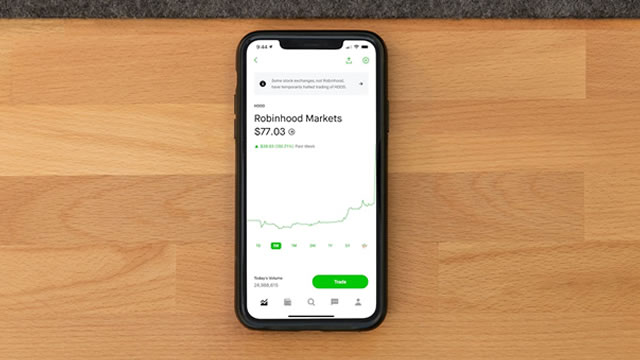

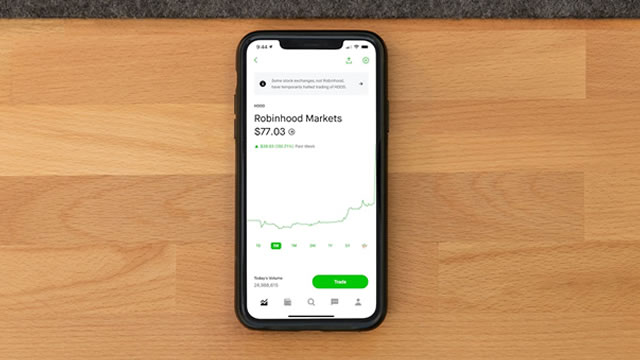

Robinhood Markets, Inc. (HOOD)

Is Robinhood's Latest Product Gambling or Innovation?

Robinhood (HOOD 2.01%) has gotten a lot of attention for its NCAA tournament futures, and not in a good way. Many observers think this is akin to gambling, but is there a bigger story here?

Robinhood to consider event contracts

CNBC's Alex Sherman reports on news regarding Robinhood and March Madness.

Robinhood Ramps Up Sports Prediction Markets For March Madness

The CNBC Sport videocast brings you interviews with the biggest names in the business. In this week's episode, CNBC's Alex Sherman sits down with JB Mackenzie, Robinhood vice president and general manager of futures and international.

You can now make March Madness bets on Robinhood. Will regulators allow sports contracts at more brokerages?

There are plenty of ways to wager money on who will win the NCAA basketball tournaments — now you can make bets in the same place you buy stocks or crypto.

March Madness Sparks Big Moves in 3 Sports Betting Stocks

Sports betting stocks are in the spotlight as March Madness drives a surge in wagering activity, with DraftKings Inc (NASDAQ:DKNG), Robinhood Markets Inc (NASDAQ:HOOD), and Flutter Entertainment PLC (NYSE:FLUT) all making notable moves.

Robinhood: 2025 Path To 14x P/E

Robinhood's earnings are accelerating, with a diversified revenue stream and strong operational performance, making it a strong buy despite the recent market selloff. The company's Q4 performance dramatically beat expectations, driven by explosive growth in crypto and options trading, signaling underestimated EPS estimates for 2025. Robinhood's high-margin business model and expanding market share support a compelling long-term bull case, with the potential for significant EPS growth and valuation upside.

Robinhood takes on sports: Here's what to know

CNBC's Alex Sherman joins 'Squawk Box' to discuss Robinhood's foray into sports, his interview with Robinhood VP & GM of Futures & International JB Mackenzie, and more.

After 50% Pullback, Is Robinhood Stock a Buy?

Shares of Robinhood (HOOD -4.59%) have fallen as much as 45% from their recent peak, but is that an opportunity for long-term investors? We explain why there's still risk, but the opportunity is looking more compelling today given Robinhood's maturing asset base.

Robinhood is Set to Roll Out Prediction Markets Hub, Stock Up 7.1%

HOOD is set to introduce Prediction Markets Hub, allowing traders to bet on the outcomes of major global events and enhancing liquidity in the market.

Robinhood Markets, Inc. (HOOD) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Robinhood Markets (HOOD). This makes it worthwhile to examine what the stock has in store.

Robinhood: A 'Golden' Opportunity After The Crash

I initiate coverage on Robinhood with a buy rating, citing value in the stock despite its significant drop from all-time highs. Strong Q4 results, high EPS growth, and robust revenue from equities and Gold subscriptions support a positive outlook for HOOD. Key risks include market share competition, aggressive investments, and potential regulatory changes impacting costs and margins.

Robinhood Markets: Fintech Growth Story Trading At Discount

Robinhood Markets stock is down 40% from its peak, but strong fundamentals and strategic initiatives suggest significant growth potential and undervaluation. February 2025 net new assets rose 28% YoY to $4.8 billion, with record trading volumes in options and equities, outpacing consensus estimates. Strategic initiatives like the desktop trading platform, futures offering, and Gold membership program diversify revenue and enhance Robinhood's competitive edge.