Kennametal Inc. (KMT)

Kennametal: The Pain May Not Be Over, But Upside Exists In The Long Run

Kennametal has faced revenue, profit, and cash flow declines due to end-market weakness, underperforming the S&P 500 since my last bullish rating. Despite near-term pain and recession risks, management's aggressive cost-cutting—including plant closures—should yield significant savings and improve future profitability. Relative to peers, KMT shares are extremely cheap on multiple valuation metrics, even when factoring in further expected earnings weakness.

Reasons Why You Should Avoid Betting on Kennametal Stock Right Now

KMT faces segment weakness, high debt and forex headwinds, causing earnings estimate cuts and stock underperformance.

Kennametal's Q4 Earnings Miss Estimates, Revenues Decline Y/Y

KMT posts Q4 earnings and sales misses as lower volumes, inflation and raw material costs pressure margins.

Is Kennametal (KMT) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Down 15.3% in 4 Weeks, Here's Why You Should You Buy the Dip in Kennametal (KMT)

Kennametal (KMT) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

Kennametal Inc. (KMT) Q4 2025 Earnings Call Transcript

Kennametal Inc. (NYSE:KMT ) Q4 2025 Earnings Conference Call August 6, 2025 9:30 AM ET Company Participants Michael Pici - Vice President of Investor Relations Patrick S. Watson - VP of Finance & CFO Sanjay K.

Compared to Estimates, Kennametal (KMT) Q4 Earnings: A Look at Key Metrics

The headline numbers for Kennametal (KMT) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Despite Fast-paced Momentum, Kennametal (KMT) Is Still a Bargain Stock

Kennametal (KMT) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen.

Kennametal (KMT) Q4 Earnings and Revenues Miss Estimates

Kennametal (KMT) came out with quarterly earnings of $0.34 per share, missing the Zacks Consensus Estimate of $0.4 per share. This compares to earnings of $0.49 per share a year ago.

Kennametal (KMT) Upgraded to Buy: Here's Why

Kennametal (KMT) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Kennametal (KMT) Is Attractively Priced Despite Fast-paced Momentum

If you are looking for stocks that have gained strong momentum recently but are still trading at reasonable prices, Kennametal (KMT) could be a great choice. It is one of the several stocks that passed through our 'Fast-Paced Momentum at a Bargain' screen.

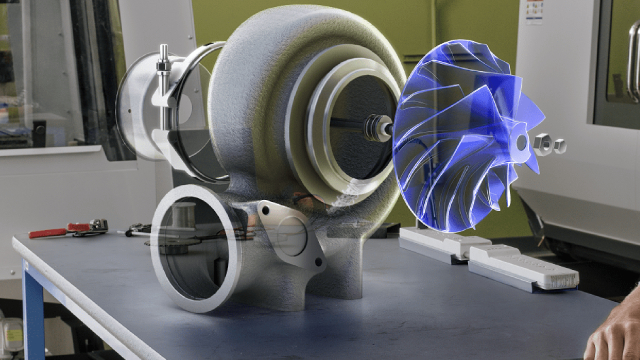

Here's Why It is Worth Investing in Kennametal Stock Now

KMT rides on strong aerospace demand, digital upgrades and rising earnings estimates to outpace its industry peers.