Keysight Technologies Inc. (KEYS)

Why Keysight Is Today's Worst Stock in the S&P 500 After Earnings

The test-equipment maker beat quarterly earnings estimates but issued light guidance.

Keysight Technologies: Uncertain Growth Outlook At A High Valuation

Keysight Technologies has shown modest recovery but faces slow growth, with recent quarterly results reflecting a slight improvement yet continued challenges in the automotive and defense sectors. Despite a strong balance sheet and increased R&D spending, the company's valuation appears stretched, and growth acceleration is not evident, making shares seem fully valued. The defense spending outlook is uncertain, and EV adoption remains slower than expected, posing structural headwinds for sustained growth in KEYS' business.

Keysight (KEYS) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for Keysight (KEYS) give a sense of how the business performed in the quarter ended January 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Keysight Technologies tops quarterly profit estimates, forecasts strong second quarter

Electronic equipment maker Keysight Technologies expects its second-quarter profit to surpass analysts' estimates, following a robust quarterly profit on Tuesday.

Keysight (KEYS) Q1 Earnings and Revenues Surpass Estimates

Keysight (KEYS) came out with quarterly earnings of $1.82 per share, beating the Zacks Consensus Estimate of $1.69 per share. This compares to earnings of $1.63 per share a year ago.

Will Healthy Y/Y Revenue Growth Boost Keysight's Q1 Earnings?

KEYS is expected to report year-over-year revenue growth in the first quarter of fiscal 2025, driven by healthy demand across several markets.

Ahead of Keysight (KEYS) Q1 Earnings: Get Ready With Wall Street Estimates for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Keysight (KEYS), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended January 2025.

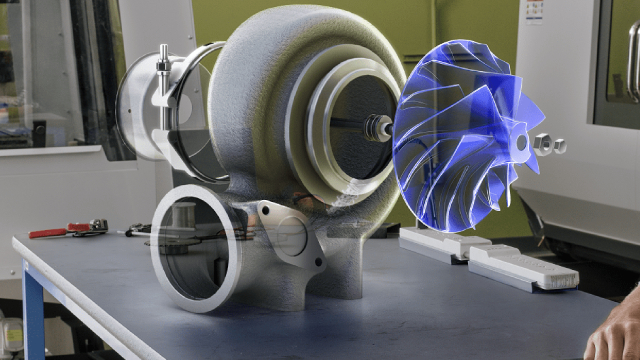

Will the Launch of LPDDR6 Design & Test Solution Aid KEYS Stock?

Keysight introduces comprehensive LPDDR6 design and test solution for next-generation memory systems.

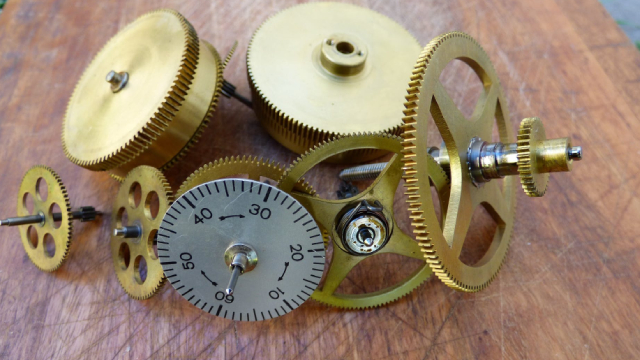

Keysight Upgrades Chiplet PHY Designer With Enhanced Support

KEYS expands chiplet interconnect standards support in its Chiplet PHY Designer 2025 tool.

Keysight Technologies: Capitalizing On AI Demand Tailwind

I give a buy rating to Keysight Technologies due to its strong positioning in the AI and data center markets, driving robust revenue growth and margin expansion. KEYS's mission-critical testing solutions are essential for hyperscale data centers, ensuring reliable performance for complex AI workloads, which boosts demand and financial performance. The acquisition of Spirent will enhance KEYS's end-to-end solutions and create cost and revenue synergies, further strengthening its market position.

Can Keysight Garner Customer Interests With Innovative Solutions?

KEYS is set to showcase next-generation solutions at DesignCon 2025.

Will the Launch of AppFusion Network Visibility Program Aid KEYS?

Keysight launches an all-in-one solution for network visibility and security.