3M Company (MMM)

3M Surprises and Rebound Accelerates: It Isn't Too Late To Get In

3M's NYSE: MMM rebound is gaining momentum because of surprisingly good results. Today's story is that repositioning efforts are taking hold and driving improved profitability while litigation risks dwindle.

3M (MMM) Q2 Earnings and Revenues Top Estimates

3M (MMM) came out with quarterly earnings of $1.93 per share, beating the Zacks Consensus Estimate of $1.66 per share. This compares to earnings of $2.17 per share a year ago.

3M's stock surges toward a 20-month high after earnings beat, raised outlook

Shares of 3M Co. MMM, +0.14% charged up 5.3% toward an 20-month high in premarket trading Friday, after the maker of Post-it Notes, Scotch tape and Command strips beat second-quarter earnings expectations and raised its full-year outlook. The earnings report is the first that doesn't include 3M's healthcare business, which was spun off as Solventum Corp. SOLV, -0.93% on April 1.

3M Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

3M Company MMM will release its financial results for the second quarter, before the opening bell on Friday, July 26.

3M Earnings Are Coming. Investors Want Growth.

The company reports second-quarter earnings on Friday. Wall Street is looking for earnings per share of $1.68 from sales of $5.9 billion.

3M Heads Into Q2 Earnings: Bullish Tailwind Or Bearish Detour?

3M Co MMM will report second-quarter earnings on Friday, July 25. Wall Street expects $1.68 in EPS and $5.9 billion in revenues as the company reports before market hours.

3M (MMM) Stock Before Q2 Earnings: To Buy or Not to Buy?

As 3M (MMM) gears up to report second-quarter earnings, let us find out how the expectations stack up and whether it is the right time to buy the stock.

Is 3M a Millionaire Maker?

Industrial giant 3M has been buffeted by legal and regulatory issues. The company's legal problems got so bad that management needed to spin off its crown jewel medical assets to raise capital.

3M: The Turnaround Isn't Done Yet

3M investors who ignored MMM's peak pessimism have performed remarkably. MMM has consolidated well along the $100 level. Selling enthusiasm has also been lacking. 3M's new leadership team must execute well in the second half to meet its FY2024 guidance promulgated previously.

3M (MMM) Expected to Beat Earnings Estimates: What to Know Ahead of Q2 Release

3M (MMM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

3M: Near-Term Growth Looks Limited, But A Fresh Start Is Welcome (Upgrade)

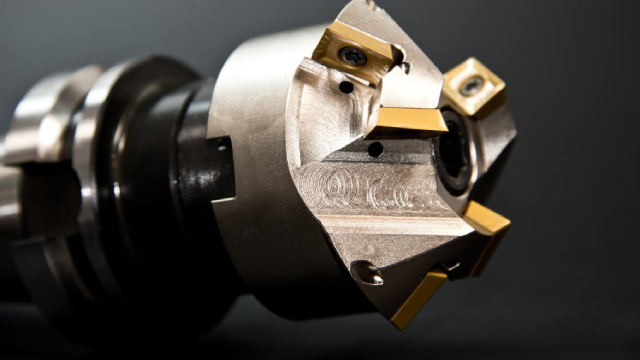

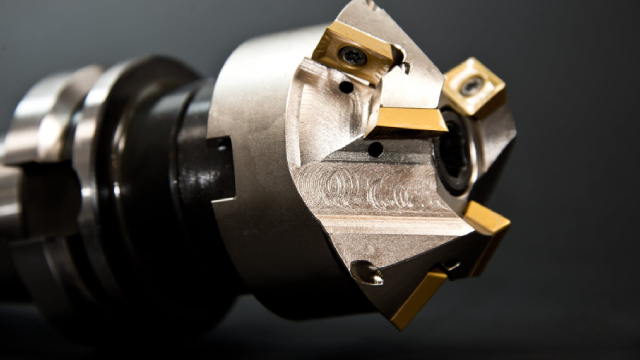

3M Company's second quarter results are expected to be lackluster compared to peers in the multi-industrial sector, with organic contraction of around 1% versus 2%-3% growth for the group. Auto electrification and electronics should be comparatively healthier businesses, but short-cycle manufacturing consumables could be weak; 2H '24 guidance will be important. 3M made a surprising move, naming Bill Brown as the new CEO; I like the prospects for meaningful transformation, but there's likely a lot of work ahead.

3M (MMM) Rises 13.4% in 3 Months: How Should You Play the Stock?

3M (MMM) is making strides in the diversified technology services market, which makes the stock worth a watch amid certain headwinds.