Intuitive Surgical, Inc. (ISRG)

Why Is Intuitive Surgical (ISRG) Up 7.1% Since Last Earnings Report?

Intuitive Surgical (ISRG) reported earnings 30 days ago. What's next for the stock?

Intuitive Surgical, Inc. (ISRG) Recently Broke Out Above the 20-Day Moving Average

After reaching an important support level, Intuitive Surgical, Inc. (ISRG) could be a good stock pick from a technical perspective. ISRG surpassed resistance at the 20-day moving average, suggesting a short-term bullish trend.

Will Ion Platform's 52% Growth Make It ISRG's Next Growth Engine?

Intuitive Surgical's Ion platform represents robust growth potential with strong procedure growth. Clinical trial data demonstrate superiority in diagnostic yield.

Intuitive Surgical, Inc. (ISRG) Is a Trending Stock: Facts to Know Before Betting on It

Intuitive Surgical (ISRG) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Robotic Surgery Will Explode: Buy This Healthcare Stock Before Its 50% Run.

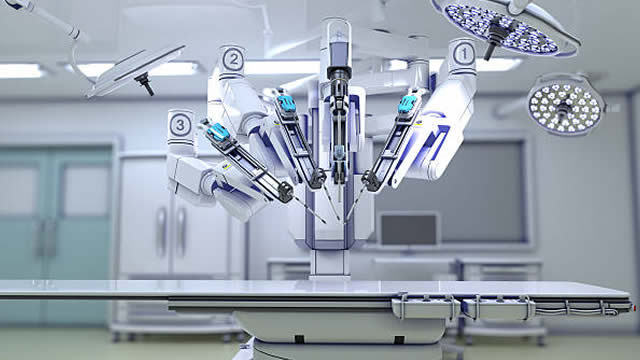

Intuitive Surgical is a pioneer in the field of surgical robotics. The company's da Vinci system is a leading technology platform in its segment.

Intuitive Surgical Stock Is Up 31% Since October Lows After Powerful Earnings Turnaround

As the overall market trend weakens, one area that remains intact is medical stocks — namely Intuitive Surgical.

Is Force Feedback the Next Big Catalyst for ISRG's da Vinci Sales?

Intuitive Surgical's new force-feedback upgrades for da Vinci 5 could spark its next adoption wave as early clinical evidence strengthens.

ISRG Stock Gains More than 28% in a Month: Should You Buy, Hold or Sell?

Intuitive Surgical's shares soar over 28% in a month on da Vinci 5 momentum, but margin and valuation pressures suggest caution for new buyers.

Investors Heavily Search Intuitive Surgical, Inc. (ISRG): Here is What You Need to Know

Intuitive Surgical (ISRG) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Intuitive Surgical Stock To $700?

Intuitive Surgical (ISRG) has been on a powerful run, fueled by rising adoption of its da Vinci robotic systems and steady growth in surgical procedure volumes worldwide. The stock has outpaced both the S&P 500 and the broader medtech sector, underscoring investor confidence in its leadership within robotic-assisted surgery.

ISRG vs BSX: Comparing Q3 Earnings, Growth Strategies and Prospects

Both Intuitive Surgical and Boston Scientific posted strong Q3 results, but their sharply contrasting growth strategies make them very different investment stories.

ISRG Rides on da Vinci 5 Momentum: Can This Growth Sustain?

Intuitive Surgical's Q3 results impress, with da Vinci 5 adoption driving 23% revenue growth, though sustaining this rapid momentum may pose new challenges ahead.