Inspire Corporate Bond ETF (IBD)

Wix Stock Surges On Earnings Beat, Raised Outlook And New Buyback

Wix (WIX) stock surged Monday after the provider of website creation services reported first quarter profit and revenue that topped estimates. The company raised its full-year revenue outlook. The Israel-based company said Q1 profit rose 42% to $1.29 a share, topping estimate of $1.05 per share. Revenue climbed 12% to $420 million, topping estimates of $418 million. The company said it's in the process of authorizing a new $225 million buyback of Wix stock. On the stock market today, Wix stock jumped 23.8% to close at 168.02. Heading into the Wix earnings report, the company owned an entry point of 146.21 from a cup base. Shares soared past a 5% buy zone on Monday. Wix raised its full year revenue outlook to a range of $1.738 billion to $1.761 billion, or 13% growth. Q1 bookings came in at $457.3 million, above estimates of $453.4 million. "Q1 bookings beat street by $6 million," said Jefferies analyst Brent Thill in a report. "Fiscal 2024 bookings guidance was raised by $13 million at the midpoint to 12% to 14% growth." Wix's website design and hosting services compete with GoDaddy (GDDY). Follow Reinhardt Krause on Twitter @reinhardtk_tech for updates on artificial intelligence, cybersecurity and cloud computing. YOU MAY ALSO LIKE: Want To Trade Options? Here Are The Basics To Get You Started IBD Digital: Unlock IBD's Premium Stock Lists, Tools And Analysis Today Learn How To Time The Market With IBD's ETF Market Strategy Monitor IBD's "Breaking Out Today" List For Companies Hitting New Buy Points

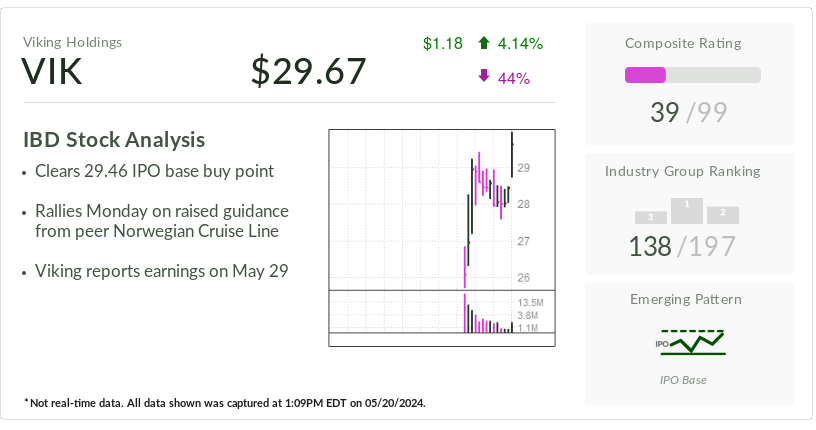

Viking Holdings, IBD Stock Of The Day, Breaks Out; Cruise Lines Sail On Norwegian Guidance

