Fidelity National Information Services, Inc. (FIS)

Will Fidelity National's (FIS) Q2 Profits Surge or Stall?

Fidelity National's (FIS) second-quarter results are likely to reflect growing Banking Solutions revenues.

Countdown to Fidelity National (FIS) Q2 Earnings: Wall Street Forecasts for Key Metrics

Besides Wall Street's top -and-bottom-line estimates for Fidelity National (FIS), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended June 2024.

3 Overvalued Stocks Teetering on the Brink of Collapse

Overvalued stocks typically trade at a price higher than their intrinsic value due to factors like high growth. However, they can be more volatile if their prices are driven by market speculation and investor sentiment rather than fundamentals.

If You Can Only Buy One Fintech Stock in July, It Better Be One of These 3 Names

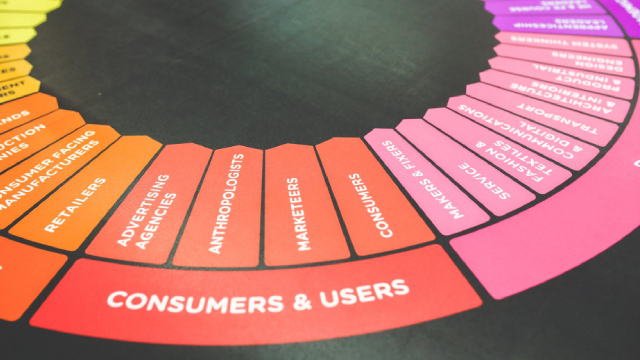

Financial technology, or fintech, is a branch of banking that utilizes technological innovation to provide all sorts of financial products and services to users from all over the world from the comfort of their mobile devices. With fintech, global citizens can save their money, borrow, lend and even invest without having to step foot in a bank or other financial institution.

Fidelity (FIS) to Enhance Efficiency With Innovative Products

Fidelity (FIS) launches Security Finance Matching Platform and SMB Digital Lending Solution, enhancing offerings and paving the way for future growth.

3 Fintech Stocks to Sell in July Before They Crash & Burn

Investors should always be aware of their current positioning in the market cycle, especially when considering fintech stocks to sell. AI greatly propelled market expansion, so much so that just 10 top stocks in the S&P 500 make up 34% of the index, breaking the previous market concentration record all the way back in the 1920s.

5 Financial Transaction Stocks in Focus Amid Digital Payment Boom

The Financial Transaction Services industry benefits from digital adoption, strong consumer spending and M&A strategies. Companies like FI, FIS, GPN, WEX and WU are well-positioned to thrive amid these favorable trends.

Fidelity National Has Gone Back To Its Core To Drive Consistent, High-Margin Growth

FIS has renewed its focus on its core legacy Banking and Capital Markets operations, selling a controlling stake in Worldpay to a private equity buyer. Both Banking Solutions and Capital Markets generate high-margin recurring revenues from sticky customer relationships, and FIS holds strong share among outsourced services to larger banks. With banks looking to leverage growth opportunities in payments, capital markets, and asset management, FIS can grow its Banking Solutions business further, as many banks can't afford a go-it-alone strategy.

Here's Why You Should Retain Fidelity National (FIS) Stock Now

Fidelity National (FIS) benefits from recurring revenue growth, cross-sale, margin expansion, and investing in high-growth opportunities.

Why Is Fidelity National (FIS) Up 2.4% Since Last Earnings Report?

Fidelity National (FIS) reported earnings 30 days ago. What's next for the stock?

Fidelity (FIS) Enhances Efficiency With New Mobile Banking App

Fidelity (FIS) launches Digital One Flex Mobile 6.0, enhancing its offerings for financial institutions.