Home Depot Inc. (HD)

2 Top Dividend Stocks to Pile Into Right Now

Home Depot is a market-crushing stock that's flat this year but has big ambitions. Realty Income offers everything a dividend investor could want -- and more.

1 Spectacular Dividend Stock Down 19% You'll Regret Not Buying on the Dip

Passive income investors can generate income at regular intervals by investing in dividend stocks.

The Home Depot, Inc. (HD) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Home Depot (HD). This makes it worthwhile to examine what the stock has in store.

Home Depot: This Dog Hunts (Technical Analysis)

Home Depot recorded better-than-expected EPS figures but fell short on revenues in Q1. In this high-interest rate environment, many people might not want to invest in kitchens and bathrooms, so the company seems to be focusing more on professional customers. We explain why we think this home improvement retailing giant might be supported with buy-on-dips trading strategies going forward.

The Meme Casino Reopens

Not your thing? Then check out our tips on how to evaluate exchange-traded funds.

Home Depot Makes Notable Cross Below Critical Moving Average

In trading on Tuesday, shares of Home Depot crossed below their 200 day moving average of $335.37, changing hands as low as $332.32 per share. Home Depot Inc shares are currently trading off about 0.9% on the day.

Home Depot's Earnings Signal Trouble for Lowe's. Home Improvement Demand Is Soft.

Analysts expect a 5.4% drop in revenue for Lowes' first fiscal quarter, underscoring the impact of the housing market's stagnation.

As hurricane season arrives, these stocks could present opportunities

With hurricane season about to start, key stocks in the home-improvement and consumer-staples industries could present opportunities, according to investing-information website Trading.biz.

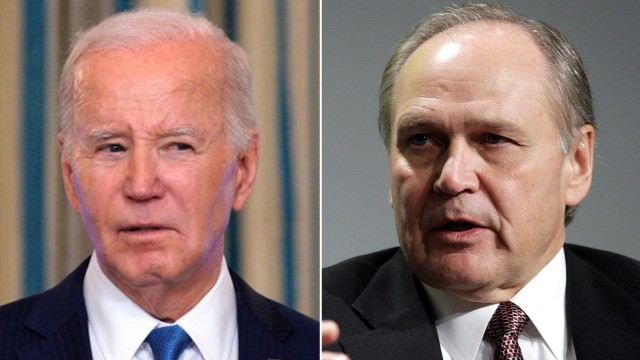

Former Home Depot CEO warns Biden's economy created a 'wrecking ball' for the next president

Former Chrysler and Home Depot CEO Bob Nardelli sounded off on inflationary pressures affecting Americans and policy decisions that have contributed to the hardship.

S&P 500: Lowe's Earnings Follow Home Depot Results Amid Same-Store Sales Skid

S&P 500 component Lowe's (LOW) reports first-quarter earnings and revenue early Tuesday as analysts expect another same-store sales decrease following results from rival Home Depot (HD) last week. LOW stock gained ground Monday. Analysts forecast Lowe's first-quarter earnings to drop 20% to $2.95 per share with sales totaling $21.14 billion, down more than 5% compared to last year, according to FactSet. The consensus among analysts also has same-store sales decreasing 5.5%. That would be the sixth consecutive quarter with a same-store sales decline, dating back to Q3 2022 — just like Home Depot. At the end of February, Lowe's management guided full-year EPS of $12-$12.30 with revenue of $84-$85 billion. Lowe's expected same-store sales to decline 2%-3% in 2024. Lowe's stock advanced 0.4% during premarket trade on Monday. The S&P 500 stock edged down 0.5% to 231.11 Friday, falling 1.7% on the week. However, LOW shares are up more than 1.3% in May. Last week, Lowe's rival Home Depot, also a S&P 500 component, announced better-than expected first-quarter earnings and reaffirmed 2024 guidance. Home Depot's Q1 earnings fell 5% to $3.63 per share while sales totaled $36.42 billion, down more than 2% compared to Q1 2023. The big box retailer also continues to predict 2024 revenue and EPS to grow around 1% while same-store sales for 2024 are forecast to decrease 1%. LOW shares are in a consolidation with a 262.49 buy point, but is trading modestly below its 50-day line, according to MarketSurge analysis. Lowe's stock approached all-time highs on March 22, hitting 262.49. Since then, the S&P 500 stock has dropped 12%, with a recent low of 224.68 on April 25. For 2024, Lowe's stock is up around 4%. Meanwhile, Home Depot stock hit a 2024 high of 396.87 on March 21 and has also fallen since then, finding support at its 200-day moving average. HD stock is below its 50-day line. Lowe's stock has a 45 Composite Rating out of a best-possible 99. The S&P 500 stock also has a 54 Relative Strength Rating and a 76 EPS Rating. Please follow Kit Norton on X @KitNorton for more coverage. Is Tesla Stock A Buy Or A Sell? Get Full Access To IBD Stock Lists And Ratings Learning How To Pick Great Stocks? Read Investor's Corner Is Rivian A Buy Right Now After It Launched Its New Product Line?

Where Will Home Depot Stock Be in 1 Year?

There was a delayed start to the spring selling season, but management isn't worried. Home Depot is expecting a second year of modest sales declines in 2024.

Home Depot Same-Store Sales Fall Again. Where Is the Stock Headed?

Home Depot has seen its same-store sales fall for six straight quarters. Home remodeling activity is expected to remain weak into the second half of this year.