select sector, a hot pick is delineated, providing the best combination amid some key financial fundamentals.