Intuitive Surgical, Inc. (ISRG)

ISRG's International Push for Ion: Strategic Bet or Overstretch?

Intuitive Surgical expands Ion into Australia and Korea after 52% procedure growth, testing Asia-Pacific adoption despite budget headwinds.

ISRG's Ion Platform Procedure Grows 52%: Can This Trend Continue?

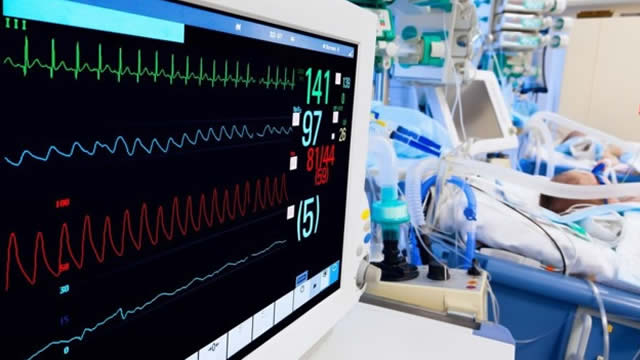

Intuitive Surgical's Ion platform saw Q2 procedures jump 52% to 35,000, expanding globally as utilization rises despite softer system placements.

Intuitive Surgical Has More Room To Grow

Intuitive Surgical's da Vinci system is driving strong global growth, with 17% YoY procedure growth and expanding adoption across hospitals and specialties. Recurring revenue streams from system sales, procedures, and services support robust financials, including 21% YoY revenue growth and 68% gross margins. The company's expanding installed base and accelerating procedure growth position it for continued earnings stability and long-term shareholder returns.

ISRG's Post-Earnings Slide: Margin Worries Overshadow Growth Story

Intuitive Surgical's Q2 revenues and procedure gains look good, but tariffs, cost inflation, and margin pressure spur a post-earnings selloff.

Here is What to Know Beyond Why Intuitive Surgical, Inc. (ISRG) is a Trending Stock

Intuitive Surgical (ISRG) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

ISRG's Ion Platform Sees Uptick in Utilization, Eyes Efficiency

Intuitive Surgical's Ion platform posted 52% procedure growth in Q2, but rising system utilization and workflow efficiency now drive its profitability focus.

Intuitive Surgical, Inc. (ISRG) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Intuitive Surgical (ISRG). This makes it worthwhile to examine what the stock has in store.

ISRG's Gross Margin Falls on Product Transition and Trade Pressures

Intuitive Surgical's Q2 gross margin declines to 67.9% as product mix shifts, new facility costs and tariffs weigh on profitability.

Can ISRG's Strong Q2 Procedure Volume Translate Into Durable EPS Upside?

ISRG's Q2 procedure growth hits 17%, but continuation of EPS growth hinges on easing margin pressure from FX and da Vinci 5 adoption.

Intuitive Surgical (ISRG) Is Considered a Good Investment by Brokers: Is That True?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Intuitive Surgical Crushes Q2 Expectations, So Why No Rally?

The world's second-largest company in the healthcare equipment and supplies industry, Intuitive Surgical NASDAQ: ISRG, just reported Q2 financials. The results were solid, but not enough to move shares higher.

ISRG Stock Gains on Q2 Earnings & Sales Beat, Gross Margin Contracts

Intuitive Surgical's second-quarter results reflect a healthy demand for procedures on higher system utilization. However, tariffs lead to a decline in the gross margin outlook.