Microchip Technology Incorporated (MCHP)

The 3 Most Undervalued Semiconductor Stocks to Buy in July 2024

Undervalued semiconductor stocks are excellent additions to any portfolio because chip sales are expected to rise 13.1% in 2024 after falling about 8% in 2023. Global semiconductor sales climbed 15.8% to $46.4 billion in April, rising monthly for the first time this year.

Microchip (MCHP) Boosts Portfolio With The Launch of PIC64

Microchip (MCHP) launches PIC64, transforming embedded computing with 64-bit RISC-V MPUs for real-time applications across various sectors.

Microchip (MCHP) Introduces MPLAB Extensions For VS Code

Microchip (MCHP) transforms embedded design with MPLAB Extensions for VS Code, merging power and flexibility for seamless development experiences.

Microchip (MCHP) Expands JAN Transistor Portfolio for Defense

Microchip (MCHP) expands its JAN transistor portfolio, now qualified to MIL-STD ELDRS standards, enhancing reliability for aerospace and defense applications.

Why Is Microchip Tech (MCHP) Up 2.1% Since Last Earnings Report?

Microchip Tech (MCHP) reported earnings 30 days ago. What's next for the stock?

Microchip Technology: A Bottom Is Near

I think Microchip Technology stock is a buy due to early signs of recovery and a near bottom in the cycle. MCHP designs and manufactures microcontrollers, mixed-signal and memory products, and has a global customer base. Management has taken measures to protect the business and maintain capital return policies, showing confidence in the management team.

Microchip (MCHP) Aids Infrastructure Security With New Launch

Microchip (MCHP) enhances critical infrastructure security and efficiency with the launch of TimeProvider 4100 Series version 2.4.

$1000 Invested In This Stock 20 Years Ago Would Be Worth $6,200 Today

Microchip Technology MCHP has outperformed the market over the past 20 years by 1.39% on an annualized basis producing an average annual return of 9.43%. Currently, Microchip Technology has a market capitalization of $52.13 billion. Buying $1000 In MCHP: If an investor had bought $1000 of MCHP stock 20 years ago, it would be worth $6,189.28 today based on a price of $96.46 for MCHP at the time of writing. Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time. This article was generated by Benzinga's automated content engine and reviewed by an editor. © 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meridian Wealth Management LLC Invests $241,000 in Microchip Technology Incorporated (NASDAQ:MCHP)

