Edison International (EIX)

Edison International (EIX) Q2 Earnings Rise Y/Y, Revenues Beat

Edison International's (EIX) second-quarter earnings increase year over year by 21.8%. The company's 2024 EPS outlook remains unchanged.

Edison International (EIX) Q2 2024 Earnings Call Transcript

Edison International (NYSE:EIX ) Q2 2024 Results Conference Call July 25, 2024 4:30 PM ET Company Participants Sam Ramraj - Vice President of Investor Relations Pedro Pizarro - President and Chief Executive officer Maria Rigatti - Executive Vice President and Chief Financial Officer Steve Powell - President and Chief Executive Officer of Southern California Edison Conference Call Participants Michael Lonegan - Evercore ISI Shar Pourreza - Guggenheim Partners Nick Campanella - Barclays David Arcaro - Morgan Stanley Ryan Levine - Citi Anthony Crowdell - Mizuho Operator Good afternoon, and welcome to the Edison International Second Quarter 2024 Financial Teleconference. My name is Julie, and I will be your operator today.

Edison International (EIX) Q2 Earnings and Revenues Top Estimates

Edison International (EIX) came out with quarterly earnings of $1.22 per share, beating the Zacks Consensus Estimate of $1.05 per share. This compares to earnings of $1.01 per share a year ago.

Will Edison International (EIX) Beat Estimates Again in Its Next Earnings Report?

Edison International (EIX) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Why Edison International (EIX) is a Top Momentum Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Yes, You Can Retire On Dividends, 2 Fat Yields +8%

Big Short Eisman highlights bullishness for the infrastructure sector. We discuss four catalysts for this sector, potentially offering tailwinds for the foreseeable future. Fill your pockets with large dividends; we discuss our top picks.

Edison International (EIX) Up 2.9% Since Last Earnings Report: Can It Continue?

Edison International (EIX) reported earnings 30 days ago. What's next for the stock?

Edison International Subsidiary's Preferred Benefits From Reduced Fire Risk

Edison International's Southern California Edison subsidiary has six exchange-traded preferred issues. Three of them are converting from fixed to floating rates. SCE.PR.J is particularly attractive, with an annualized return of 9% in my base case.

Quadrant Capital Group LLC Has $237,000 Stock Position in Edison International (NYSE:EIX)