Viking Holdings is the IBD Stock Of The Day for Monday. Shares of the newly publicly traded parent of Viking Cruises are breaking out of a short IPO base. Viking and other cruise stocks sailed higher after Norwegian Cruise Line Holdings (NCLH) hiked its outlook. Los Angeles-based Viking Holdings (VIK) debuted on the New York Stock Exchange on May 1 at 24 per share. The IPO raised about $1.5 billion, making it the largest public offering since Arm Holdings (ARM) launched in September, according to data from IPO research firm Renaissance Capital. Viking was founded in 1997 and operates a fleet of nearly 100 smaller ships for luxury river, ocean and lake cruises across the globe. The company focuses primarily on Europe and the Mediterranean with niche, upscale experiences that feature art, science, history, culture and cuisine to target an older, wealthier audience. Viking's European river vessels have an average capacity of about 190 passengers and its ocean liners hold about 930 passengers. The company's typical passenger load pales in comparison to the 3,000 load of average cruise ships. Meanwhile, cruise demand is expected to grow from 31.5 million cruise travelers in 2023 to 35.7 million in 2024, according to Expedia Cruises. Viking shares on Monday surged 4.2% to 29.68, breaking out past an official 29.46 buy point for a new IPO base on the weekly chart, MarketSurge data shows. However, Viking releases its Q1 results early on May 29. That will be its first report as a public company. FactSet estimates are not yet available for the report. Investors can take a position in VIK stock, but won't have a lot of time to build a cushion before earnings. Viking stock ranks 17th in the Leisure-Services Group, according to IBD Stock Checkup. Royal Caribbean (RCL) leads the IBD industry group, which ranks 108th out of the 197 groups tracked by IBD. VIK stock's relative strength line has climbed in recent weeks. The stock has a 70 RS Rating out of a best-possible 99. Norwegian Cruise Line Holdings hiked its outlook Monday ahead of its investor day presentation. The Miami-based cruise line announced its new "Charting the Course" strategy, which includes investment initiatives in the company culture and employees, guest product offerings, Norwegian's growth platform, as well as optimizing performance. By the end of 2026, Norwegian expects to achieve adjusted earnings of $2.45 per share, representing a two-year compound annual growth rate of over 30% from 2024 to 2026. Norwegian plans to achieve an adjusted operational EBITDA margin of about 39% to approach historical levels. The company by the end of 2026 also intends to reduce its greenhouse gas emissions by 10% from 2019 baseline levels. "We have continued to see very strong demand and record bookings," CFO Mark Kempa said in the release. "We are now thrilled to launch this financial plan by setting long-term targets with increased 2024 guidance, putting ourselves on solid footing to enhance shareholder value in the coming years." Norwegian also raised its 2024 outlook based on its 2026 targets. The company now expects adjusted earnings to surge 103% to $1.42 per share, up from its prior forecast of $1.32 per share. Norwegian guided net yield growth to rise 7.2%, compared with the prior guidance of 6.4% growth. Norwegian now sees 2024 adjusted EBITDA increasing 23.6% to $2.3 billion. The cruise line guided adjusted EBITDA of $2.25 billion with its first-quarter results on May 1. Norwegian maintained its occupancy guidance of around 105.1% capacity. NCLH stock leapt 8.3% Monday to rebound back above its 21-day exponential moving average and 10-day lines. Shares are trading just shy of their 200-day line. Norwegian stock had fallen 14.8% in 2024. Royal Caribbean spiked 5% Monday on the Norwegian Cruise Line announcement. RCL stock is extended above a buy zone for a cup base following a late March breakout. Monday's move offered current investors an add-on entry as RCL cleared a few weeks of resistance. Royal Caribbean shares have rallied 15% year to date. Carnival (CCL) jumped 7% Monday to bounce strongly above its 50-day and 200-day lines. CCL stock is off 13.7% so far this year. You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison YOU MAY ALSO LIKE: Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists Looking For The Next Big Stock Market Winners? Start With These 3 Steps Join IBD Live And Learn Top Chart Reading And Trading Techniques From Pros Learn How To Time The Market With IBD's ETF Market Strategy

Can Nvidia Stock Reach The Summit With Its Fiscal Q1 Report?

