Ingersoll-Rand Inc. (IR)

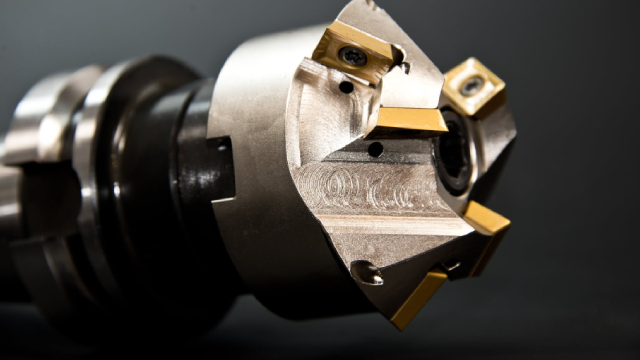

Ingersoll Rand Boosts Product Portfolio With 3 Acquisitions

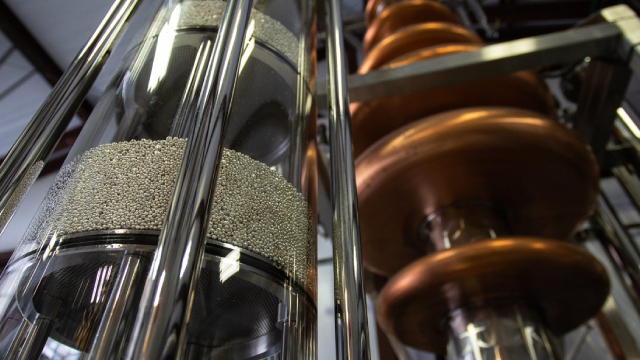

The acquisition of APSCO is set to boost IR's position in the dry and liquid bulk markets with energy-efficient solutions.

Ingersoll Rand (IR) Is Up 1.35% in One Week: What You Should Know

Does Ingersoll Rand (IR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Ingersoll Rand Exhibits Strong Prospects Despite Headwinds

IR is set to benefit from solid momentum across its segments. However, increasing costs and expenses remain a concern.

Support in Place for Industrial Stock

Subscribers to Schaeffer's Weekend Trader options recommendation service received this IR commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters.

Ingersoll Rand (IR) Q2 Earnings & Revenues Top Estimates

Ingersoll Rand's (IR) second-quarter 2024 adjusted earnings of 83 cents per share increase 22.1% year over year.

Ingersoll (IR) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Ingersoll (IR) give insight into how the company performed in the quarter ended June 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Ingersoll Rand (IR) Q2 Earnings and Revenues Surpass Estimates

Ingersoll Rand (IR) came out with quarterly earnings of $0.83 per share, beating the Zacks Consensus Estimate of $0.77 per share. This compares to earnings of $0.68 per share a year ago.

Exploring Analyst Estimates for Ingersoll (IR) Q2 Earnings, Beyond Revenue and EPS

Beyond analysts' top -and-bottom-line estimates for Ingersoll (IR), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended June 2024.

Ingersoll Rand (IR) Reports Next Week: Wall Street Expects Earnings Growth

Ingersoll (IR) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Here is Why Growth Investors Should Buy Ingersoll (IR) Now

Ingersoll (IR) is well positioned to outperform the market, as it exhibits above-average growth in financials.

Will Ingersoll (IR) Beat Estimates Again in Its Next Earnings Report?

Ingersoll (IR) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Reasons to Add Ingersoll Rand (IR) Stock to Your Portfolio Now

Ingersoll Rand (IR) stands to benefit from strength in its businesses, acquired assets and a solid liquidity position.