Emerson Electric Co. (EMR)

Emerson Electric (EMR) Tops Q3 Earnings Estimates

Emerson Electric (EMR) came out with quarterly earnings of $1.43 per share, beating the Zacks Consensus Estimate of $1.42 per share. This compares to earnings of $1.29 per share a year ago.

Emerson Electric (EMR) to Post Q3 Earnings: Is a Beat in Store?

Emerson Electric's (EMR) Q3 results are likely to benefit from strong demand, solid backlog and contributions from acquisitions. However, high operating expenses are likely to have affected its margins.

Seeking Clues to Emerson Electric (EMR) Q3 Earnings? A Peek Into Wall Street Projections for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Emerson Electric (EMR), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2024.

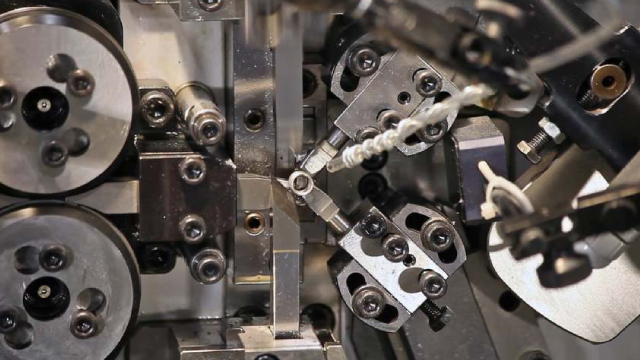

3 Manufacturing Stock Picks for the Rebuilding of America

Former President Donald Trump wants to rebuild America. Frankly, that's what every candidate says or some variation of that theme.

Emerson Electric (EMR) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Emerson Electric (EMR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Emerson Electric (EMR) Exceeds Market Returns: Some Facts to Consider

The latest trading day saw Emerson Electric (EMR) settling at $116.84, representing a +1.96% change from its previous close.

7 American Robotics Stocks to Buy if You're Betting on Trump 2024

Robotics are set to revolutionize industries ranging from transportation to healthcare. And America will be a major growth market.

Wall Street Bulls Look Optimistic About Emerson Electric (EMR): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Emerson Electric Co. (EMR) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Emerson Electric (EMR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why Emerson Electric (EMR) Dipped More Than Broader Market Today

Emerson Electric (EMR) reachead $115.68 at the closing of the latest trading day, reflecting a -0.74% change compared to its last close.

Here's Why Emerson Electric (EMR) Fell More Than Broader Market

Emerson Electric (EMR) closed at $116.54 in the latest trading session, marking a -1.45% move from the prior day.

Emerson Electric Co. (EMR) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Emerson Electric (EMR). This makes it worthwhile to examine what the stock has in store.