Newmont Corporation (NEM)

Newmont Corporation (NEM) Stock Declines While Market Improves: Some Information for Investors

Newmont Corporation (NEM) closed the most recent trading day at $58.09, moving 2.3% from the previous trading session.

Are You Looking for a Top Momentum Pick? Why Newmont Corporation (NEM) is a Great Choice

Does Newmont Corporation (NEM) have what it takes to be a top stock pick for momentum investors? Let's find out.

Newmont Corporation (NEM) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Newmont (NEM). This makes it worthwhile to examine what the stock has in store.

NEM's Divestments Drive Tier-1 Focus: Will Streamlining Unlock Value?

NEM sheds non-core assets to sharpen Tier-1 focus, cut debt and fund high-return growth projects.

Newmont Corporation (NEM) Beats Stock Market Upswing: What Investors Need to Know

In the most recent trading session, Newmont Corporation (NEM) closed at $59.46, indicating a +2.11% shift from the previous trading day.

Newmont (NEM) Upgraded to Strong Buy: Here's Why

Newmont (NEM) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

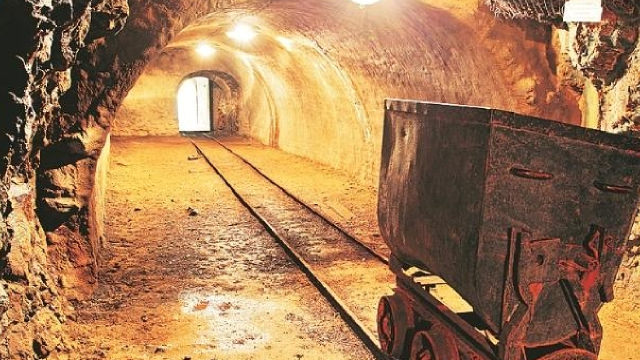

5 Gold Mining Stocks to Buy as Industry Prospects Look Bright

With rising gold prices and solid demand boding well for the Zacks Mining - Gold industry, investors may scoop up stocks like NEM, FNV, KGC, EGO and NGD.

Newmont Gains 22% in 3 Months: How Should Investors Play the Stock?

NEM climbs 22% in 3 months, fueled by gold's surge on strong safe-haven demand and rising earnings estimates.

NEM's Gold Output Hit by Divestments: Can Tier-1 Assets Close the Gap?

NEM's gold production dropped in Q1 as it exited non-core assets, with Tier-1 mines now facing pressure to deliver.

Here's Why Newmont Corporation (NEM) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

Newmont (NEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Newmont Corporation (NEM) Recently Broke Out Above the 20-Day Moving Average

Newmont Corporation (NEM) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, NEM broke through the 20-day moving average, which suggests a short-term bullish trend.