Robinhood Markets, Inc. (HOOD)

2 Stocks That Have More Than Doubled in the Past Year to Buy and Hold for a Decade

Equity markets recently dipped due to concerns of deteriorating macroeconomic conditions, with the latest trigger being President Trump's trade wars. The S&P 500 index's performance over the trailing-12-month period no longer looks quite as impressive as it did at the start of 2025 -- the equity index is down nearly 1.5% over this period.

Huge News for Robinhood Stock: Why Growth Will Slow in Q1

Robinhood (HOOD -9.95%) stock has been on a tear as the company has grown its business, but early data for 2025 indicates investors should reduce their growth expectations. In the video below, Travis Hoium explains why Robinhood is still a growth company, but volatility is ahead in 2025.

Is Now the Time to Buy Robinhood Stock?

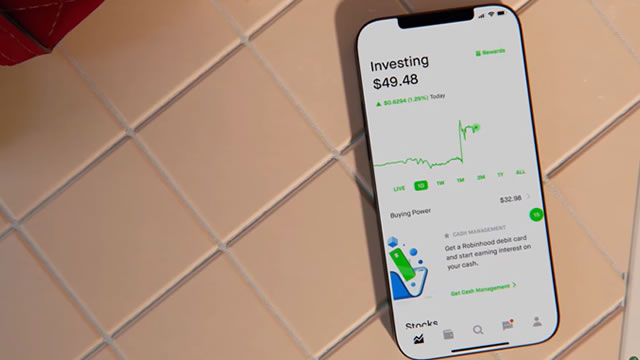

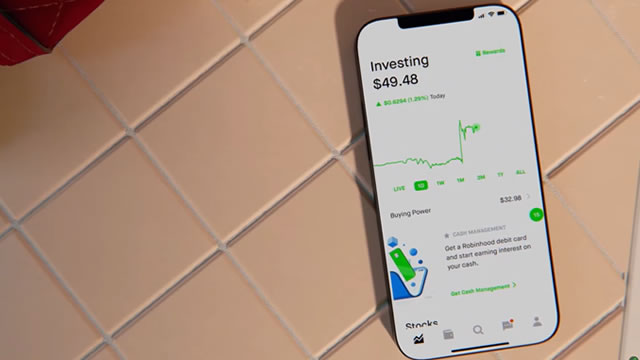

Discount broker Robinhood Markets (HOOD 1.26%) has quickly established itself as an important force in the brokerage industry. Offering free trades, for example, led to a massive change in the way brokers competed on cost.

Can Robinhood's (HOOD) New Wealth Management Services Lead to a Winning 2025?

Believe it or not, but Robinhood (Nasdaq: HOOD) is still up year-to-date.

Robinhood Is Changing the Game

Robinhood (HOOD 1.20%) held another Gold event last week, introducing even more products for Robinhood Gold customers, including investment planning and banking services. This could help the company attract more customers and grow assets under custody, which Travis Hoium covers in this video.

This Unstoppable Stock Has 150% Upside, According to a Select Wall Street Firm -- but I'm Not Buying It

The financial markets had a spectacular year in 2024. Every major U.S. stock index soared to an all-time high, and even the total value of the cryptocurrency market set a new record of $3.9 trillion.

From Trading to Checking Accounts: Robinhood's Big Bet on Banking

Robinhood Markets, Inc. NASDAQ: HOOD, the platform synonymous with commission-free trading and the surge of retail investor activity in recent years, is making a dramatic pivot. Known for democratizing access to stock, options, and cryptocurrency markets, the company is now setting its sights on the core territory of traditional finance: banking and wealth management.

Robinhood to Launch Wealth Management & Private Banking Services

HOOD is rolling out wealth management and private banking services to retail investors.

Robinhood Markets, Inc. (HOOD) is Attracting Investor Attention: Here is What You Should Know

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

The Best Stocks to Invest $50,000 in Right Now

You can buy a lot of wonderful things with $50,000 -- a car, a boat, even the trip of a lifetime.

Robinhood is getting into banking, and its ‘luxury' perks include cash delivered to your doorstep

Trading platform Robinhood, best known for introducing a new generation of traders to the stock market, crypto, and ETFs, is growing up alongside its customers, moving one step closer to becoming a full financial-service company, along the likes of Fidelity or Charles Schwab.

Robinhood CEO on new wealth management service, crypto regulation & what could move bitcoin higher

Asking for a Trend anchor Josh Lipton breaks down the latest market trends for March 27, 2025. Also, Robinhood CEO Vlad Tenev discusses his company's banking and wealth management products.