Express Inc (EXPR)

SEC and Express Settle Charges Related to Disclosure Obligations

The Securities and Exchange Commission (SEC) settled charges with Express, Inc., in which it alleged that the fashion retailer failed to disclose executive compensation paid to its now-former CEO in fiscal years 2019, 2020 and 2021. Express Inc.

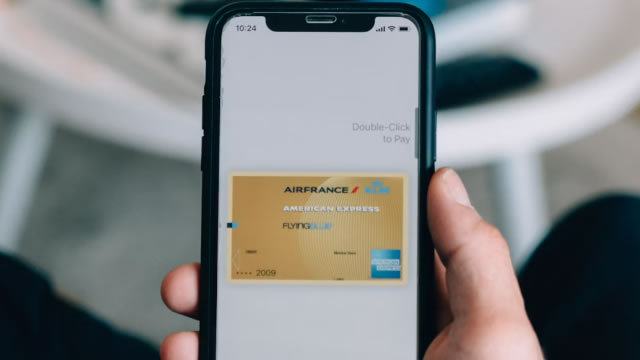

Is It Too Late to Buy American Express Stock?

American Express delivered impressive financial results in the first half of 2024. The company is benefiting from strong growth trends from its international business.

International Money Express: This Global Remittance Play Is Now An Activist Target

International Money Express (IXMI) soared during 2022 and the first half of 2023, but mixed results/guidance have since pushed shares back to the high-teens per share. However, a recent uptick in shareholder activism with this stock suggests better times lie ahead for IXMI investors. Why? There are not one, but two ways this factor could drive much stronger price performance going forward.

American Express stock has upside, but a pullback can't be ruled out

American Express (AXP) stock has done well as we predicted in our last article in April when we compared it with Mastercard and Visa. It has soared to a record high of $271.35, bringing its year-to-date high gains to almost 50%, making it one of the best-performing companies in finance.

Voss Capital wants to maximize shareholder value at International Money Express. How it may play out

The firm is a long-term investor at the money remittance services provider.

Tradepulse Power Inflow Alert: American Express Inc. Moves Up Over 4% After Alert For The Day

TradePulse's latest Power Inflow alert indicated institutional volume is coming into American Express Inc., signaling a shift from net selling to buying. This shift is a key indicator of rising investor confidence and the potential for an uptrend in AXP's stock.

Should You Buy American Express While It's Below $300?

American Express is expanding as credit metrics continue to hold up. The company could see double-digit earnings growth for several years.

Where Will American Express Stock Be in 3 Years?

American Express continues to thrive in a challenging macroeconomic environment. Its diversified business model and focus on higher-income consumers insulate it from inflationary headwinds.

Why American Express Is Trading Higher Today

American Express is a cyclical stock and struggled last week as investors grew concerned about the economy. Many investors and industry participants still think a soft landing is in the cards.

Berkshire Hathaway Holds Bank of America, American Express, Visa, and Mastercard Stock, but So Does This Low-Cost Vanguard ETF

Berkshire Hathaway is so much more than its holdings in public companies. The financial sector has a lower valuation and a higher yield than the S&P 500.

American Express, Knot Enhance Card Members' Checkout Experience

AXP and Knot introduce a pilot feature to streamline online payments at select retailers, enhancing checkout efficiency and AXP's Card Member experience.

American Express: Consumer Confidence Rebound Is Big

American Express is well-positioned to perform well due to its focus on high-income consumers, who are less affected by inflation and economic downturns. Recent consumer confidence data shows increasing optimism, particularly among higher-income groups, suggesting the market's negative outlook on consumer spending is overstated. American Express' strong ROE and conservative EPS growth assumptions imply significant upside potential, with shares potentially undervalued by about 20.9%.