Newmont Corporation (NEM)

Newmont Corporation (NEM) Reports Next Week: Wall Street Expects Earnings Growth

Newmont (NEM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Newmont (NEM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why Newmont Corporation (NEM) Outpaced the Stock Market Today

In the latest trading session, Newmont Corporation (NEM) closed at $47.52, marking a +0.74% move from the previous day.

Newmont: Big Turnaround Story Is Unfolding Before Our Eyes

Newmont Corporation investors are enjoying a remarkable revival. Fed Chair Jerome Powell didn't rock the boat in his recent congressional testimony. It has set the stage for Newmont's continued turnaround, as inflation and supply chain headwinds are expected to cool further.

Newmont Corporation: Now On A Run With Its Companion - Gold

Newmont Corporation, a gold producer, changed course in February and is now running with the price of gold. A merger last year left investors uncertain about its future. Newmont is focused on maintaining a strong balance sheet and generating massive amounts of free cash flow.

Newmont Corporation (NEM) Stock Declines While Market Improves: Some Information for Investors

Newmont Corporation (NEM) closed the most recent trading day at $44.13, moving -0.85% from the previous trading session.

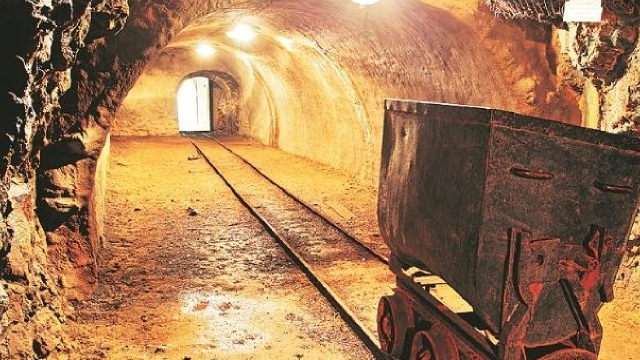

Teck Resources And Newmont Corp: A Golden Long/Short In The Mining Space

Undervaluation in Newmont along with over optimism in Teck's price leaves a unique opportunity to go long Gold and short Coal. Newmont continues to show growth in its pipeline, proving management's ability to think years ahead. Significant run up in Gold prices gives Newmont tailwinds for years to come.

Newmont (NEM) Gains 12% in 3 Months: Should You Buy the Stock?

While Newmont's (NEM) robust portfolio of growth projects, solid financial health, healthy growth trajectory and attractive dividend yield paint a promising picture, its high production costs warrant caution.

A Slow Recovery for Newmont

Newmont Corporation (NEM, Financial) released its first-quarter earnings on April 25. It was a significant quarter because the Newcrest acquisition was finalized on Nov. 6, 2023, so metals production fully reflects the merger's completion.

Wall Street Analysts Think Newmont (NEM) Is a Good Investment: Is It?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

2 Of My Top Gold Stocks For This Gold Bull Market: Newmont And Sandstorm

Gold should continue to shine and protect investors from inflation, and gold mining stocks are the best way to play the gold bull market. Newmont has substantially underperformed and is arguably the most compelling risk/reward play in the sector. Sandstorm is the most undervalued of all the top streaming and royalty stocks in the sector and has considerable upside.

Newmont Corporation (NEM) Stock Dips While Market Gains: Key Facts

Newmont Corporation (NEM) closed the most recent trading day at $41.90, moving -1.64% from the previous trading session.