Johnson & Johnson (JNJ)

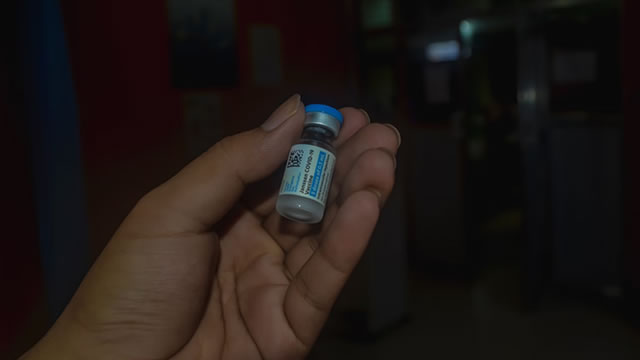

US judge rejects J&J's $10 billion baby powder settlement

A U.S. bankruptcy judge on Monday rejected Johnson & Johnson's $10 billion proposal to end lawsuits alleging that its baby powder and other talc products cause ovarian cancer, marking the third time the company's bankruptcy strategy has failed in court.

Why Johnson & Johnson (JNJ), United Health (UNH) And Procter & Gamble (PG) Are Holding the S&P 500 From Dropping More

As President Trump's April 2nd “Liberation Day” approaches, the stock market has been selling off due to uncertainties on the impact of the tariff policy implementation intended to even out the presently skewed international playing field.

Are You Looking for a High-Growth Dividend Stock?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Johnson & Johnson (JNJ) have what it takes?

JNJ's Rybrevant-Lazcluze Combo Outshines AZN's Tagrisso in Lung Cancer

Study investigators expect that J&J's combo drug can extend overall survival by at least a year over the current standard of care in certain NSCLC patients.

Procter & Gamble, Johnson & Johnson Among 10 Companies To Announce Dividend Increases In First Half Of April

This is my latest article where I provide predictions of upcoming dividend increases from companies with long-term dividend growth histories. A slow March brought mid-single digit percentage dividend boosts from consumer goods company Colgate-Palmolive and defense contractor General Dynamics. Widely-held Johnson & Johnson, Procter & Gamble, and Costco will announce increases in the first half of April.

Johnson & Johnson Needs Time To Consolidate (Technical Analysis And Downgrade)

Two recent catalysts, one technical and one fundamental, have promoted me to adjust my rating on JNJ to a HOLD from my earlier buy rating. Technical trading patterns signal that JNJ is entering a consolidation phase with no clear directional momentum in the near term. In the meantime, JNJ's valuation ratios have expanded, narrowing the discount compared to historical averages and shifting its return/risk profile.

Johnson & Johnson unit ordered to pay $1.64 billion in HIV drug marketing case

A federal judge ordered a Johnson & Johnson unit on Friday to pay the U.S. government $1.64 billion after a jury found it liable in a whistleblower lawsuit for illegally promoting the HIV drugs Prezista and Intelence.

Investors Heavily Search Johnson & Johnson (JNJ): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Johnson & Johnson (JNJ). This makes it worthwhile to examine what the stock has in store.

2 Recession-Proof Dividend Stocks to Buy and Hold

Fears of a looming recession seem to be rising, partly fueled by President Donald Trump's macroeconomic policies. While it's impossible to predict whether an economic downturn is indeed coming, it's not a bad idea for investors to purchase shares of companies that are likely to perform relatively well in case it does happen.

The Big 3: JNJ, GE, LULU

Healthcare headwinds have @Theotrade's Don Kaufman leaning bearish on Johnson & Johnson (JNJ) while staying bullish in GE Aerospace (GE) despite hitting 18-year highs today. He offers options trades in those companies alongside an earnings play for Lululemon (LULU).

Here's Why Johnson & Johnson (JNJ) is a Strong Value Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Johnson & Johnson (JNJ) Stock Dips While Market Gains: Key Facts

The latest trading day saw Johnson & Johnson (JNJ) settling at $163.29, representing a -0.21% change from its previous close.