NextEra Energy, Inc. (NEE)

NextEra: Data Centers And Reshoring Activities Will Boost Renewables Demand

NextEra is well positioned to benefit from rising electricity demand thanks to data centers (AI) and reshoring activities. The company delivered a strong quarter marked by renewables bookings with a critical win from Google. NextEra has a solid asset base and offers downside protection. Recycling activities demonstrate this.

NextEra (NEE) Up 7.5% Since Last Earnings Report: Can It Continue?

NextEra (NEE) reported earnings 30 days ago. What's next for the stock?

Is NextEra (NEE) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

3 Stocks That Raised Their Dividend in Each of the Last 3 Recessions

RTX offers investors resilient dividend growth. Sherwin-Williams is a boring business, but its stock is anything but.

NextEra Energy, Inc. (NEE) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to NextEra (NEE). This makes it worthwhile to examine what the stock has in store.

FE vs. NEE: Which Stock Is the Better Value Option?

Investors looking for stocks in the Utility - Electric Power sector might want to consider either FirstEnergy (FE) or NextEra Energy (NEE). But which of these two stocks offers value investors a better bang for their buck right now?

3 Dividend Stocks to Double Up on Right Now

NextEra Energy is targeting 10% annual dividend growth. Parker-Hannifin is a multi-bagger stock with an impeccable dividend track record.

Investors Heavily Search NextEra Energy, Inc. (NEE): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to NextEra (NEE). This makes it worthwhile to examine what the stock has in store.

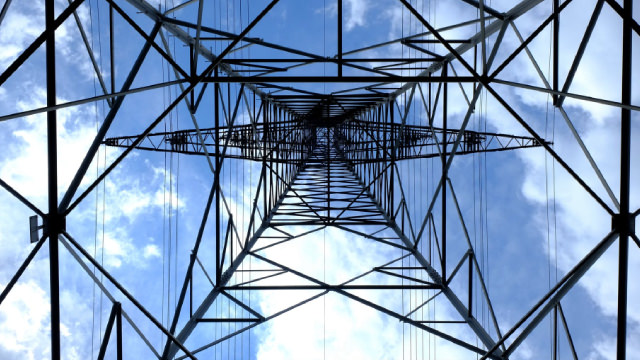

1 Top Energy Stock Built for This Once-in-a-Generation Opportunity

U.S. power demand is on track to surge over the next two decades. That should drive even more robust demand growth for renewable energy.

How Much Will NextEra Energy Pay Out in Dividends This Year?

NextEra Energy is an electric utility that offers a 2.9% forward dividend yield. The company has hiked its dividend at an 11% CAGR over the past decade.

3 Dividend Stocks to Buy on the Dip: July 2024

After Wednesday's painful market sell-off, investors seeking value and bountiful dividend stocks may have more of a chance to pounce. Indeed, the broader market indices are fresh off their worst day since 2022.

12%+ Yields: 1 Very Overrated And 1 Very Underrated Dividend Stocks

High-yield stocks offer attractive dividend yields and potential for passive income growth and total return. However, investors need to look beyond juicy yields and popular names when picking high-yield stocks. We share one very overrated and one very underrated 12%+ yielding dividend stocks.