3M Company (MMM)

Parker Hannifin, 3M and six other manufacturing stocks likely to grow in 2025

Despite the US economy showing resilience with strong GDP growth, manufacturing stocks have lagged behind broader market indices, but analysts believe the sector is poised for a turnaround in 2025.

Where Will 3M Stock Be in 3 Years?

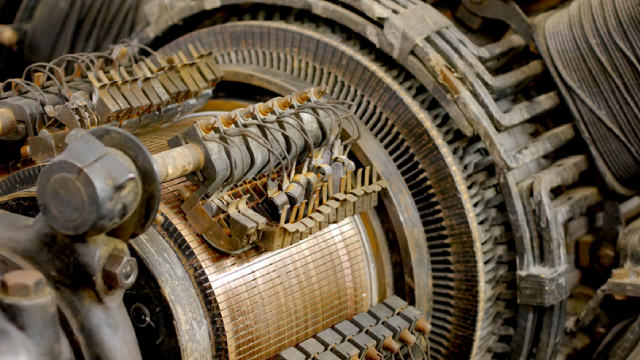

3M (MMM 2.58%) was once a dependable dividend stock for conservative investors. The diversified conglomerate sold a broad range of industrial, worker safety, and consumer goods, and it was a Dividend King that consistently raised its dividend annually for more than 50 years.

3M Stock Trading at a Premium Value: Should You Buy, Sell or Hold?

3M Company MMM is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 17.13X compared with the Zacks Diversified Operations industry's 15.11X. With a Value Score of F, MMM stock may not present a compelling value proposition at these levels.

Here's My Top Value Stock to Buy for 2025

It's far from clear where the economy is heading in 2025, but that isn't the sole focus of investors in 3M (MMM 0.13%). Instead, they're most likely hoping that CEO Bill Brown's plans to rejuvenate the company's fortunes will significantly release shareholder value.

MMM Is Finally Compelling, Warranting An Upgrade To Buy

MMM's strategic focus on high-growth markets and improved balance sheet health justify an upgrade to Buy, thanks to the recent sideways trading. The company's raised FY2024 guidance and potential to outperform these numbers based on YTD outperformance, underscore a promising growth trajectory. MMM's valuations appear compelling with a FWD P/E of 17.71x, with an upward re-rating nearer to its peers potentially triggering a double-digit capital appreciation.

Is 3M a Top Stock to Buy for 2025?

After years of underperformance, 3M (MMM -0.81%) stock delivered a respectable performance to investors in 2024 -- gaining some 17%. But what will 2025 bring?

Tiger Royalties shares surge 50% on acquisition and £3m fundraising plan

Shares in Tiger Royalties and Investments Plc doubled in value following the announcement of a strategic acquisition, a £3 million fundraising, and plans to expand its investing policy. The company will acquire Bixby Technology Inc.

Trump SEC Pick's Firm Received More Than $3M From Entities He'd Soon Oversee

A Trump transition spokesman said: “All nominees and appointees will comply with the ethical obligations of their respective agencies.”

3M Company Rises 29.8% in 6 Months: What Should Investors Do?

MMM is strategically positioned, leveraging its strong foothold in key end markets amid certain challenges.

3M Company (MMM) Goldman Sachs Industrials and Materials Conference (Transcript)

3M Company (NYSE:MMM ) Goldman Sachs Industrials and Materials Conference Call December 5, 2024 8:40 AM ET Company Participants Bill Brown - Chief Executive Officer Anurag Maheshwari - Executive Vice President & Chief Financial Officer Conference Call Participants Joe Ritchie - Goldman Sachs Joe Ritchie All right. We're ready to kick it off with the second track today.

3M: Consolidating YTD Gains, Monitoring EPS Growth Into 2025

I reiterate 3M a hold due to its fair valuation near $130 per share and mixed technical indicators. Despite a strong mid-year rally and solid Q3 earnings, MMM's growth prospects and valuation multiples remain modest. Key risks include potential margin pressures, supply chain issues, and global GDP growth weakness, which could impact future performance.

3M Rises 23.4% in 6 Months: Time to Buy or Hold the Stock?

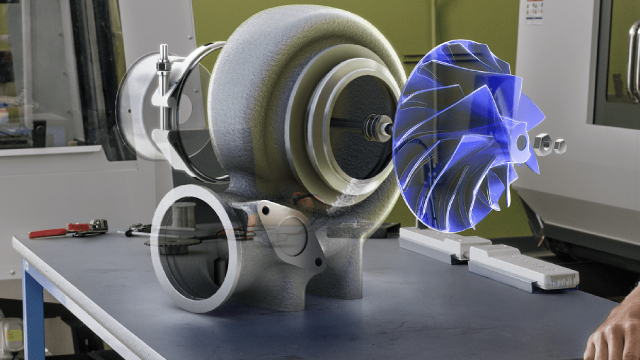

MMM is making strides in the transportation and electrical markets, which makes the stock worth a watch amid certain headwinds.