Gold Fields Ltd. Sponsored ADR (GFI)

Gold Fields (GFI) Stock Slides as Market Rises: Facts to Know Before You Trade

Gold Fields (GFI) reachead $13.97 at the closing of the latest trading day, reflecting a -0.64% change compared to its last close.

GFI or RGLD: Which Is the Better Value Stock Right Now?

Investors with an interest in Mining - Gold stocks have likely encountered both Gold Fields (GFI) and Royal Gold (RGLD). But which of these two stocks presents investors with the better value opportunity right now?

Should Value Investors Buy Gold Fields Limited (GFI) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Best Income Stocks to Buy for November 12th

GGAL, HMC and GFI made it to the Zacks Rank #1 (Strong Buy) income stocks list on November 12, 2024.

Best Value Stocks to Buy for November 12th

HMC, GFI and GGAL made it to the Zacks Rank #1 (Strong Buy) value stocks list on November 12, 2024.

GFI vs. RGLD: Which Stock Is the Better Value Option?

Investors interested in stocks from the Mining - Gold sector have probably already heard of Gold Fields (GFI) and Royal Gold (RGLD). But which of these two stocks presents investors with the better value opportunity right now?

Should Value Investors Buy Gold Fields Limited (GFI) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

GFI or RGLD: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Mining - Gold sector might want to consider either Gold Fields (GFI) or Royal Gold (RGLD). But which of these two stocks presents investors with the better value opportunity right now?

Are Investors Undervaluing Gold Fields Limited (GFI) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

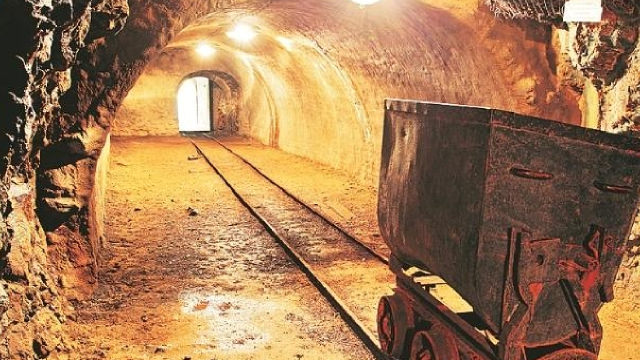

'The gold sector is highly fragmented'- Gold Fields Mike Fraser on consolidation in the mining space

Michael McCrae is leading Kitco's coverage of the mining sector. McCrae, who has both an MBA and CMA, knows how to build digital media properties.

Gold Fields' Half-Year Earnings: Not As Bad As Some Might Have Feared

Gold Fields Limited reported disheartening first-half results on Friday, leading to a near 10% drop in stock price. Production decreased, costs increased, and guidance was downgraded for the full year. However, most of the company's production headwinds were non-core events, such as weather disruptions and fatalities. Despite its operational challenges, the normalization of operations, rising gold prices, and a lucrative dividend policy may present a buying opportunity.

Gold Fields Limited (GFI) Q2 2024 Earnings Call Transcript

Gold Fields Limited (NYSE:GFI ) Q2 2024 Earnings Call Transcript August 23, 2024 1:00 AM ET Company Participants Mike Fraser - CEO Alex Dall - Interim CFO Mike Fraser Good day all and thank you for joining us today for the presentation of our operational and financial results for the six months ending 30th of June 2024. With me today is our Interim CFO, Alex Dall.