IDEX Corporation (ID7)

Summary

ID7 Chart

Why Is Idex (IEX) Up 2% Since Last Earnings Report?

Idex (IEX) reported earnings 30 days ago. What's next for the stock?

IDEX Stock Exhibits Strong Prospects Despite Persisting Headwinds

IEX gains from strong FMT and HST momentum, strategic acquisitions and enhanced shareholder returns despite FSDP softness.

IDEX Corporation (IEX) Q3 2025 Earnings Call Transcript

IDEX Corporation ( IEX ) Q3 2025 Earnings Call October 29, 2025 9:00 AM EDT Company Participants James Giannakouros - Vice President of Investor Relations Eric Ashleman - CEO, President & Director Akhil Mahendra - Interim CFO & VP of Corporate Development Conference Call Participants Deane Dray - RBC Capital Markets, Research Division Michael Halloran - Robert W. Baird & Co. Incorporated, Research Division Joseph Giordano - TD Cowen, Research Division Nathan Jones - Stifel, Nicolaus & Company, Incorporated, Research Division Bryan Blair - Oppenheimer & Co. Inc., Research Division Vladimir Bystricky - Citigroup Inc., Research Division Robert Jamieson - Vertical Research Partners, LLC Walter Liptak - Seaport Research Partners Brett Linzey - Mizuho Securities USA LLC, Research Division Presentation Operator Greetings, and welcome to the Third Quarter 2025 IDEX Corporation Earnings Conference Call.

IDEX Corporation (ID7) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has IDEX Corporation ever had a stock split?

IDEX Corporation Profile

| - Industry | - Sector | Eric D. Ashleman CEO | XDUS Exchange | US45167R1041 ISIN |

| US Country | 9,000 Employees | 16 Jan 2026 Last Dividend | 22 May 2007 Last Split | 21 Jun 1991 IPO Date |

Overview

IDEX Corporation, established in 1987 and headquartered in Northbrook, Illinois, operates globally, offering a wide range of applied solutions through its subsidiaries. The company is structured into three main segments: Fluid & Metering Technologies (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FSDP). IDEX specializes in the design, production, and distribution of a variety of equipment and systems across diverse industries, including food, chemical, general industrial, water and wastewater, agricultural, energy, life sciences, analytical instruments, pharmaceutical and biopharmaceutical, industrial, semiconductor, automotive/transportation, medical/dental, energy, cosmetics, marine, chemical, wastewater and water treatment, research, and aerospace/defense markets.

Products and Services

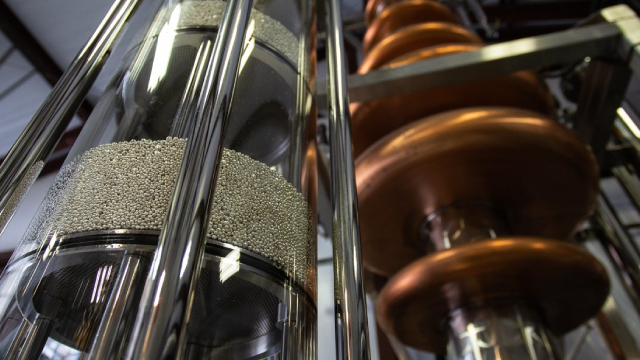

Fluid & Metering Technologies (FMT): Offers a variety of fluid-handling products, including positive displacement pumps, valves, small volume provers, flow meters, and injectors. These are critical for operations in the food, chemical, general industrial, water and wastewater, agricultural, and energy industries. The segment also provides flow monitoring and other services that complement its hardware offerings.

Health & Science Technologies (HST): This segment produces and distributes precision fluidics, powder and liquid processing technologies, drying systems, micro-precision components, pneumatic components, sealing solutions, engineered hygienic mixers, valves, biocompatible medical devices and implantables, air compressors and blowers, optical components and coatings, laboratory and commercial equipment, and precision photonic solutions. It caters to a wide range of industries from food and beverage, life sciences, analytical instruments, to pharmaceutical and biopharmaceutical, industrial, semiconductor, automotive/transportation, medical/dental, energy, cosmetics, marine, chemical, wastewater and water treatment, research, and aerospace/defense.

Fire & Safety/Diversified Products (FSDP): Focuses on products for the fire and rescue industry, including firefighting pumps, valves and controls, and rescue tools. This segment also offers lifting bags and other components and systems vital for safety and rescue operations. Additionally, it develops engineered stainless steel banding and clamping devices for a variety of industrial and commercial applications, along with precision equipment for dispensing, metering, and mixing colorants and paints used in retail and commercial businesses.