Robinhood Markets, Inc. (HOOD)

Why Robinhood's Growth Has Just Begun

Robinhood Markets (HOOD -4.40%) has been one of the hottest stocks on the market over the past year, and for good reason. The company's revenue and profitability is picking up, and there could be years of growth ahead.

Should You Buy Robinhood While It's Below $80?

Robinhood (HOOD 2.32%) is perhaps best known for its role in the meme stock frenzy a few years ago. After facing significant scrutiny from investors and regulators, the company has transformed its platform, delivering impressive growth in the process.

Earnings Estimates Rising for Robinhood Markets (HOOD): Will It Gain?

Robinhood Markets (HOOD) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Are Finance Stocks Lagging Robinhood Markets (HOOD) This Year?

Here is how Robinhood Markets, Inc. (HOOD) and The Charles Schwab Corporation (SCHW) have performed compared to their sector so far this year.

Don't Forget Value As Robinhood Benefits From Speculation Trends

Robinhood Q4 was strong, but lofty growth targets risk overshooting reality; the speculative user base and tokenization pivot raise questions about a lasting moat. A crypto-centric focus and budding prediction markets may amplify speculation, limiting appeal among serious capital managers and threatening long-term stability. Despite fair valuation and moderate upside, near-term profitability hurdles and volatility suggest a Hold stance targeting ~10% annual returns.

5 Robinhood Analysts React To 'Blowout' Q4 Earnings: Can The 'Tremendous Momentum' Continue?

Robinhood Markets Inc HOOD analysts on Thursday raised price targets on Robinhood shares following the company's fourth-quarter results. Analysts are overwhelmingly impressed with profitability metrics combined with accelerating growth.

How Robinhood is expanding into wealth management

Robinhood Markets (HOOD) stock surges after the trading platform reported its fourth quarter earnings beat. Whalen Global Advisors chairman Chris Whalen joins Morning Brief with Brad Smith and Madison Mills to discuss how the company can compete with the big financial services players.

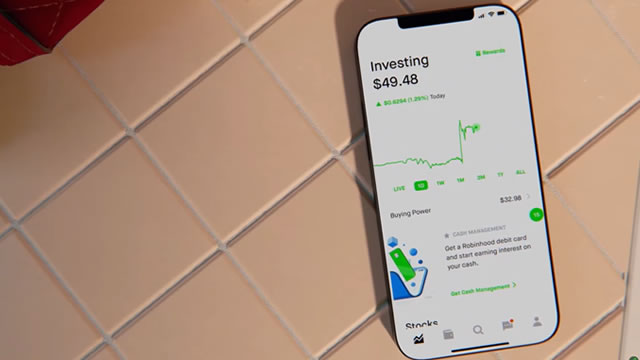

Robinhood reports record Q4 revenue driven by crypto trading fees

Robinhood Markets Inc (NASDAQ:HOOD) posted a record $1.01 billion in Q4 revenue, fueled by a 500% surge in crypto trading fees, which reached a record $358 million. The financial services company's performance comes as a result of a renewed wave of retail interest in crypto, with the platform benefiting from the ongoing bull market.

Robinhood Q4 revenue soars on crypto trading

Robinhood Markets (HOOD) surges ahead by 15% Thursday morning, continuing gains since the brokerage platform posted its fourth quarter earnings beat on Wednesday. Revenue tied to crypto trading is one factor contributing to this ride higher as Robinhood reported $358 million in crypto revenue, above expectations for $329.7 million, jumping by 700% year-over-year.

Why Robinhood Stock Hit the Bullseye Today

Robinhood Markets (HOOD 10.38%) stock soared 12.5% through 11 a.m. ET Thursday after crushing its Q4 earnings report last night.

Robinhood CEO Vlad Tenev: Prediction markets are the future

CNBC's Kate Rooney sits down with Robinhood CEO Vlad Tenev to discuss the company's most recent quarter, outlooks on how Robinhood will approach sports contract arena, and more.

Why Robinhood Stock Is Soaring After Earnings

Robinhood stock is sizzling Thursday after the online trading platform reported impressive fourth-quarter results. Here's what investors need to know.