Merck & Co., Inc. (MRK)

Big Pharma, Bigger Bargain: Why Merck Stock Is Too Cheap To Ignore (Upgrade)

Healthcare costs are rising, with PwC projecting the highest commercial healthcare spending growth in 13 years, impacting consumers and insurance companies negatively. Healthcare stocks, including Merck & Co., Inc., have underperformed the S&P 500, making them attractive as the broader market reaches high valuations. Despite Merck's recent 30% stock decline due to poor guidance and Gardasil challenges, I believe it offers good long-term value.

Merck & Co., Inc. (MRK) Q4 2024 Earnings Call Transcript

Merck & Co., Inc. (NYSE:MRK ) Q4 2024 Results Conference Call February 4, 2025 9:00 AM ET Company Participants Peter Dannenbaum - Senior Vice President, Investor Relations Rob Davis - Chairman and Chief Executive Officer Caroline Litchfield - Chief Financial Officer Dr. Dean Li - President of Merck Research Labs Conference Call Participants Umer Raffat - Evercore ISI Terence Flynn - Morgan Stanley Luisa Hector - Berenberg Mohit Bansal - Wells Fargo Daina Graybosch - Leerink Partners Geoff Meacham - Citi Chris Schott - JPMorgan Tim Anderson - Bank of America Akash Tewari - Jefferies Trung Huynh - UBS Vamil Divan - Guggenheim Courtney Breen - Bernstein James Shin - Deutsche Bank Operator Thank you for standing by. Welcome to the Merck & Company Q4 Sales and Earnings Conference Call.

Merck Q4 Earnings & Sales Beat Estimates, Stock Down on Weak '25 View

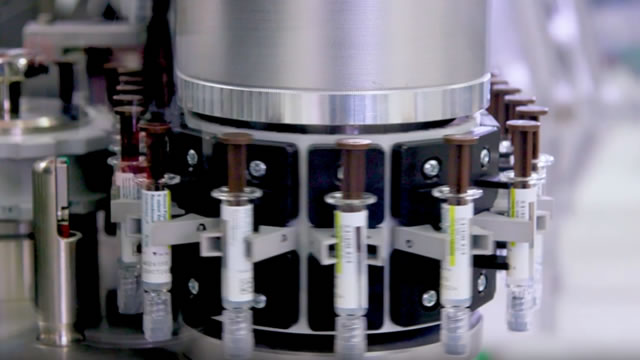

MRK posts encouraging Q4 results. However, the decision to temporarily halt shipments of Gardasil vaccines to China has affected its 2025 sales forecast.

Merck shares plunge on weak 2025 outlook, pause in Gardasil shipments to China

Merck & Co Inc (NYSE:MRK, ETR:6MK) shares fell more than 10% after the drugmaker issued weak guidance for 2025 and announced it would halt shipments of its HPV vaccine Gardasil to China until at least the middle of the year due to declining demand. It reported a 17% year-over-year decline in Gardasil sales to $1.55 billion for the fourth quarter.

Merck (MRK) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for Merck (MRK) give a sense of how its business performed in the quarter ended December 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Merck Stock Slumps as Q4 Profits, 2025 Forecast Fall Short

Merck shares tumbled Tuesday morning after the drugmaker's soft outlook outweighed fourth-quarter revenue that topped expectations.

2 Blue-Chip Drug Stocks in Focus Today After Earnings

Stocks are struggling for direction today, and one sector that represents this choppiness is blue-chip drugmakers.

Merck (MRK) Tops Q4 Earnings and Revenue Estimates

Merck (MRK) came out with quarterly earnings of $1.72 per share, beating the Zacks Consensus Estimate of $1.69 per share. This compares to earnings of $0.03 per share a year ago.

Merck's Gardasil Vaccine Slowdown In China Bites Again, Stock Falls On Weak 2025 Outlook

On Tuesday, Merck & Co Inc MRK reported fourth-quarter sales of $15.62 billion, up 7% year over year and slightly beating the consensus estimate of $15.49 billion. Excluding the impact of foreign exchange, sales increased 9%.

Merck's soft guidance overshadows quarterly beat to send stock down 6%

Merck's stock tumbled 6% early Tuesday, after the drug company's softer-than-expected guidance for the current year offset better-than-expected fourth-quarter earnings.

Merck's 2025 revenue outlook falls short as it pauses Gardasil vaccine shipments to China

Merck on issued full-year 2025 revenue guidance that fell short of Wall Street's expectations. The company said that sales range reflects a decision to halt shipments of Gardasil, a vaccine that prevents cancer from HPV, into China beginning in February through and going through at least mid-2025.

Merck pauses Gardasil shipments to China, hitting its 2025 outlook

Merck said it will pause shipments of Gardasil to China through at least mid-year, as continued weak demand for the HPV vaccine there is expected to hurt 2025 revenue, but it still posted a strong fourth-quarter profit on sales of cancer drug Keytruda.