Emerson Electric Co. (EMR)

Will Emerson Electric (EMR) Beat Estimates Again in Its Next Earnings Report?

Emerson Electric (EMR) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

Emerson Electric (EMR) concluded the recent trading session at $137.79, signifying a +1.68% move from its prior day's close.

Emerson Electric: A Safe Buy For Long-Term Investors

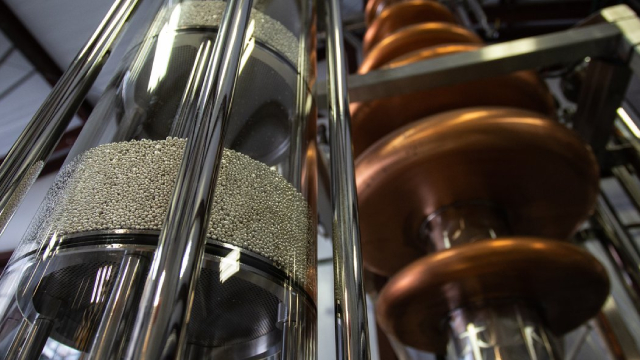

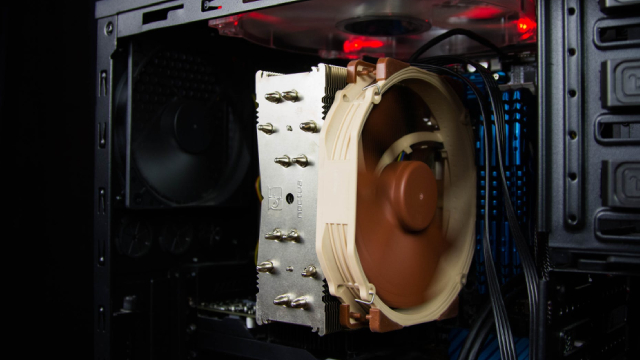

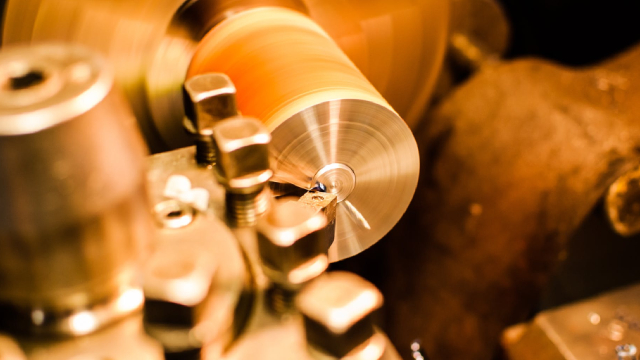

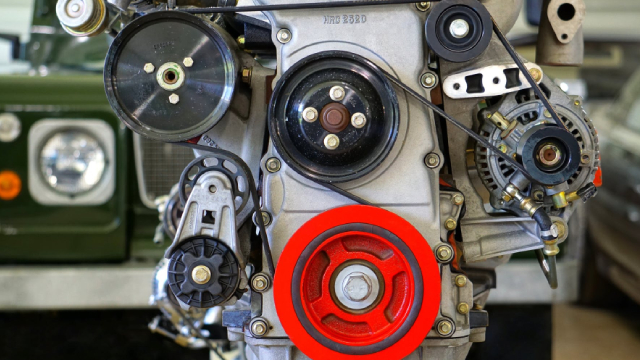

Emerson Electric is a leader in industrial automation, benefiting from automation, digitalization, and sustainability trends, making it a compelling long-term investment. The company's expanding software and services portfolio, strong recurring revenues, and robust free cash flow underpin its market leadership and financial resilience. Risks include project-based revenue volatility, oil and gas exposure, and execution risks from major acquisitions, but strong backlogs and order momentum provide visibility.

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

Emerson Electric (EMR) concluded the recent trading session at $132.73, signifying a +2.54% move from its prior day's close.

Emerson Electric (EMR) Advances But Underperforms Market: Key Facts

In the closing of the recent trading day, Emerson Electric (EMR) stood at $130.73, denoting a +1.02% move from the preceding trading day.

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

The latest trading day saw Emerson Electric (EMR) settling at $128.68, representing a +2.5% change from its previous close.

Emerson Electric Co. (EMR) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Emerson Electric (EMR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Emerson Electric Co. (EMR) Presents at Wells Fargo Industrials & Materials Conference Transcript

Emerson Electric Co. (NYSE:EMR ) Wells Fargo Industrials & Materials Conference Call June 10, 2025 4:00 PM ET Company Participants Colleen Mettler - Vice President of Investor Relations Ram R. Krishnan - Executive VP & COO Conference Call Participants Unidentified Analyst All right.

Emerson Electric: A Balanced Play On Industrial Digitization And Energy Transition

Emerson exited the first half of FY25 with flat top line growth as softness in discrete automation offset strength in software and process businesses. Near-term outlook remains mixed, but improving order momentum, robust $7.5B backlog, and strength in process/hybrid verticals should support sales growth for FY25. Margin expansion is expected to be driven by cost reductions, pricing actions, and operational improvements, with further upside from planned debt reduction.

Why Is Emerson Electric (EMR) Up 9% Since Last Earnings Report?

Emerson Electric (EMR) reported earnings 30 days ago. What's next for the stock?

Emerson Exhibits Strong Prospects Despite Persisting Headwinds

EMR benefits from solid momentum across the Intelligent Devices and Software and Control segments. However, forex woes remain a concern.

Emerson Electric Co. (EMR) is Attracting Investor Attention: Here is What You Should Know

Emerson Electric (EMR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.