Fastenal Company (FAST)

Fastenal (FAST) Lags Q4 Earnings and Revenue Estimates

Fastenal (FAST) came out with quarterly earnings of $0.46 per share, missing the Zacks Consensus Estimate of $0.48 per share. This compares to earnings of $0.46 per share a year ago.

Manufacturing Earnings Are Coming. There's Reason for Hope.

For Fastenal's fourth quarter, Wall Street is looking for earnings per share of 48 cents from sales of $1.8 billion.

Fastenal Gears Up to Report Q4 Earnings: Things to Keep in Mind

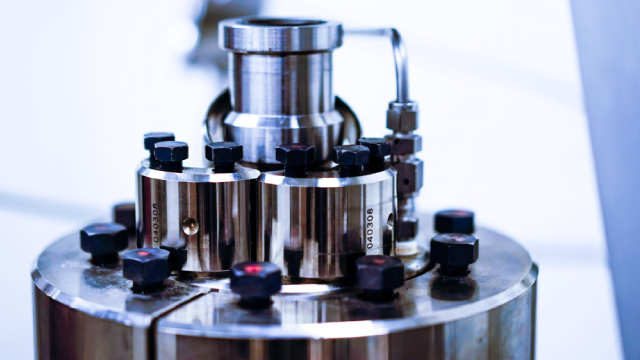

FAST's Q4 results are likely to reflect manufacturing growth, albeit at a slow pace, with a strong digital strategy and a balanced onsite/offsite mix. Yet, soft industrial markets are concerning.

Fastenal Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Fastenal Company FAST will release its fourth-quarter financial results, before the opening bell, on Friday, Jan. 17, 2025.

The Setup: Taiwan Semi, Fastenal and UnitedHealth

The Investment Committee previews this week's market earnings. Don't miss their expert analysis!

Ahead of Fastenal (FAST) Q4 Earnings: Get Ready With Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Fastenal (FAST) for the quarter ended December 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

How To Earn $500 A Month From Fastenal Stock Ahead Of Q4 Earnings

Fastenal Company FAST will release its fourth-quarter financial results, before the opening bell, on Friday, Jan. 17, 2025.

Fastenal: An Excellent Dividend Paying Stock, But Valuation Is Rich

Fastenal has a robust dividend growth history, increasing dividends for 25 consecutive years, and a strong long-term track record of revenue and earnings growth. Shares are currently overvalued, trading at nearly 36 times 2024 earnings estimates, above the historical average, posing a risk to strong returns. I rate Fastenal as a hold, awaiting a valuation closer to my target range of 28 to 30 times earnings for a more attractive entry point.

Fastenal's Daily Sales in November Rise 3.4%: Here's What You Need to Know

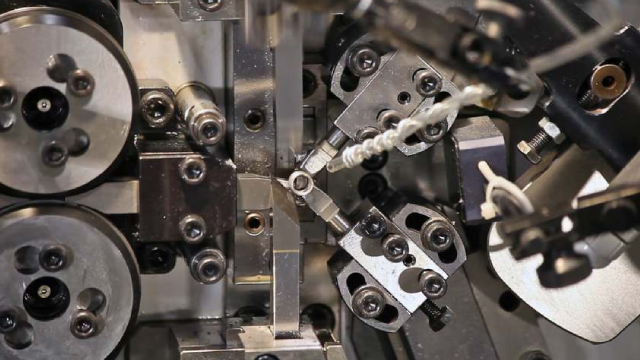

FAST's average daily sales increase year over year, backed by strong trends across the total Manufacturing end market.

Zacks Industry Outlook The Home Depot, Lowe's, Fastenal, Beacon Roofing Supply and Tecnoglass

The Home Depot, Lowe's, Fastenal, Beacon Roofing Supply and Tecnoglass have been highlighted in this Industry Outlook article.

Fastenal's October Daily Sales Increase 2.8%, Stock Up

FAST's average daily sales growth rate moderated sequentially in October, with improving heavy manufacturing end markets though declines in non-residential markets returned.

Why Fastenal Stock Could Hit New Highs After Strong Q3 Results

Fastenal FAST stock has increased more than 250% since 2016 due to customer growth, the growing number of Onsite locations, deepening service penetration, and improving business metrics. The rally in stock prices can continue because those factors continue to drive results.