Merck & Co., Inc. (MRK)

Is An Earnings Beat In The Cards For Merck Stock?

Merck (NYSE: MRK) will report its Q2 2024 results on Tuesday, July 30. We expect the company to post revenue of $15.9 billion and adjusted earnings of $2.20, slightly ahead of the street estimates.

Countdown to Merck (MRK) Q2 Earnings: A Look at Estimates Beyond Revenue and EPS

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Merck (MRK), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2024.

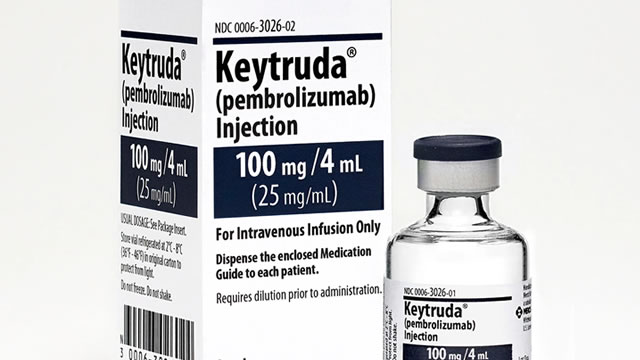

Merck Q2 Earnings Preview: We Need To Talk About Keytruda's LOE

Merck & Co will announce Q2 2024 earnings on July 30th. Merck's share price has risen 65% in the past 3 years, driven by the success of Keytruda, the world's best-selling drug. Keytruda revenues were up 25% year-on-year in Q1 2024, contributing nearly 45% of Merck's total revenues last quarter.

Should You Buy, Sell or Hold Merck (MRK) Ahead of Q2 Earnings?

Investor focus is likely to be on the sales of Merck's (MRK) blockbuster oncology medicine, Keytruda, when the company reports second-quarter 2024 earnings.

Merck (MRK) Earnings Expected to Grow: Should You Buy?

Merck (MRK) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Merck's RSV drug meets main goals of mid-to-late stage trial

Merck said on Tuesday its respiratory syncytial virus (RSV) drug met the safety and efficacy goals in a mid- to late- stage study testing it in infants.

Merck (MRK) Stock Sinks As Market Gains: Here's Why

Merck (MRK) closed at $125.69 in the latest trading session, marking a -0.06% move from the prior day.

Looking for Stocks with Positive Earnings Momentum? Check Out These 2 Medical Names

Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

Merck & Co., Inc. (MRK) Is a Trending Stock: Facts to Know Before Betting on It

Merck (MRK) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2 Magnificent Stocks to Buy With $500

Merck's long-term prospects look strong despite a major incoming patent cliff. Novartis' diversified lineup and pipeline, solid results, and dividend record make it an excellent pick.

Merck (MRK) Up 17% YTD on Keytruda Strength: Should You Buy?

Merck (MRK) stock is being driven by the strong sales of key products like Keytruda and Gardasil and positive pipeline and regulatory developments.

Merck: Positive Developments, But Watch The Q2 Earnings

Merck's price rise might have stalled in the past quarter, but at least for now, there's potential for some upswing again. Keytruda continues to drive revenue growth, and expansion in its usage along with positive news on other treatments and an acquisition related bump up too, the sales outlook is healthy. Concerns arise, however, regarding the earnings outlook due to the acquisition of Eyebiotech, which can impact non-GAAP EPS and potentially reduce guidance.