Intuitive Surgical, Inc. (ISRG)

3 Medical Instruments Industry Stocks to Buy on genAI and M&A Boost

ISRG, MASI and VCYT from the Zacks Medical Instruments industry are worth buying based on genAI adoption, strategic developments and strong fundamentals. Yet, geopolitical complications and wage and supply issues mar the prospects.

Intuitive Surgical, Inc. (ISRG) Rises Higher Than Market: Key Facts

Intuitive Surgical, Inc. (ISRG) concluded the recent trading session at $490.93, signifying a +1.38% move from its prior day's close.

Intuitive Surgical, Inc. (ISRG) Is a Trending Stock: Facts to Know Before Betting on It

Intuitive Surgical (ISRG) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Intuitive Surgical, Inc. (ISRG) Sees a More Significant Dip Than Broader Market: Some Facts to Know

In the most recent trading session, Intuitive Surgical, Inc. (ISRG) closed at $476.69, indicating a -1.05% shift from the previous trading day.

Intuitive Surgical, Inc. (ISRG) Wells Fargo 2024 Healthcare Conference (Transcript)

Intuitive Surgical, Inc. (NASDAQ:ISRG ) Wells Fargo 2024 Healthcare Conference September 5, 2024 9:30 AM ET Company Participants Brandon Lamm - Investor Relations Jamie Samath - Chief Financial Officer Conference Call Participants Larry Biegelsen - Medical Device Analyst, Wells Fargo Larry Biegelsen Good morning. Welcome back.

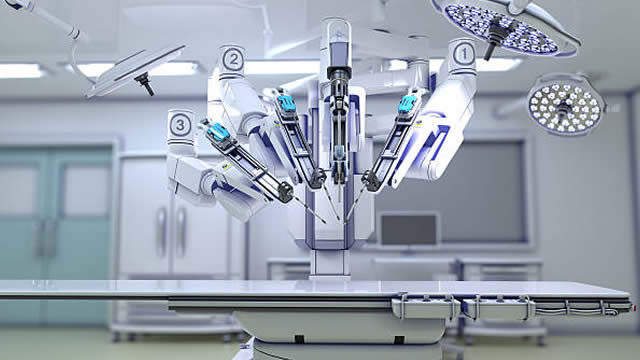

Intuitive Surgical Gains 40.5% Year to Date: What's Driving the Stock?

ISRG's shares gain on the back of strength in da Vinci surgical system.

Intuitive Surgical, Inc. (ISRG) Sees a More Significant Dip Than Broader Market: Some Facts to Know

The latest trading day saw Intuitive Surgical, Inc. (ISRG) settling at $481.73, representing a -0.35% change from its previous close.

Why Is Intuitive Surgical Stock Up 80%?

Intuitive Surgical (NASDAQ: ISRG) has seen solid gains of over 80% from levels of around $270 in early January 2021 to nearly $500 now, vs. an increase of about 50% for the S&P 500 over this period.

2 Top Healthcare Growth Stocks to Buy Right Now

Even as some sectors face uncertainty, healthcare spending is on the upswing. Industry powerhouse UnitedHealth Group is rising above its short-term challenges.

Investors Heavily Search Intuitive Surgical, Inc. (ISRG): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Intuitive Surgical (ISRG). This makes it worthwhile to examine what the stock has in store.

Intuitive Surgical: Detached From Fundamentals

Against expectations of a growth slowdown, Intuitive Surgical's results have been strong in 2024, supported by robust procedure volumes and a solid da Vinci 5 launch. Intuitive Surgical's margins picked up in Q2, despite the scaling of da Vinci 5 sales. Margins will come under pressure in coming quarters though as additional costs begin to hit. Intuitive Surgical has a large competitive advantage and a long growth runway, but its valuation will make it difficult for the company to generate strong returns.

2 Top Growth Stocks You Can Still Buy in August

Different companies have responded to the bull market in a variety of ways. Intuitive Surgical has seen shares soar as procedure volume and revenue increase steadily.