Enphase Energy Inc. (ENPH)

Enphase Expands IQ Energy Management to Include Water Heaters

ENPH expands its IQ Energy Management system to control electric water heaters, enhancing AI-driven smart home energy use across Europe.

Why the Market Dipped But Enphase Energy (ENPH) Gained Today

The latest trading day saw Enphase Energy (ENPH) settling at $36.71, representing a +1.89% change from its previous close.

Why Investors Need to Take Advantage of These 2 Oils and Energy Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Enphase Energy (ENPH) Rises Higher Than Market: Key Facts

Enphase Energy (ENPH) reached $37.73 at the closing of the latest trading day, reflecting a +1.93% change compared to its last close.

Enphase Energy (ENPH) Stock Drops Despite Market Gains: Important Facts to Note

The latest trading day saw Enphase Energy (ENPH) settling at $35.39, representing a -1.91% change from its previous close.

Is Trending Stock Enphase Energy, Inc. (ENPH) a Buy Now?

Recently, Zacks.com users have been paying close attention to Enphase Energy (ENPH). This makes it worthwhile to examine what the stock has in store.

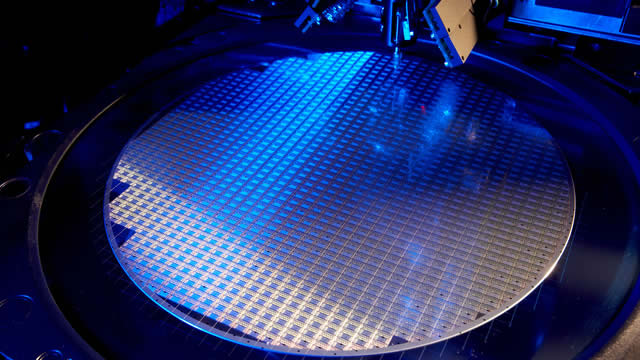

ENPH Starts US Pre-Orders for IQ9 Commercial Microinverters With GaN

Enphase Energy begins U.S. pre-orders for its IQ9N-3P Commercial Microinverter to boost efficiency and cut installation costs in commercial solar energy.

Enphase Energy (ENPH) Stock Drops Despite Market Gains: Important Facts to Note

In the latest trading session, Enphase Energy (ENPH) closed at $38.81, marking a -2.12% move from the previous day.

Enphase: I Was Wrong, Updating My Bullish Thesis

ENPH faces significant near-term headwinds from expiring solar tax credits, elevated competition, and macro uncertainty, likely pressuring profitability and cash flow in the next several years. Despite these risks, ENPH maintains a net cash balance sheet and remains GAAP profitable, providing resilience to weather the coming downturn. The stock offers high upside torque to potential catalysts like lower interest rates or reinstated tax credits, making it attractive for risk-tolerant investors.

25 Stocks to Avoid in September, Historically

September is, historically, the most bearish month of the year for stocks.

ENPH or SEDG: Which Stock Shines Brighter in the Solar Energy Market?

Enphase Energy and SolarEdge showcase growth, new products and challenges as investors weigh opportunities in the solar energy market.

Solar Stocks in the Shade After Trump Comments

The solar sector is taking a beating today, after President Donald Trump announced on Truth Social that the U.S. will not approve wind or solar projects, blaming the renewables for high electricity and energy costs.