With Nvidia (NVDA) stock trading near its all-time high, investors are wondering if it has enough oxygen to continue its ascent. The answer likely will come when the AI-chip leader releases its fiscal first-quarter results late Wednesday. Analysts polled by FactSet expect the graphics-chip maker to earn an adjusted $5.60 a share, up 414% year over year, on sales of $24.59 billion, up 242%, in the quarter ended April 28. That would mark its fourth straight quarter of triple-digit percentage growth in sales and earnings. Investors will key in on its guidance for the current quarter. For the fiscal second quarter, Wall Street is modeling Nvidia earnings of $5.96 a share, up 121% year over year, on sales of $26.62 billion, up 97%. Nvidia stock has been consolidating for the past 10 weeks at a buy point of 974, which is also its all-time high, according to IBD MarketSurge. Last week, Nvidia cleared an early-entry buy point, based on IBD analysis. In afternoon trades on the stock market today, Nvidia stock was up 2.7% to 949.30. On Monday, at least four Wall Street firms raised their price targets on Nvidia stock: Baird, Barclays, Stifel and Susquehanna. All four firms have buy ratings on Nvidia shares. They see continued strong demand for Nvidia's graphics processing units, or GPUs, by cloud computing service providers running AI applications. Nvidia's quarterly report Wednesday will mark the one-year anniversary of the company delivering a monster beat-and-raise report that accelerated the AI stock boom. It also means Nvidia will start to face tougher comparisons on a year-over-year basis, analysts say. One headwind for Nvidia has been its inability to source components from its contract manufacturers. The company could be supply constrained through calendar 2024, especially with new products ramping in the second half of the year. Those products include the new Blackwell series GPUs. While Nvidia is experiencing an improved supply, it still faces shortages of high-bandwidth memory and CoWoS, Rosenblatt Securities analyst Hans Mosesmann said in a client note Monday. CoWoS, which stands for Chip-on-Wafer-on-Substrate, is an advanced packaging technology. Another concern with Nvidia stock is whether the company will hit an "air pocket" in sales of current Hopper series GPUs when Blackwell series GPUs become available later this year. "We do not subscribe to the air-pocket theory in the Hopper to Blackwell transition for the July-quarter guide as the transition to B100 is scheduled for later in 2024," Mosesmann said. "In reality, it is the transitions to B200 and GB200 — both of which are 2025 products — that will drive the true generational disruption. We also anticipate that Blackwell will be completely sold out, at least for a year." Mosesmann rates Nvidia stock as buy with a price target of 1,400. Piper Sandler analyst Harsh Kumar said he also does not think demand for Hopper GPUs will slip ahead of the Blackwell series launch. "Customers are wary of taking themselves out of line for Hopper allocation in fears that supply will be further limited for the Blackwell product," Kumar said in a report Thursday. "Furthermore, customers also expect that if they do receive an allocation of B100 chips, then it will most likely not be the full order amount." Kumar rates Nvidia stock as overweight, or buy, with a price target of 1,050. Nvidia's results and guidance will have an impact on other artificial intelligence plays such data-center computer makers Dell Technologies (DELL) and Super Micro Computer (SMCI). Other companies that stand to benefit from continued strong Nvidia AI chip sales include connectivity-chip makers Astera Labs (ALAB) and Marvell Technology (MRVL) and high-bandwidth-memory chip maker Micron Technology (MU). Nvidia stock is on six IBD stock lists including Leaderboard, SwingTrader, IBD 50, Big Cap 20, Sector Leaders and Tech Leaders. Further, Nvidia stock is one of the so-called Magnificent Seven stocks that had a huge run last year. In a client note Friday, Goldman Sachs strategist David Kostin said the Magnificent Seven group needs to be retired because they all aren't performing well now. Apple (AAPL) and Tesla (TSLA) are laggards this year while Alphabet (GOOGL), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT) and Nvidia are up in 2024. Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks. YOU MAY ALSO LIKE: Broadcom's New Networking Gear Aims To Resolve AI Data Center Bottlenecks Chip Gear Giant Applied Materials Beats Targets On DRAM Equipment Sales AMD Stock Rises On Microsoft Plan To Offer AMD AI Processors On Azure MarketSurge: Research, Charts, Data And Coaching All In One Place See Stocks On The List Of Leaders Near A Buy Point

