First Solar Inc. (FSLR)

First Solar (FSLR) Beats Stock Market Upswing: What Investors Need to Know

First Solar (FSLR) closed the most recent trading day at $207, moving +2.63% from the previous trading session.

First Solar: The One Green Energy Play I Like Under This Administration

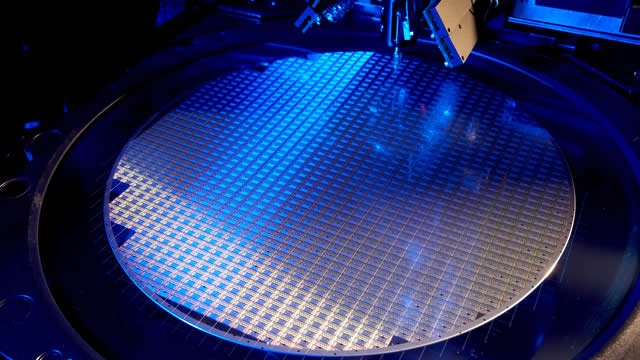

I am bullish on First Solar due to its superior thin-film technology, higher margins, and strong positioning in large-scale utility projects versus retail-focused peers. FSLR benefits from U.S.-based manufacturing, avoiding tariff impacts and supply chain risks that hurt competitors relying on imported silicon modules. Robust policy support, tax credits, and global expansion—especially in India—fuel growth, though risks remain around policy changes and commodity price swings.

First Solar, Inc. (FSLR) Is a Trending Stock: Facts to Know Before Betting on It

First Solar (FSLR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

First Solar, Inc. (FSLR) is Attracting Investor Attention: Here is What You Should Know

First Solar (FSLR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

First Solar (FSLR) Crossed Above the 20-Day Moving Average: What That Means for Investors

After reaching an important support level, First Solar (FSLR) could be a good stock pick from a technical perspective. FSLR surpassed resistance at the 20-day moving average, suggesting a short-term bullish trend.

Putting America First With First Solar

First Solar is a buy due to its strong U.S. manufacturing base, national security benefits, and limited reliance on Chinese inputs. FSLR's valuation is attractive, with low PE ratios and a conservative DCF model indicating undervaluation despite sector headwinds. Domestic policy, including tariffs and incentives benefits First Solar, though political uncertainty and China's dominance remain risks. Some domestic policies may disfavor First Solar as well, however.

First Solar: A Profitable Solar Stock That Gets More Compelling, Risks Remain

FSLR's risk-reward profile is a lot more compelling upon the clarity from One Big Beautiful Bill, with the 45x tax credits likely to sustain its rich profit margins. This is on top of the strategic monetization from the tax credit transfers, allowing the management to fund the ongoing capex expansions in the US. Combined with the discounted valuations, healthy balance sheet, & FQ2'25 new bookings, we can understand why the stock has recorded rich recoveries since the April 2025 bottom.

First Solar: A Cash-Generative Asset In The Energy Transition

First Solar is expanding capacity to 25GW by 2027, leveraging vertical integration and innovative CdTe technology to maintain US solar leadership. IRA 45X tax credits and US trade protection shield First Solar from Chinese competition, supporting margins and long-term profitability. Key risks include potential US solar price erosion and policy shifts favoring fossil fuels, which could impact demand and margins.

First Solar, Inc. (FSLR) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching First Solar (FSLR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

First Solar Stock Jumps as Firm Lifts Full-Year Sales Outlook

First Solar (FSLR) was one of the best-performing stocks in the S&P 500 Friday after the company posted stronger-than-expected earnings and raised its 2025 sales outlook.

First Solar Beats Q2 Earnings Estimates, Raises '25 Sales Guidance

FSLR tops Q2 earnings and sales estimates, narrows 2025 EPS range and raises full-year revenue and shipment outlook.