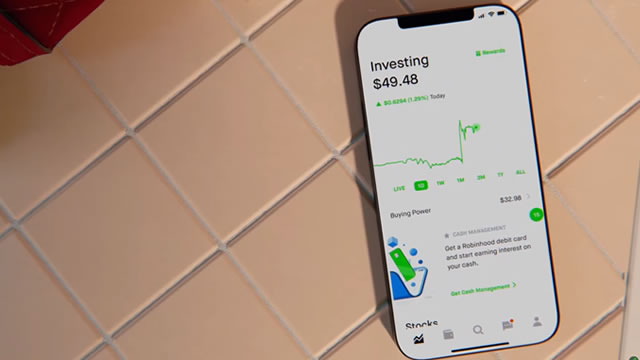

Robinhood Markets, Inc. (HOOD)

Can Robinhood Markets (HOOD) Keep the Earnings Surprise Streak Alive?

Robinhood Markets (HOOD) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Interest Rate Cuts Are Terrific News for These 2 Stocks, But Terrible News for Another

The Federal Reserve slashed the fed funds rate last month, and more cuts are likely on the way.

Robinhood launches crypto transfers in Europe as it pushes overseas expansion

Retail investing platform Robinhood announced that it's offering customers in Europe the ability to transfer cryptocurrencies in and out of its app. The company is looking to broaden its product capabilities in the region as it ramps up its international expansion.

Will Interest Rate Cuts Hurt Robinhood and Halt HOOD Stock Rally?

The Fed lowers interest rates. Will this hurt Robinhood's top-line growth and impede the stock's rally?

Robinhood To Rally Over 13%? Here Are 10 Top Analyst Forecasts For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

1 Undervalued Growth Stock to Buy Now for Long-Term Investors

Finding undervalued growth stocks is difficult amid a bull market.

Why Robinhood Markets, Inc. (HOOD) Dipped More Than Broader Market Today

Robinhood Markets, Inc. (HOOD) concluded the recent trading session at $22.39, signifying a -1.67% move from its prior day's close.

Is Trending Stock Robinhood Markets, Inc. (HOOD) a Buy Now?

Recently, Zacks.com users have been paying close attention to Robinhood Markets (HOOD). This makes it worthwhile to examine what the stock has in store.

Robinhood Stock Is Up 83% in 2024, but Interest Rate Cuts Might Spell Bad News

Robinhood's stock trading platform is a hit with young investors, but its core business has struggled since 2021. High interest rates have been the main source of Robinhood's revenue growth since 2022.

Robinhood Touts Rock-Bottom Fees for Options Trading. Then Come the Hidden Costs.

Customers using the platform face higher transaction costs than those of other brokers, a study finds.

Robinhood Markets, Inc. (HOOD) Stock Slides as Market Rises: Facts to Know Before You Trade

Robinhood Markets, Inc. (HOOD) reachead $22.81 at the closing of the latest trading day, reflecting a -0.61% change compared to its last close.

This Robinhood Analyst Raises Forecast By 17% On Retail Trading and Crypto Expansion - Here's Why

Robinhood Markets Inc HOOD stock is up after Piper Sandler analyst Patrick Moley maintained an Overweight rating and raised its price target from $23 to $27.