MicroStrategy Inc. (MSTR)

Strategy CEO: Still able to raise money in a bitcoin down cycle

Phong Le, Strategy CEO, joins 'Power Lunch' to discuss the company's ties to bitcoin, the long-term thesis for Strategy and much more.

Is Strategy (MSTR) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Strategy (MSTR Stock) Sentiment Is Sinking Faster Than Bitcoin on The Titanic

Shares of MicroStrategy (NASDAQ:MSTR) are trading 20% below their 200-day moving average of $332.74, coinciding with a sharp deterioration in retail investor sentiment.

MSTX: Even If Strategy Doubles Tomorrow, You Will Still Be Down Over -50% YTD

The Defiance Daily Target 2X Long MSTR ETF targets 2x daily returns of Strategy, not cumulative 2x returns over longer periods. MSTX is down over -85% YTD, dramatically underperforming MSTR's -40% decline due to the compounding effects of daily leverage in volatile markets. Even if MSTR doubled overnight, MSTX holders would still face a >50% YTD loss, underscoring the risks of leveraged ETFs in non-trending markets.

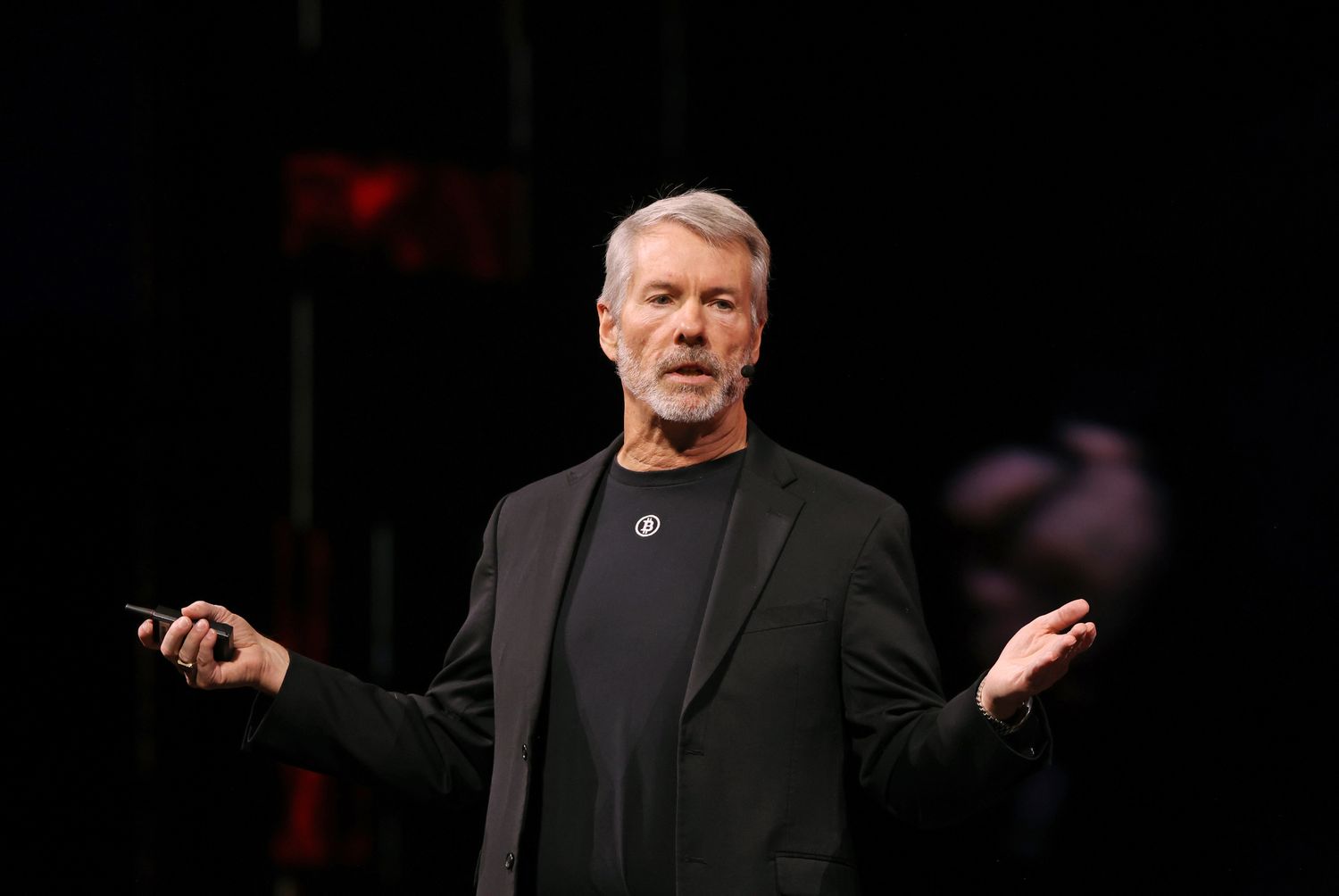

Michael Saylor's Strategy Has Been a Major Bitcoin Buyer. Is the Company About to Sell From Its Stockpile?

The enterprise software company evangelized buying and holding bitcoin. It appears to be changing its tune.

The Contrarian Case for MSTR Amid MSCI Delisting Debacle

Shares of Strategy Inc. NASDAQ: MSTR, formerly known as MicroStrategy, have fallen by 43% year-to-date (YTD), with a substantial portion of this decline taking place in the last month.

Stock Trader's Almanac editor on year-end rally and 2026, Strategy CEO's bitcoin investing outlook

Market Catalysts anchor Julie Hyman breaks down the latest market news for December 2, 2025. Stock Trader's Almanac editor Jeff Hirsch joins Julie for a discussion on market seasonality and how investors should be thinking throughout December, and his concerns for next year.

Strategy (MSTR) Fire Sale: Should you Buy?

While Strategy remains a polarizing stock, many of the most significant risks appear priced in already. The combination of a historical NAV discount, panic-driven sentiment across crypto, and strong technical support provides a compelling rebound setup.

Bitcoin Selloff Triggers Strategy Stock Slide, Forecast Cut

Crypto treasury and software stock Strategy Inc (NASDAQ:MSTR) was last seen trading down 10.8% at $158.95, plummeting alongside crypto leader Bitcoin (BTC) , as it slides further below $87,000.

Strategy shares tumble amid Bitcoin selloff

Strategy, formerly MicroStrategy Incorporated (NASDAQ:MSTR), shares plunged more than 10% on Monday following a sharp drop in Bitcoin prices and the company's announcement of a new US dollar reserve. Bitcoin was down 6.6% at about $84,500, sharply lower than its highs above $100,000 at the start of November.

Strategy Inc (MSTR) Is a Trending Stock: Facts to Know Before Betting on It

Strategy (MSTR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

MSTR Shares Implodes as BTC and Investor Sentiment Both Plummet

Shares of MicroStrategy (NASDAQ: MSTR) are down 40% from October highs, mirroring Bitcoin's decline from its $104,050 peak on November 13 to $90,903 today.