IBD 50 Restaurant Stock Wingstop Flies High, Offers New Buy Point

Chicken wing restaurant chain Wingstop (WING) is Monday's pick for IBD 50 Growth Stocks To Watch. Wingstop stock completed a bullish pattern on Friday, offering investors a new buy point. The fast-food eatery specializes in spicy chicken wings, along with chicken sandwiches and sides. The Texas-based company opened 65 net new locations in the first quarter, bringing the total number of global locations to 2,279 as of March 30. Wingstop stock ranks No. 5 out of 53 stocks in the retail-restaurants group. The group ranks a high No. 9 out of the 197 Investor's Business Daily industry groups. Wingstop also is an IBD Leaderboard Sector Leader. The restaurant stock gained around 0.6% in Monday morning trading. On Friday, Wingstop stock completed a bullish three-weeks-tight pattern with a 400.99 buy point, according to MarketSurge pattern recognition. The entry is also its all-time high, reached on May 10. Shares have soared since it broke out of an early stage cup base with a 223.77 buy point in November. The stock rode its 10-week moving average up, with several tests in April. Wingstop stock dipped 0.2% in heavy volume on May 1, after the company's first quarter earnings report. Shares have traded mostly sideways and formed the new pattern as volume has been tapering. The restaurant stock has climbed around 51% this year so far. Wingstop topped first quarter earnings and sales estimates in early May. Its adjusted earnings growth accelerated to 66% over the prior year's same period, and was up from 53% and 7% in the prior two quarters. Sales growth also picked up steam, and increased 34% in the first quarter from 26% and 21% in the previous two periods. "Our fiscal first quarter 2024 showcased the momentum behind the Wingstop brand and the continued strength of our strategies, delivering 21.6% domestic same-store sales growth driven almost entirely by transaction growth," Chief Executive Michael Skipworth said in the company's earnings release. The company also raised its domestic full-year 2024 same-store sales growth to low double digits from mid-single-digit growth. FactSet estimates show second-quarter profit growth decelerating to 36%, followed by 20% and 28% in the next two periods. Full-year 2024 profit growth is expected to continue its two-year trend of greater than 30%. Analysts see profit increasing 37% this year before sliding to 22% in 2025. Meanwhile, analyst forecasts show second-quarter sales growth of 30% then ease to 24% and 20% in the third and fourth quarters. Mutual funds own a high 72% of the restaurant stock, with 760 owning Wingstop shares in March. That's up from 720 in December and 636 in September. Its IBD Accumulation/Distribution Rating of B indicates institutions have been moderately buying shares over the last 13 weeks. Wingstop stock boasts a 97 out 99 possible IBD Composite Rating and a 96 Earnings Per Share Rating. Follow Kimberley Koenig for more stock market news on X/Twitter @IBD_KKoenig. YOU MAY ALSO LIKE: IBD 50 Sports Betting Giant Climbs In Base, But Proceed With Caution | Market Trends Pinterest Stock Explodes On Heels Of 150% Profit Growth | Stocks To Watch Five S&P 500 Stocks To Watch In Today's Market; Amazon Stock Hits New High | Stocks To Watch Looking For Market Insights? Check Out Our Live Daily Segment | Stocks To Watch AI Powers This IBD 50 Logistics Leader; Sales Look To Soar 90% | Stocks To Watch

