Emerson Electric Co. (EMR)

Emerson Electric (EMR) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Emerson Electric (EMR) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

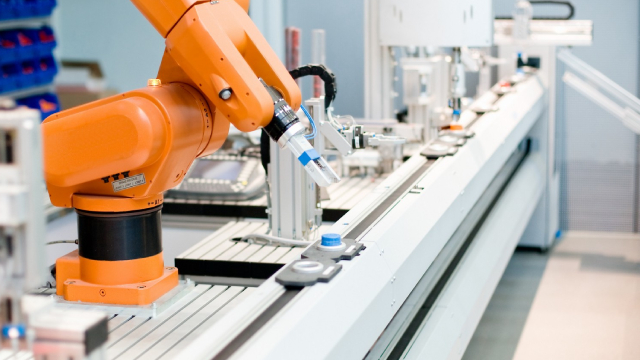

Emerson Electric: The Calm After The Rebuild. Why Boring Looks Bullish

Emerson (EMR) has completed its restructuring and now operates as a focused automation and software platform. Its moat rests on high switching costs, reliability, and half a century of embedded systems. Strong balance sheet (20x interest coverage) allows for increased shareholder returns.

Emerson Electric (EMR) Upgraded to Buy: Here's What You Should Know

Emerson Electric (EMR) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Are Industrial Products Stocks Lagging Emerson Electric Co. (EMR) This Year?

Here is how Emerson Electric (EMR) and Mitsui & Co. (MITSY) have performed compared to their sector so far this year.

Is Emerson Electric (EMR) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

4 Manufacturing Electronics Stocks to Consider on Promising Industry Trends

The Zacks Manufacturing - Electronics industry gains from strength across major end markets. ETN, EMR, FELE and POWL are some notable stocks in the industry.

Emerson Electric (EMR) Rises Higher Than Market: Key Facts

Emerson Electric (EMR) concluded the recent trading session at $133.19, signifying a +2.37% move from its prior day's close.

Emerson Electric (EMR) Advances While Market Declines: Some Information for Investors

In the latest trading session, Emerson Electric (EMR) closed at $129.77, marking a +1.24% move from the previous day.

Why Emerson Electric (EMR) Outpaced the Stock Market Today

The latest trading day saw Emerson Electric (EMR) settling at $132.94, representing a +1.1% change from its previous close.

Can Emerson Electric (EMR) Keep the Earnings Surprise Streak Alive?

Emerson Electric (EMR) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Why Investors Need to Take Advantage of These 2 Industrial Products Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Why Emerson Electric (EMR) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.