Flowserve Corporation (FLS)

Here's Why You Should Consider Investing in Flowserve Stock Now

FLS is likely to benefit from strength across its end markets, solid backlog level, acquired assets and shareholder-friendly policies.

Here's Why Flowserve (FLS) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

FLS or NDSN: Which Is the Better Value Stock Right Now?

Investors interested in stocks from the Manufacturing - General Industrial sector have probably already heard of Flowserve (FLS) and Nordson (NDSN). But which of these two stocks is more attractive to value investors?

Flowserve (FLS) Upgraded to Buy: Here's Why

Flowserve (FLS) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

Why Flowserve (FLS) is a Top Growth Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

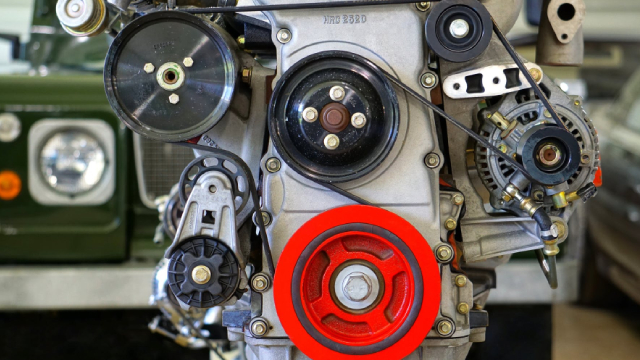

Flowserve (FLS) to Acquire MOGAS & Boost Product Portfolio

Flowserve (FLS) is set to strengthen its product offerings and boost its position in the mining, mineral extraction and process industries with the acquisition of MOGAS.

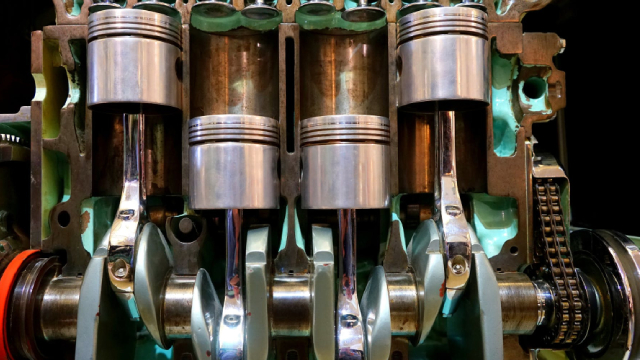

Flowserve (FLS) Exhibits Strong Prospects Despite Headwinds

Flowserve (FLS) is set to benefit from strength in the Flowserve Pump Division and Flow Control Division segments. However, increasing costs remain a concern.

Why Flowserve (FLS) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

FLS or NDSN: Which Is the Better Value Stock Right Now?

Investors interested in stocks from the Manufacturing - General Industrial sector have probably already heard of Flowserve (FLS) and Nordson (NDSN). But which of these two companies is the best option for those looking for undervalued stocks?

Flowserve (FLS) Q2 Earnings & Revenues Top Estimates, Rise Y/Y

Flowserve's (FLS) second-quarter 2024 revenues increase 7.1% year over year, driven by the impressive performance of its Pump Division and Flow Control Division units.

Flowserve Corporation (FLS) Q2 2024 Earnings Call Transcript

Flowserve Corporation (NYSE:FLS ) Q2 2024 Earnings Conference Call July 30, 2024 10:00 AM ET Company Participants Jay Roueche - Vice President, Treasurer and Investor Relations Scott Rowe - President and Chief Executive Officer Amy Schwetz - Senior Vice President and Chief Financial Officer Conference Call Participants Mike Halloran - Baird Joe Giordano - TD Cowen Andy Kaplowitz - Citigroup Deane Dray - RBC Capital Markets Damian Karas - UBS Nathan Jones - Stifel Brett Linzey - Mizuho Eric Look - Mizuho Joe Ritchie - Goldman Sachs Operator Good day, and welcome to the Second Quarter 2024 Flowserve Corporation Earnings Conference Call. Today's conference is being recorded.

Flowserve: Mixed Q2 Results Hints At Limited Upside

Flowserve Corporation reported Q2 financial results, with revenue slightly below expectations but adjusted earnings exceeding forecasts. Management increased guidance for adjusted earnings per share for the year, showing a positive trend in profitability metrics. Despite ambitious goals and an upward revision in earnings, shares are not cheap enough to upgrade from a 'hold' rating.