Nvidia Stock Back Near Highs Amid Expectations For Another Huge Quarter

Nvidia (NVDA) gets top billing on the latest earnings calendar, but don't overlook Modine Manufacturing (MOD), a provider of thermal management solutions in the fast-growing data center market. Nvidia stock soared above a buy point Wednesday, while Modine is trying to clear a cup base after several months of outperformance. For Nvidia stock to move to new highs from here, it'll most likely need another big earnings and revenue beat, along with a significantly raised forecast from the company. Same goes for Modine. With Nvidia, HSBC upped the artificial intelligence leader's price target earlier in the week to 1,350, saying that the company's earnings power hasn't fully been valued into the stock. It's no secret what's been fueling Nvidia's price strength in recent months — torrid earnings and revenue growth for three quarters in a row. When Nvidia reported fiscal fourth-quarter earnings Feb. 21, shares gapped up sharply the next day. Nvidia said adjusted profit soared 486% year over year to $5.16 a share. Revenue jumped 265% to $22.1 billion, with data center sales up 409% to $18.4 billion, helped by strong demand for its graphics processors used to run AI applications. The company's gaming business, which includes graphics cards for laptops and PCs, rose 56% to $2.87 billion. "Accelerated computing and generative AI have hit the tipping point," Chief Executive Jensen Huang said in the earnings release. "Demand is surging worldwide across companies, industries and nations." Huang also said that while demand remains strong from large cloud-service providers, the company is also seeing robust demand from enterprise software and consumer internet firms. Nvidia raised its revenue outlook for the April-ended quarter to $24 billion. At the time, analysts had predicted $22.17 billion in sales. Results for the quarter are due Wednesday after the close. Nvidia stock analysts polled by FactSet predict adjusted profit of $5.22 a share, up 474% year over year, with revenue up 241% to $24.5 billion. Modine has been on a tear in recent months, helped by strong earnings growth in recent quarters, although estimates are for a much slower pace. Revenue growth is expected to pick up in the second half of the year. Artificial Intelligence News And AI Stocks To Watch Modine stock was volatile when the company's earnings report in late January showed adjusted profit up 54% year over year to 74 cents a share. Revenue was flat at $561.4 million. Shares fell 10% intraday, but Modine reversed higher for a gain of 3.5% in strong volume, helped by an upwardly-revised full-year earnings outlook for the third straight quarter. Still, revenue at Modine's climate solutions segment fell slightly to $242.5 million. The decrease came on lower sales of heat transfer products. That was partly offset by higher sales of data center cooling products, along with heating, ventilation and air conditioning systems as well as refrigeration products. "We are experiencing rapid sales growth to the data center market, supported by robust demand from both hyperscale and colocation customers," said Modine CEO Neil Brinker. Modine stock tripled in price last year and was up another 83% this year through Wednesday. Modine is currently trying to clear a cup base with a 106.01 entry. Results for the March-ended quarter will be out Tuesday after the close. A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here's how the option trading strategy works, and what a call-option trade recently looked like for Nvidia stock. First, identify top-rated stocks with a bullish chart. Some might be setting up in sound early-stage bases. Further, others already might have broken out and are getting support at their 10-week moving averages for the first time. And a few might be trading tightly near highs and refusing to give up much ground. Avoid extended stocks that are too far past proper entry points. Join IBD experts as they analyze leading stocks in the current stock market rally on IBD Live A call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price. Once you've identified a bullish setup in the earnings calendar, check strike prices with your online trading platform, or at cboe.com. Also, make sure the option is liquid, with a relatively tight spread between the bid and ask. Look for a strike price just above the underlying stock price — that's out of the money — and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money strike price is OK as long as the premium isn't too expensive. Choose an expiration date that fits your risk objective. But keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost. When Nvidia stock traded around 946.25, a slightly out-of-the-money weekly call option with a 950 strike price and a May 24 expiration came with a premium of around $44 per contract. That was 4.6% of the underlying stock price at the time. One contract gave the holder the right to buy 100 shares of Nvidia at 950 per share. The most that could be lost was $4,400 — the amount paid for the 100-share contract. To break even, Nvidia would need to rise to 994, factoring in the premium paid. Keep in mind that this is not a trade for a smaller portfolio. The reason is that taking delivery of 100 shares of Nvidia in the above scenario would cost $95,000. The expected move in the options market for Nvidia stock, based on the at-the-money strike price of 945, was about 91 points up or down. That's found by adding the at-the-money call premium and a put premium for the May 24 contract. Follow Ken Shreve on X/Twitter @IBD_KShreve for more stock market analysis and insight. YOU MAY ALSO LIKE: Best Growth Stocks To Buy And Watch Catch The Next Big Winning Stock With MarketSurge IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks IBD Digital: Unlock IBD's Premium Stock Lists, Tools And Analysis Today Dow Jones Closes Above 40,000; All Eyes On Nvidia Earnings

A Stock Rises Again After Its First Breakout Fails; Should You Buy The Second Time Around?

