Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) Guggenheim Global Healthcare Conference (Transcript)

Johnson & Johnson (NYSE:JNJ ) Guggenheim Global Healthcare Conference November 12, 2024 10:30 AM ET Company Participants Biljana Naumovic - Worldwide VP, Global Commercial Strategy, Oncology Mark Wildgust - VP, Global Medical Affairs Oncology Conference Call Participants Vamil Divan - Guggenheim Securities Edouard Mullarky - Guggenheim Securities Vamil Divan All right. I think we're ready to get started.

2 Of The Cheapest, High-Quality Dividend Stocks On The Market

In today's market, sticky inflation and elevated valuations make stock picking a challenge. But some dividend stocks still stand out as strong, long-term picks. These two dividend stocks offer growth potential and inflation protection. They're built to thrive in today's economic climate, offering stability and income. Even with market volatility, these picks have the ability to deliver consistent returns. Their solid fundamentals and strong business models provide confidence.

Why Is Johnson & Johnson (JNJ) Down 6.7% Since Last Earnings Report?

Johnson & Johnson (JNJ) reported earnings 30 days ago. What's next for the stock?

Johnson & Johnson: Tracking Well Above The Industry

In the second half of 2024, Johnson & Johnson made significant progress in developing its oncology franchise. So, Darzalex sales were $3.02 billion in the third quarter of 2024, up 20.7% year-on-year, thanks in part to its label expansions. Moreover, on November 8, 2024, the company announced the filing of regulatory applications to the FDA and EMA seeking approval of Darzalex Faspro for the treatment of high-risk smoldering MM.

Johnson & Johnson Enters Oversold Territory

Legendary investor Warren Buffett advises to be fearful when others are greedy, and be greedy when others are fearful. One way we can try to measure the level of fear in a given stock is through a technical analysis indicator called the Relative Strength Index, or RSI, which measures momentum on a scale of zero to 100.

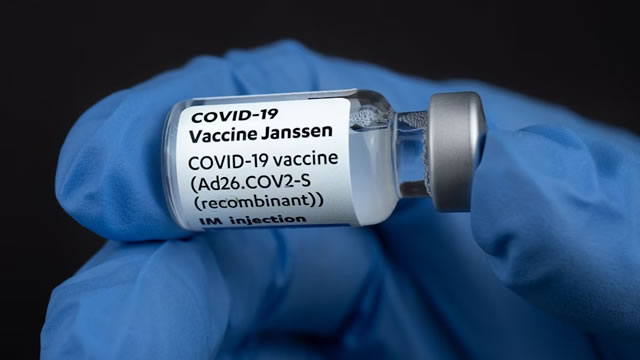

US FDA approves Johnson & Johnson's device for heart condition

The U.S. Food & Drug Administration has approved Johnson & Johnson's device for a type of heart condition, the company said on Thursday.

Johnson & Johnson (JNJ) Is a Trending Stock: Facts to Know Before Betting on It

Johnson & Johnson (JNJ) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Investors Heavily Search Johnson & Johnson (JNJ): Here is What You Need to Know

Johnson & Johnson (JNJ) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Johnson & Johnson: Q3 Earnings Highlights Resilience And New Growth

J&J's Q3 2024 earnings beat expectations with $22.5B in revenue, driven by strong performances from Darzalex, STELARA, and MedTech, despite ongoing challenges. The company updated its full-year guidance, showing optimism despite headwinds like talc litigation and STELARA generic competition, maintaining strong cash flow and dividend payouts. New growth opportunities in oncology and MedTech segments, along with strategic acquisitions, are expected to offset potential declines in STELARA sales due to generics.

J&J's Q3 Earnings & Sales Top: Time to Buy, Sell or Hold the Stock?

JNJ beats third-quarter estimates for both earnings and sales. Those who already own J&J's stock may stay invested.

Johnson & Johnson Stock: Setting the Stage for 2025 Highs

Johnson & Johnson's JNJ stock price advance has been reinvigorated. The stock price rally stalled a few years ago due to the COVID-19 bubble bursting and the divestiture of Kenvue KVUE, but those days are behind, and business growth is still ahead.

ETFs in Focus Post JNJ Q3 Earnings Beat, Target Price Hike

Johnson & Johnson infused positive optimism after posting solid third-quarter 2024 earnings. A few analysts raised their target price on the stock.