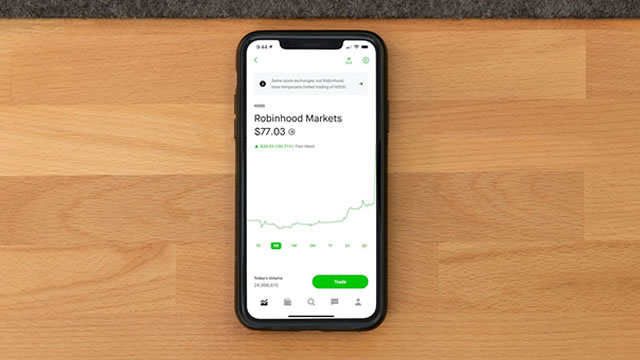

Robinhood Markets, Inc. (HOOD)

Will Legal Action Slow HOOD's Event Contracts Business Growth?

Robinhood faces a Connecticut halt on event contracts as regulators question whether its offerings resemble unlicensed sports gambling.

Prediction-Markets Data Is On CNN Now. Expect to See It Just About Everywhere Soon

CNN will start to integrate Kalshi data across its programming.

2 Top-Ranked Tech Stocks to Buy in December: HOOD, CLS

Two market-crushing Zacks Rank #1 (Strong Buy) technology stocks--Robinhood Markets and Celestica--that investors should consider buying in December and beyond.

Is It Worth Investing in Robinhood Markets (HOOD) Based on Wall Street's Bullish Views?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Is Robinhood's Sky-High Valuation Backed by Real Growth?

Robinhood Markets' HOOD shares are trading at a massive premium to the industry. At present, the company has a price/tangible book (P/TB) of 14.69X for the trailing 12 months compared with the industry average of 2.93X.

Robinhood's Latest Prediction Markets Move Has Its Stock Flying

Robinhood's latest venture raises the prediction-markets stakes.

Robinhood Goes All In On Prediction Markets with Susquehanna. The Stock Rises.

The online brokerage will launch a futures and derivatives exchange with Susquehanna International Group.

HOOD Partners With Susquehanna to Expand Prediction Market Business

Robinhood accelerates its prediction-market push with a 90% MIAX Derivatives stake, aiming to build a dedicated futures and derivatives exchange by 2026.

Polymarket Just Got CFTC Sign-Off. Prediction Markets Are on the March.

CEO Shayne Coplan said in a social media post that the predictions market has marked a "key milestone for permeating the US financial system."

Robinhood, Susquehanna to Launch Exchange to Expand Prediction Markets Offerings

The new exchange will help Robinhood offer additional prediction contracts tied to sports, elections and other future events.

Is Trending Stock Robinhood Markets, Inc. (HOOD) a Buy Now?

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

HOOY: Some Of Its Shine Is Getting Dull

YieldMax HOOD Option Income Strategy ETF offers high income potential through covered calls on Robinhood Markets, Inc., but with capped upside. HOOY has delivered strong distributions since its inception, rewarding early investors, though recent declines in HOOD have pressured HOOY's share price. Investment strategies discussed include early entry for rapid capital recovery, dollar-cost averaging to manage risk, and prudent position sizing for portfolio balance.