All too often, the leading growth stocks drop below their buy points only to bounce back above them. The big question for investors is, should they buy the second time around? The answer is yes, so long as the break below the buy point is modest and shares don't spend weeks below the entry. A minor decline is quite normal. Historically, 40% of stocks will dip back to or mildly below their buy points after a solid breakout, then resume their winning advances. So even when stocks exhibit power at the breakout, it's almost normal for them to recede to around the buy point. But once a stock falls 7% or 8% below the proper buy point in a good base, consider the breakout a failure. Such a loss triggers an automatic sell rule. You need to forget about the stock unless it later forms a new, sound pattern. Sometimes stocks will give signals that they'll bounce back. For example, the stock may make bullish price reversals or close near session highs on a daily or weekly basis. Or, the stock may bounce from a touch of the 50-day moving average. Both would indicate that institutional investors are buying on dips. Lacking those signals, a solid move back above the entry is still enough to make a purchase. One other point: If a stock reclaims the buy point, volume may be lackluster or weak. While big volume is ideal, what's more important is for the initial breakout to have strong volume. It should be at least 40% more than the 50-day average (which is found in IBD Charts and IBD quotes); expect small and mid-cap stocks to show even higher volume, double or triple average. Also, make sure the IBD current outlook for the stock market is in a positive state. You can check this in seconds by either seeing IBD's Market Trend page, reading The Big Picture column, or going to the IBD ETF Market Strategy. Chinese internet company Sina broke out Aug. 7, 2017, past a 97.89 correct buy point; a few days later, it was below the buy point. Shares sank no more than 6% from the entry, so there was no loss-cutting sell signal. Instead, Sina found support at the 50-day line; on Aug. 11 it reversed higher (1), a bullish sign. The stock rose back above 97.89 the next session and sailed to 119.20 in five weeks, resulting in a robust gain of 22% and a good time to take profits. (Sina no longer trades in the U.S. stock market.) Whenever a stock spends several weeks below the ideal buy point, unable to reclaim it, then the situation is more delicate. Chances are, the stock will form a new base and investors must wait for the pattern and new entry to develop. Atlassian (TEAM) broke out past a 38 proper buy point on July 25, 2017, and soon fell back below it. But instead of reclaiming the entry, the stock wound up forming a new base the next 10 weeks. The breakout from that August-early October formation at 39.35 was successful for the work-collaboration software maker. A version of this column was first published on Jan. 12, 2018, and has been updated. YOU MIGHTALSO LIKE: Current Growth Stocks In IBD Leaderboard Why A Bull Market Rally Is The Time To Review Your Stock-Selling Smarts Stocks Near A Buy Zone How To Find Excellent Growth Stocks: Start With A Simple Routine

Inspirational Quotes: Gene Hackman, Tom Clancy And Others

Read inspirational quotes about taking on challenges, setting big goals for yourself and focusing on the present. The difference between a hero and a coward is one step sideways. Gene Hackman, actor Nothing is as real as a dream. The world can change around you, but your dream will not. Tom Clancy, novelist Accuracy of observation is the equivalent of accuracy of thinking. Wallace Stevens, poet How we treat other people changes them, but even more so, how we treat other people changes us. Bryant McGill, author Maybe there's a 10-year-old girl who just lost her leg and doesn't know what she can do with her life and she turns on the TV or looks on her phone and says "Look at this girl, she's just like me, if she can do that, I can do it as well." Melissa Stockwell, Paralympic triathlete YOU MAY ALSO LIKE: Meet The Guy Who Runs A Massive $2.7 Trillion Bond Portfolio Be Detailed And Targeted To Raise Money Inspirational Quotes: Columbus Short, Sam Rayburn And Others IBD Digital: Unlock IBD's Premium Stock Lists, Tools And Analysis Today Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens