AngloGold Ashanti plc (HT3)

Summary

HT3 Chart

Can AngloGold Ashanti Meet Its Upbeat 2025 Gold Production Guidance?

AU eyes strong 2025 growth as Sukari and other key mines lift output and support its reaffirmed production outlook.

AU Stock Soars 266% YTD: What's the Right Strategy for Investors Now?

AngloGold Ashanti's 266% YTD surge is powered by soaring gold output, a strong cash flow and new assets, pushing investors to assess its growth path.

Still Ascending Is AngloGold Ashanti

AngloGold Ashanti (AU) is upgraded to Strong Buy, driven by bullish momentum in gold and AU's standout fundamentals. AU's Q3'25 results highlight record free cash flow, disciplined cost management, and a growing dividend, justifying its premium valuation. Geita and Nevada assets provide visible growth, with Geita's reserve expansion and Nevada's Tier 1 discovery positioning AU for long-term upside.

AngloGold Ashanti plc (HT3) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has AngloGold Ashanti plc ever had a stock split?

AngloGold Ashanti plc Profile

| Metals & Mining Industry | Materials Sector | Alberto Calderon BA Econ, Econ, Law, M Phil Econ, CEO | XBER Exchange | GB00BRXH2664 ISIN |

| GB Country | 12,634 Employees | 28 Nov 2025 Last Dividend | 5 Aug 1998 Last Split | - IPO Date |

Overview

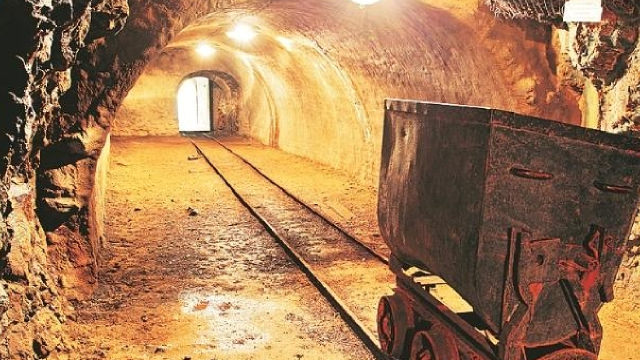

AngloGold Ashanti plc is a prominent player in the gold mining sector, having a broad operational footprint that spans Africa, the Americas, and Australia. Established in 1944, the company has cultivated a reputation for being a major explorer and producer of gold. Not limited to gold, AngloGold Ashanti also partakes in the production of silver and sulphuric acid as by-products, enriching its product portfolio. Its operations are strategically placed, with its flagship project, the Geita mine in Tanzania, showing commitment to exploring and expanding within gold-rich regions. The company's commitment to growth and exploration is also evidenced by its diverse portfolio in Ghana, Brazil, Argentina, Nevada, and Guinea, amongst others. Headquartered in Greenwood Village, Colorado, AngloGold Ashanti showcases a global presence alongside a rich heritage in mining and exploration.

Products and Services

AngloGold Ashanti plc's product and service offerings are centered around the mining and production of valuable resources, primarily focusing on gold but also including other by-products. Here is a deeper look into their portfolio:

- Gold Exploration and Production: As the cornerstone of its operations, the company is heavily involved in the exploration and mining of gold, boasting a vast portfolio of mining projects scattered across different continents. Each project, such as the flagship Geita mine in Tanzania, along with operations in Ghana (Iduapriem and Obuasi mines), Brazil (AGA Mineração and Serra Grande), Australia (Sunrise Dam and Tropicana), and others, reflects the company's dedication to harnessing the value of gold in diverse geographies.

- Silver Production: Apart from gold, AngloGold Ashanti engages in the production of silver as a valuable by-product of its mining operations. This diversifies its product lineup and takes advantage of the geological deposits where silver is present alongside gold.

- Sulphuric Acid Production: Highlighting the company’s versatility in mining and chemical production, sulphuric acid is produced as another by-product. This not only optimizes the usage of extracted minerals but also contributes to the chemical industry, where sulphuric acid is in demand for a multitude of applications.