Robinhood Markets, Inc. (HOOD)

HOOD Unveils Micro Futures for BTC, SOL, XRP: Riding on Crypto Demand?

Robinhood rolls out micro futures for BTC, SOL and XRP, aiming to widen crypto access and boost trading volume.

Jim Cramer's Safest Stock For a Huge Market Selloff in July

Key Points in This Article: The S&P 500 hit a record high in June, driven by a U.S.

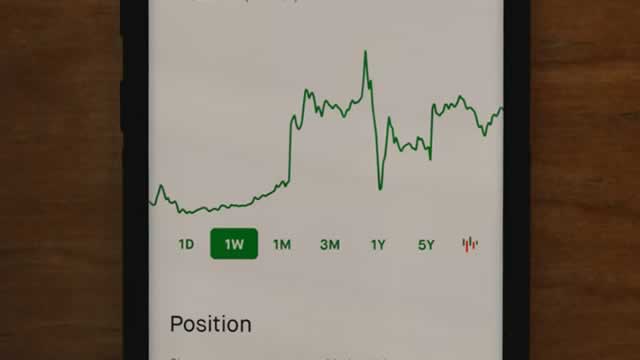

Robinhood: High Market Volatility Is This Company's Moment To Shine

Robinhood's transformation into a financial super-app is accelerating, with new products attracting diverse users and boosting engagement. Deposit growth is robust, driven by innovative offerings like Robinhood Gold and expansion into international markets such as the UK. Profitability is surging, with strong adjusted EBITDA, free cash flow, and a Rule of 40 score above 100, reflecting operational excellence.

Robinhood: Still Cheap Despite What You May Think

Robinhood's explosive growth, diversified revenue streams, and expanding product suite position it as a future all-in-one brokerage leader. Profitability is exceptional, with net income and margins outpacing peers—only Nvidia matches HOOD's growth and profit profile. Despite a 270% run-up, long-term valuation remains attractive; conservative modeling suggests 2.7x-3.5x upside by 2035.

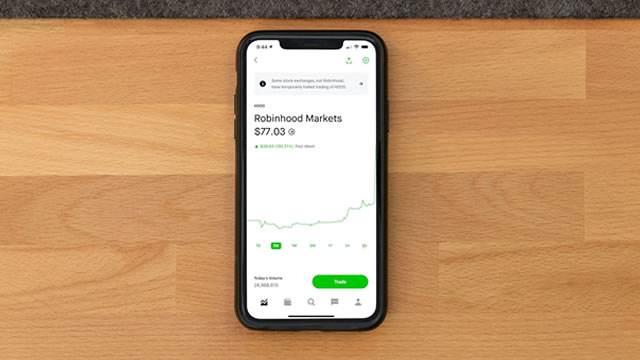

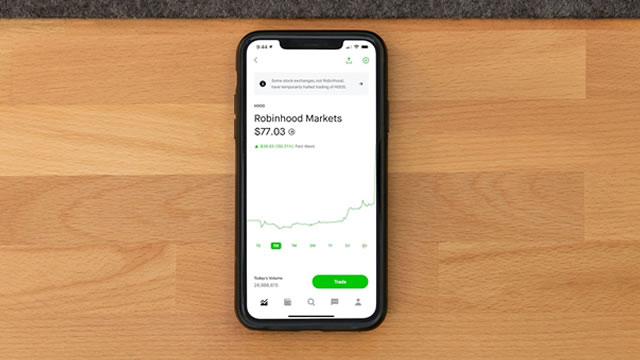

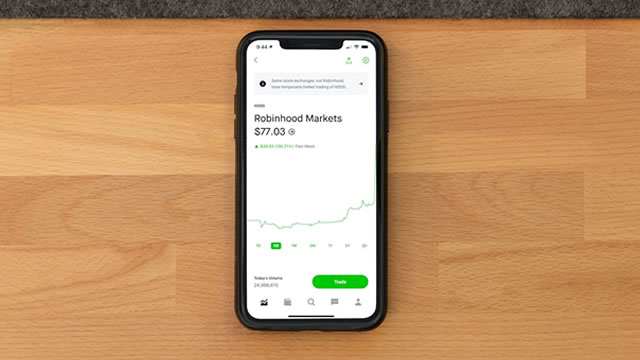

Robinhood Hits All-Time High: Is it Too Late to Buy HOOD Stock?

HOOD hits a record high of $85.55, backed by global expansion, crypto bets and bold diversification moves. Is there still room to run?

Robinhood CEO reveals benefits of crypto technology

Robinhood CEO Vlad Tenev discusses the stock hitting an all-time record on 'The Claman Countdown.'

Robinhood Markets, Inc. (HOOD) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Robinhood Markets (HOOD) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Robinhood CEO Vlad Tenev Wants to Change the Future of AI

The race to creating the most efficient and most intelligent AI programs has some unlikely contenders who are hoping to redefine specific industries through more advanced models. Robinhood's Vlad Tenev is developing “mathematical superintelligence” for provable accuracy in math and science, while SandboxAQ's Jack Hidary backs “large quantitative models” trained on numbers, not words.

Robinhood: Becoming The Costco Of Financial Services (Rating Upgrade)

I'm upgrading Robinhood to bullish, impressed by its robust growth, high margins, and expanding customer base of 25.9 million. HOOD's strategic initiatives—Robinhood Gold, new trading tools, and acquisitions—are driving sustained profitability, market share gains, and product ecosystem expansion. Despite regulatory and cybersecurity risks, HOOD's strong financials, buybacks, and projected EPS growth make it a compelling long-term investment.

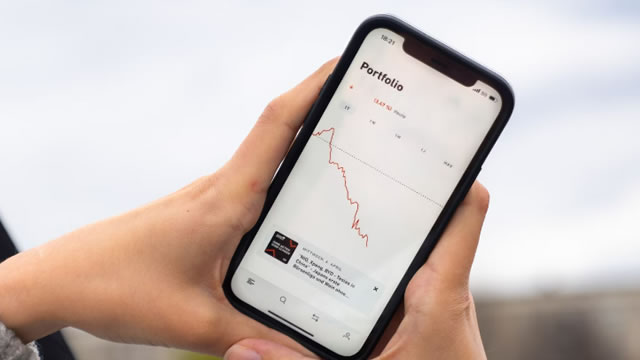

Meme stocks and Robinhood users show why long-term investing is your best bet

“Betting against Robinhood users is a profitable business,” according to one survey, as top stocks bought by users fell 5% in the month after.

Robinhood Director Sells Millions, But HOOD Stock Eyes Gains

Understanding incentives and narratives in the market is just as important as understanding its history; however, two truths remain constant through the test of time. People typically buy a stock to make a profit, but these same participants often hesitate to sell a stock just to realize those profits.

Robinhood Launches New Tools to Woo Traders

The new features are part of a 10-year strategy to build its business beyond its trading platform.