Quadrant Capital Group LLC grew its holdings in shares of Edison International (NYSE:EIX – Free Report) by 9.8% in the 4th quarter, according to its most recent disclosure with the SEC. The fund owned 3,316 shares of the utilities provider’s stock after acquiring an additional 297 shares during the period. Quadrant Capital Group LLC’s holdings in Edison International were worth $237,000 as of its most recent SEC filing. A number of other hedge funds also recently modified their holdings of EIX. Janney Montgomery Scott LLC increased its stake in shares of Edison International by 7.5% in the fourth quarter. Janney Montgomery Scott LLC now owns 114,115 shares of the utilities provider’s stock valued at $8,158,000 after buying an additional 7,919 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. boosted its position in shares of Edison International by 4.4% during the 4th quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 389,357 shares of the utilities provider’s stock worth $27,870,000 after purchasing an additional 16,425 shares in the last quarter. RBA Wealth Management LLC grew its stake in shares of Edison International by 2.5% in the 4th quarter. RBA Wealth Management LLC now owns 33,170 shares of the utilities provider’s stock valued at $2,371,000 after buying an additional 816 shares during the period. Massachusetts Financial Services Co. MA increased its position in Edison International by 4.0% in the 4th quarter. Massachusetts Financial Services Co. MA now owns 5,261,803 shares of the utilities provider’s stock valued at $376,166,000 after buying an additional 202,541 shares in the last quarter. Finally, Avantax Advisory Services Inc. raised its stake in Edison International by 73.2% during the 4th quarter. Avantax Advisory Services Inc. now owns 21,114 shares of the utilities provider’s stock worth $1,509,000 after buying an additional 8,922 shares during the period. Institutional investors and hedge funds own 88.95% of the company’s stock. Analysts Set New Price Targets A number of equities research analysts have commented on the company. StockNews.com raised Edison International from a “sell” rating to a “hold” rating in a research note on Saturday, February 24th. The Goldman Sachs Group initiated coverage on shares of Edison International in a research report on Wednesday, April 10th. They issued a “neutral” rating and a $78.00 price target for the company. Royal Bank of Canada lowered their price objective on shares of Edison International from $81.00 to $80.00 and set an “outperform” rating on the stock in a report on Thursday, March 7th. Wells Fargo & Company upgraded shares of Edison International from an “equal weight” rating to an “overweight” rating and lifted their price objective for the company from $72.00 to $86.00 in a report on Tuesday, May 14th. Finally, TheStreet lowered shares of Edison International from a “b” rating to a “c+” rating in a report on Thursday, February 22nd. One investment analyst has rated the stock with a sell rating, five have given a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of “Hold” and an average target price of $76.00. View Our Latest Stock Report on Edison International Insiders Place Their Bets In other news, CEO J Andrew Murphy sold 58,099 shares of the stock in a transaction dated Friday, May 10th. The shares were sold at an average price of $75.01, for a total value of $4,358,005.99. Following the sale, the chief executive officer now directly owns 19,660 shares of the company’s stock, valued at $1,474,696.60. The sale was disclosed in a legal filing with the SEC, which is available at this link. 1.20% of the stock is owned by corporate insiders. Edison International Price Performance NYSE EIX opened at $76.30 on Monday. The company has a market cap of $29.36 billion, a PE ratio of 33.47 and a beta of 0.95. The company has a quick ratio of 0.93, a current ratio of 1.00 and a debt-to-equity ratio of 2.04. The firm’s 50-day simple moving average is $70.81 and its two-hundred day simple moving average is $68.78. Edison International has a 52 week low of $58.82 and a 52 week high of $76.39. Edison International (NYSE:EIX – Get Free Report) last released its quarterly earnings data on Tuesday, April 30th. The utilities provider reported $1.13 EPS for the quarter, topping the consensus estimate of $1.12 by $0.01. The company had revenue of $4.08 billion during the quarter, compared to the consensus estimate of $4.16 billion. Edison International had a net margin of 6.14% and a return on equity of 12.48%. Edison International’s revenue for the quarter was up 2.8% on a year-over-year basis. During the same period last year, the firm earned $1.09 EPS. Research analysts predict that Edison International will post 4.92 earnings per share for the current year. Edison International Announces Dividend The business also recently disclosed a quarterly dividend, which was paid on Tuesday, April 30th. Investors of record on Thursday, March 28th were issued a dividend of $0.78 per share. The ex-dividend date of this dividend was Wednesday, March 27th. This represents a $3.12 dividend on an annualized basis and a yield of 4.09%. Edison International’s dividend payout ratio (DPR) is 136.84%. Edison International Company Profile (Free Report) Edison International, through its subsidiaries, engages in the generation and distribution of electric power. The company supplies and delivers electricity to approximately 50,000 square mile area of southern California to residential, commercial, industrial, public authorities, agricultural, and other sectors.

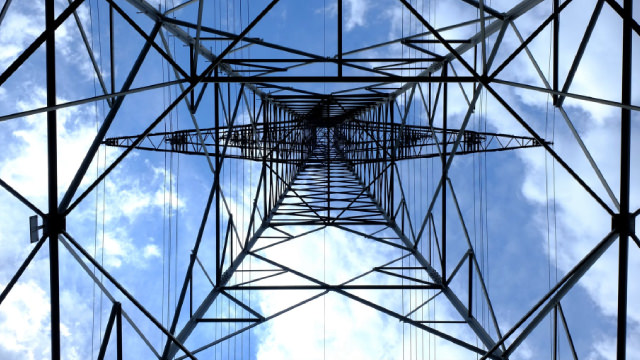

3,870 Shares in Edison International (NYSE:EIX) Purchased by Meridian Wealth Management LLC

