Barrick Gold Corporation (GOLD)

Why Barrick Gold (GOLD) Dipped More Than Broader Market Today

Barrick Gold (GOLD) closed the most recent trading day at $15.23, moving -1.81% from the previous trading session.

Why Is Barrick Stock Down When Gold Prices Up?

Barrick Gold stock (NYSE: GOLD) has fallen about 21% in the last two months, currently trading at about $17 per share. This compares to the S&P 500 which remains up by about 3% and gold prices which have fallen about 2% over the same period.

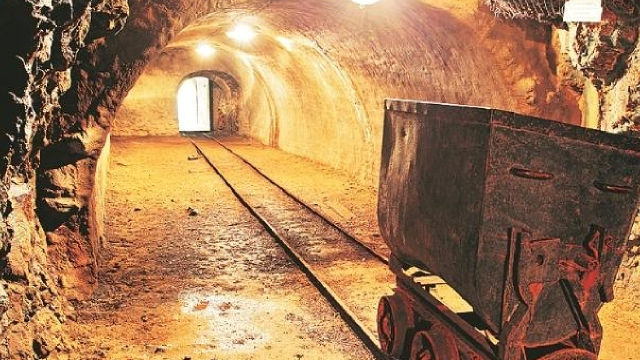

Barrick faces mounting challenges in Mali; operations at Loulo-Gounkoto in jeopardy

Barrick Gold Corp. (TSX:ABX, NYSE:GOLD) continues to grapple with escalating tensions in Mali, where unresolved disputes with the government over its 80%-owned Loulo-Gounkoto gold mine have led to a suspension of gold shipments and the imprisonment of several local employees. The company warned that operations at the mine could be halted if shipments remain blocked, marking a critical juncture in its negotiations with the Malian government.

Why Barrick Gold (GOLD) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Should You Buy, Sell or Retain Barrick Gold Stock at 9.87X P/E?

While GOLD's actions to drive production, solid financial health and a safe dividend yield paint a promising picture, its high costs warrant caution.

Dealmaker Hannam sues Randgold for up to $18 mln over Barrick merger work

Dealmaker Ian Hannam is suing Randgold Resources for up to $18 million he says he is owed for work on its acquisition by Canada's Barrick Gold , telling a London court on Friday that the gold miner reneged on their agreement.

Here's Why Barrick Gold (GOLD) is a Strong Value Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Barrick Gold's Fourmile Project Displays World-Class Potential

The strategy of investing in organic expansion through exploration and mineral resource management has distinguished GOLD from the industry.

Is the Options Market Predicting a Spike in Barrick Gold (GOLD) Stock?

Investors need to pay close attention to Barrick Gold (GOLD) stock based on the movements in the options market lately.

Barrick Gold: An Alternative To Gold Investment

In 3Q24, Barrick Gold generated $3.37 billion in revenues, posting year-on-year and sequential growth of 17.68% and 6.51%, respectively; the company's top line had beat estimates by $31.17 million. GOLD is positioned to benefit from the continued gold demand. Results of a central bank survey suggest that central banks will continue to shift reserves into gold. The Company has multiple projects in its pipeline and expects production to increase 30% by 2030.

Barrick Gold's Valuation Is Too Good To Ignore

Barrick Gold's post-earnings selloff presents a favorable risk/reward setup, with the uptrend intact unless $16.59 is breached. Despite rising revenues, production declines and increasing costs hinder Barrick's profit potential, impacting margins significantly. Barrick's valuation at 9.2X forward earnings is extremely low, suggesting market pessimism or potential earnings misses.

GOLD vs. TFPM: Which Stock Is the Better Value Option?

Investors looking for stocks in the Mining - Gold sector might want to consider either Barrick Gold (GOLD) or Triple Flag Precious Metals (TFPM). But which of these two stocks presents investors with the better value opportunity right now?