3M Company (MMM)

3M Posts Better-Than-Expected Q2 Results, Lifts Profit Forecast

3M (MMM) has raised its full-year profit forecast, even after accounting for the impact of tariffs.

3M lifts full-year profit forecast after strong Q2 results

3M Co (NYSE:MMM) raised its full-year earnings forecast after posting stronger-than-expected second-quarter results, driven by margin expansion and modest organic sales growth. The diversified industrial giant reported adjusted earnings of $2.16 per share for the quarter ended June 30, beating analysts' average estimate of $2.01, according to LSEG data.

3M's Stock Depends on Managing a Weakening Consumer

3M reports second-quarter earnings on Friday. Wall Street is looking for earnings per share of $2.01 from sales of $6.1 billion.

How Will 3M Stock React To Its Upcoming Earnings?

3M (NYSE: MMM) is set to release its earnings report on Friday, July 18, 2025, prior to the market opening. This announcement is an important occasion for traders, especially those utilizing event-driven strategies.

MMM Gears Up to Post Q2 Earnings: What Lies Ahead for the Stock?

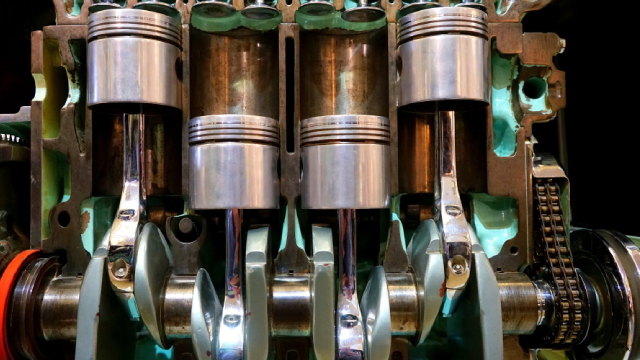

3M's Q2 results are poised for gains from industrial and aerospace strength, but consumer softness and foreign exchange headwinds are likely to weigh.

Insights Into 3M (MMM) Q2: Wall Street Projections for Key Metrics

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for 3M (MMM), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2025.

3M Rises 40.2% in a Year and Outpaces Industry: Should You Buy the Stock Now?

MMM has soared 40.2% in a year, but high debt, soft retail demand and a stretched valuation temper near-term upside.

3M's Safety & Industrial Growth Picks Up: A Sign of More Upside?

MMM sees momentum in Safety & Industrial as the 2025 outlook improves on strong demand across key end markets.

3M Rises 15.8% YTD: Should You Buy the Stock Now or Wait?

MMM is making strides in the aerospace, industrial adhesives and tapes, and electrical markets, which makes the stock worth a watch amid certain headwinds.

3M: High Valuation, But The Chart Points To Potentially Explosive Gain

I maintain a hold rating on 3M, citing slightly high valuation and a technical chart with strong potential, amid recent outperformance versus the S&P 500. Q1 results were solid, with strong operating performance and raised dividend, but macro and litigation risks persist. Guidance for 2025 EPS remains positive, and the recent PFAS settlement adds clarity, though sellside sentiment has cooled.

3M: A Resilient Innovator Positioned For Long-Term Growth

3M has rebounded strongly, gaining 46% in the past year, driven by robust Q1 earnings and a renewed focus on innovation and operational efficiency. Despite legal settlements, I believe 3M remains financially strong, with litigation risks overcompensated in the current undervalued share price. 3M's strategy centers on accelerating product innovation, improving margins, and disciplined capital allocation through dividends and buybacks.

Here's Why You Should Retain 3M Stock in Your Portfolio Now

MMM benefits from strength in its business segment, buyouts and shareholder-friendly policies. Softness in the retail market is concerning.