Meridian Wealth Management LLC bought a new stake in shares of Edison International (NYSE:EIX – Free Report) during the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund bought 3,870 shares of the utilities provider’s stock, valued at approximately $277,000. Several other institutional investors and hedge funds also recently bought and sold shares of EIX. Pzena Investment Management LLC increased its stake in Edison International by 1.5% in the 3rd quarter. Pzena Investment Management LLC now owns 13,316,887 shares of the utilities provider’s stock valued at $842,826,000 after buying an additional 197,259 shares during the period. Wellington Management Group LLP increased its stake in shares of Edison International by 3.3% in the third quarter. Wellington Management Group LLP now owns 9,842,171 shares of the utilities provider’s stock worth $622,911,000 after acquiring an additional 317,297 shares during the last quarter. Clearbridge Investments LLC raised its holdings in shares of Edison International by 8.9% during the third quarter. Clearbridge Investments LLC now owns 6,830,749 shares of the utilities provider’s stock worth $432,318,000 after acquiring an additional 558,351 shares in the last quarter. Legal & General Group Plc boosted its position in Edison International by 2.0% during the third quarter. Legal & General Group Plc now owns 5,590,765 shares of the utilities provider’s stock valued at $353,840,000 after purchasing an additional 108,138 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA grew its stake in Edison International by 4.0% in the fourth quarter. Massachusetts Financial Services Co. MA now owns 5,261,803 shares of the utilities provider’s stock valued at $376,166,000 after purchasing an additional 202,541 shares in the last quarter. Hedge funds and other institutional investors own 88.95% of the company’s stock. Insider Activity In related news, CEO J Andrew Murphy sold 9,794 shares of Edison International stock in a transaction dated Monday, May 13th. The stock was sold at an average price of $75.07, for a total transaction of $735,235.58. Following the sale, the chief executive officer now directly owns 19,660 shares of the company’s stock, valued at $1,475,876.20. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. 1.20% of the stock is owned by company insiders. Wall Street Analyst Weigh In A number of equities research analysts have recently weighed in on EIX shares. Wells Fargo & Company upgraded Edison International from an “equal weight” rating to an “overweight” rating and lifted their price target for the company from $72.00 to $86.00 in a report on Tuesday, May 14th. The Goldman Sachs Group assumed coverage on shares of Edison International in a research note on Wednesday, April 10th. They issued a “neutral” rating and a $78.00 target price for the company. Royal Bank of Canada dropped their price target on shares of Edison International from $81.00 to $80.00 and set an “outperform” rating on the stock in a research note on Thursday, March 7th. TheStreet downgraded shares of Edison International from a “b” rating to a “c+” rating in a report on Thursday, February 22nd. Finally, Mizuho upped their price objective on shares of Edison International from $75.00 to $85.00 and gave the stock a “buy” rating in a report on Friday. One analyst has rated the stock with a sell rating, five have issued a hold rating and five have given a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of “Hold” and an average target price of $76.00. Check Out Our Latest Stock Report on EIX Edison International Price Performance NYSE EIX opened at $76.30 on Monday. The stock has a 50-day simple moving average of $70.81 and a 200 day simple moving average of $68.78. Edison International has a twelve month low of $58.82 and a twelve month high of $76.39. The stock has a market capitalization of $29.36 billion, a PE ratio of 33.47 and a beta of 0.95. The company has a debt-to-equity ratio of 2.04, a quick ratio of 0.93 and a current ratio of 1.00. Edison International (NYSE:EIX – Get Free Report) last issued its quarterly earnings results on Tuesday, April 30th. The utilities provider reported $1.13 EPS for the quarter, topping analysts’ consensus estimates of $1.12 by $0.01. The company had revenue of $4.08 billion during the quarter, compared to analyst estimates of $4.16 billion. Edison International had a return on equity of 12.48% and a net margin of 6.14%. The company’s quarterly revenue was up 2.8% compared to the same quarter last year. During the same period in the previous year, the company earned $1.09 earnings per share. Research analysts anticipate that Edison International will post 4.92 EPS for the current year. Edison International Announces Dividend The business also recently disclosed a quarterly dividend, which was paid on Tuesday, April 30th. Stockholders of record on Thursday, March 28th were given a dividend of $0.78 per share. This represents a $3.12 dividend on an annualized basis and a dividend yield of 4.09%. The ex-dividend date of this dividend was Wednesday, March 27th. Edison International’s dividend payout ratio is currently 136.84%. Edison International Company Profile (Free Report) Edison International, through its subsidiaries, engages in the generation and distribution of electric power. The company supplies and delivers electricity to approximately 50,000 square mile area of southern California to residential, commercial, industrial, public authorities, agricultural, and other sectors. Read More Five stocks we like better than Edison International Dividend King Proctor & Gamble Is A Buy On Post-Earnings Weakness JD’s Earnings Could Mean Chinese Stocks Making a Comeback How to Use the MarketBeat Stock Screener Canada Goose Flies Higher Driven By DTC Growth TSX Venture Exchange (Formerly Canadian Venture Exchange) CVS Health Stock Has a Silver Lining Called Value