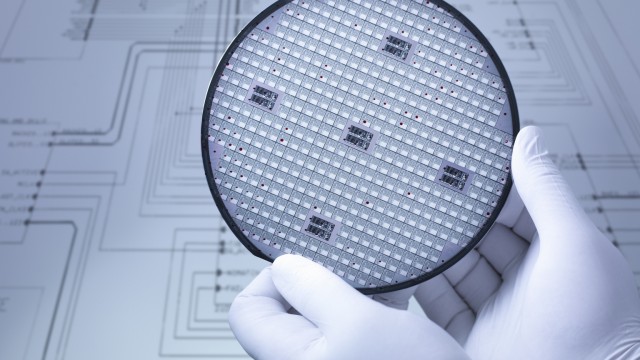

Meridian Wealth Management LLC purchased a new stake in shares of Microchip Technology Incorporated (NASDAQ:MCHP – Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund purchased 2,673 shares of the semiconductor company’s stock, valued at approximately $241,000. A number of other hedge funds also recently bought and sold shares of the business. BKM Wealth Management LLC purchased a new position in shares of Microchip Technology during the fourth quarter valued at about $27,000. Rakuten Securities Inc. purchased a new stake in shares of Microchip Technology in the 4th quarter worth approximately $27,000. Fortitude Family Office LLC bought a new position in Microchip Technology during the 4th quarter valued at approximately $29,000. Milestone Investment Advisors LLC purchased a new position in Microchip Technology during the third quarter valued at $36,000. Finally, Operose Advisors LLC grew its stake in shares of Microchip Technology by 79.3% in the third quarter. Operose Advisors LLC now owns 502 shares of the semiconductor company’s stock worth $39,000 after acquiring an additional 222 shares during the last quarter. Hedge funds and other institutional investors own 91.51% of the company’s stock. Microchip Technology Stock Up 0.1 % NASDAQ MCHP opened at $94.33 on Monday. Microchip Technology Incorporated has a 12 month low of $68.75 and a 12 month high of $96.14. The stock’s 50 day moving average is $89.44 and its 200 day moving average is $86.53. The company has a current ratio of 1.20, a quick ratio of 0.67 and a debt-to-equity ratio of 0.75. The stock has a market cap of $50.98 billion, a PE ratio of 27.18, a P/E/G ratio of 3.29 and a beta of 1.60. Microchip Technology (NASDAQ:MCHP – Get Free Report) last released its quarterly earnings data on Monday, May 6th. The semiconductor company reported $0.57 EPS for the quarter, meeting the consensus estimate of $0.57. Microchip Technology had a net margin of 24.98% and a return on equity of 36.78%. The business had revenue of $1.33 billion during the quarter, compared to the consensus estimate of $1.33 billion. During the same quarter in the prior year, the firm earned $1.56 EPS. The business’s revenue was down 40.6% on a year-over-year basis. Research analysts predict that Microchip Technology Incorporated will post 2.38 EPS for the current fiscal year. Microchip Technology Increases Dividend The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, June 5th. Stockholders of record on Wednesday, May 22nd will be issued a dividend of $0.452 per share. This represents a $1.81 annualized dividend and a dividend yield of 1.92%. This is a boost from Microchip Technology’s previous quarterly dividend of $0.45. The ex-dividend date is Tuesday, May 21st. Microchip Technology’s dividend payout ratio is 51.87%. Insider Activity In related news, VP Stephen V. Drehobl sold 7,830 shares of the company’s stock in a transaction on Thursday, May 16th. The shares were sold at an average price of $95.06, for a total transaction of $744,319.80. Following the sale, the vice president now owns 79,509 shares of the company’s stock, valued at $7,558,125.54. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. In related news, VP Stephen V. Drehobl sold 10,000 shares of the stock in a transaction on Wednesday, May 8th. The stock was sold at an average price of $90.88, for a total transaction of $908,800.00. Following the sale, the vice president now owns 82,203 shares in the company, valued at approximately $7,470,608.64. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, VP Stephen V. Drehobl sold 7,830 shares of the company’s stock in a transaction dated Thursday, May 16th. The shares were sold at an average price of $95.06, for a total transaction of $744,319.80. Following the transaction, the vice president now owns 79,509 shares in the company, valued at $7,558,125.54. The disclosure for this sale can be found here. In the last ninety days, insiders sold 19,800 shares of company stock worth $1,818,403. 2.07% of the stock is currently owned by insiders. Analysts Set New Price Targets Several analysts recently commented on MCHP shares. Evercore ISI assumed coverage on shares of Microchip Technology in a research report on Tuesday, April 16th. They set an “outperform” rating and a $106.00 price objective on the stock. KeyCorp upped their price objective on Microchip Technology from $90.00 to $110.00 and gave the company an “overweight” rating in a research report on Tuesday, May 7th. Piper Sandler reissued a “neutral” rating and issued a $90.00 target price (up previously from $80.00) on shares of Microchip Technology in a report on Tuesday, May 7th. B. Riley boosted their price target on Microchip Technology from $105.00 to $110.00 and gave the stock a “buy” rating in a research note on Tuesday, May 7th. Finally, UBS Group increased their price objective on Microchip Technology from $95.00 to $103.00 and gave the company a “buy” rating in a research report on Tuesday, May 7th. Six research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company’s stock. According to MarketBeat, the stock presently has an average rating of “Moderate Buy” and a consensus price target of $99.39. Read Our Latest Report on Microchip Technology About Microchip Technology (Free Report) Microchip Technology Incorporated develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Microchip (MCHP) Boosts Aerospace Portfolio With New Launch

Microchip Technology (MCHP) enhances space exploration with SAMD21RT, a radiation-tolerant microcontroller for high-performance, compact and reliable space applications.