International Business Machines Corporation (IBM)

IBM remains top software name as with AI, quantum momentum driving upside, Wedbush says

International Business Machines Corp (NYSE:IBM) has earned a price target increase from Wedbush analysts, who also maintained their ‘Outperform' rating on their bullish view of the tech giant's role in the ongoing AI revolution. “We believe that IBM is well-positioned to capitalize on the current demand shift for hybrid and AI applications with more enterprises looking to implement AI for productivity gains and drive long-term profitable growth,” they wrote.

IBM vs. Oracle: Which Hybrid Cloud Stock Offers Better Growth?

IBM's strong hybrid cloud push, AI deals and cheaper valuation give it an edge over Oracle despite tough competition.

IBM still has room to run, says BofA as it lifts price target

Bank of America raised its price target on International Business Machines Corp (NYSE:IBM) to $320 from $290, saying the stock could re-rate higher on the back of transformational initiatives, expanding free cash flow, and accelerating revenue growth. While IBM shares are trading near all-time highs at about 22 times forward enterprise value to free cash flow, BofA analysts argue the valuation is still attractive given the company's strategic overhaul and positioning in generative and Agentic AI.

IBM: It's Better, Mostly

IBM's recent rally is driven more by tech momentum and indexation than by valuation or standout fundamentals. Key triggers include strong growth in automation, hybrid cloud, and AI, with recurring revenue and margin expansion supporting the thesis. Downside risk centers on IBM's ability to sustain growth and execution; failure could lead to a multiple de-rating given current valuations.

IBM Builds A Solid AI And Cloud Foundation For GARP Investors

IBM's transformation under CEO Krishna has positioned it as a leader in hybrid cloud, enterprise AI, and quantum computing, appealing to GARP investors. The HashiCorp acquisition and focus on regulated industries strengthen IBM's hybrid cloud offering and deepen its trusted relationships with key enterprise clients. Financials are robust: software growth, strong free cash flow, sustainable dividends, and a solid balance sheet support ongoing investment and shareholder returns.

IBM (IBM) Exceeds Market Returns: Some Facts to Consider

In the most recent trading session, IBM (IBM) closed at $281.83, indicating a +1.66% shift from the previous trading day.

International Business Machines Corporation (IBM) Is a Trending Stock: Facts to Know Before Betting on It

IBM (IBM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

IBM Up 10 Days in a Row: What's Driving the Winning Streak?

Markets have staged a fierce rally in the last month, led by typical tech giants like NVIDIA, Meta Platforms, Microsoft, and

ChatGPT picks 2 quantum computing stocks to buy in June

Quantum computing is seeing renewed momentum, with numerous entities investing in the space and making notable progress.

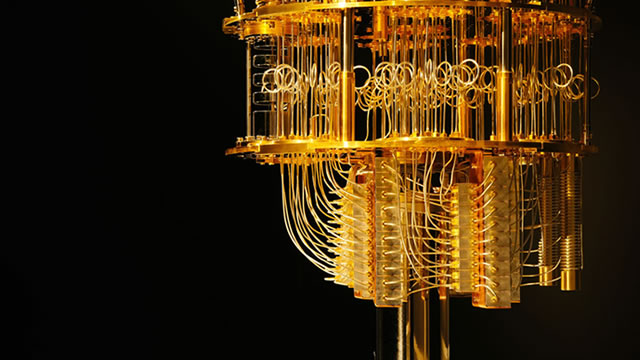

ETFs to Buy as IBM Launches Fault-Tolerant Quantum PC

IBM shares surged with Starling launch. Play these ETFs to ride out the quantum wave.

IBM (IBM) Outperforms Broader Market: What You Need to Know

In the most recent trading session, IBM (IBM) closed at $276.24, indicating a +1.53% shift from the previous trading day.

IBM's stock set a new all-time high. This was the latest spark.

The tech company's shares were up 1.5% at the closing bell Tuesday after it unveiled plans for a large-scale, fault-tolerant quantum computer.