Netflix Inc. (NFLX)

Markets Reflect Flattish - Q3 Earnings from NFLX, TXN, MAT

While the S&P 500 and Nasdaq were modestly on either side of zero, the Dow finished the session up +0.47% and the small-cap Russell 2000 was -0.49%.

Netflix Executives Downplay Any Interest In Warner Acquisition

Netflix is also said to be among the interested buyers in Warner Bros. Discovery after the Hollywood media company officially put itself on the market earlier in the day, saying it had several potential interested suitors.

Netflix CEOs Ted Sarandos & Greg Peters Weigh In On Media M&A With WBD In Play

Netflix co-CEO Greg Peters took another dig at big media M&A today as Warner Bros. Discovery formally put itself in play, calling studio mergers no sort of solution to the industry's challenges. “You have to do that by the hard work of developing those capabilities in the trenches day to day.

Netflix Shares Down 5% After Q3 Earnings: Everything You Need to Know

Netflix (Nasdaq: NFLX) reported Q3 earnings after the bell today.

Netflix shares drop after streamer misses earnings estimates, citing Brazilian tax dispute

CNBC's Julia Boorstin reports on Netflix earnings.

Netflix revenue climbs but EPS falls short; shares slide

Netflix Inc (NASDAQ:NFLX, ETR:NFC) reported third-quarter earnings that slightly missed Wall Street expectations for per-share profit, even as revenue and cash flow continued to grow, underscoring the streaming giant's ongoing expansion amid rising content costs. For the quarter ended September 30, Netflix's revenue rose 17% year-on-year to $11.51 billion, just below analysts' estimate of $11.52 billion.

Netflix shares fall after company reports profit miss

The company's earnings came in below expectations, with the stage set for big gains with the company's ad business in the fourth quarter.

Netflix stock drops 6% after earnings miss due to Brazilian tax fight

Netflix generated record revenue last quarter, but it incurred an approximately $619 million expense due to a tax dispute. Shares fell 6% after hours as its operating income came in below expectations.

Netflix is Set to Report Earnings Today. Hits Like 'KPop Demon Hunters' Likely Drove Strong Results

Can Netflix keep up its recent momentum and maintain its reputation as a streaming winner?

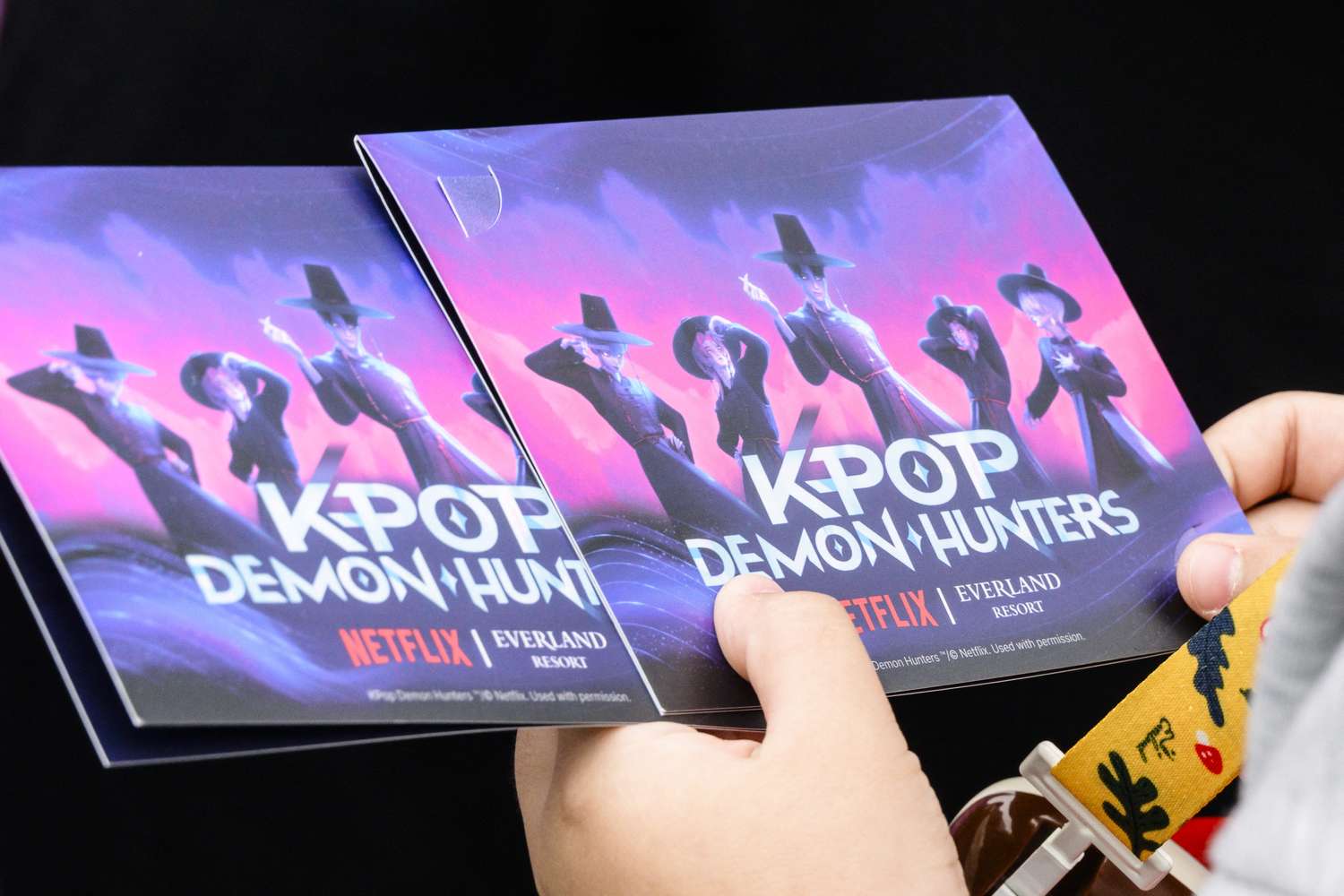

Netflix strikes 'KPop Demon Hunters' toy deals with both Mattel and Hasbro

Netflix has signed on Mattel and Hasbro to make toys and consumer products based off "KPop Demon Hunters." Mattel will handle dolls, action figures, accessories and playsets, while Hasbro will focus on plush, electronics, roleplay items and board games.

Earnings Preview: What To Expect From Netflix Results

Netflix Inc. Inc. scheduled to report earnings after Tuesday's close. The stock hit a record high of $1,341/share in June 2025 and, as of this writing, it is currently trading near $1,240.

Netflix Earnings Preview: Expectations Rather 'Meh' Pre-Earnings Likely A Good Thing

The stock has traded in a narrow range the last few months, gyrating around its 50-day moving average at $1,214. Analysts are expecting Netflix to earn $6.96 in earnings per share on $11.52 billion in revenue, for expected y-o-y growth of 29% and 17%, respectively. Closing at $1,238 today, Monday, October 20, 2025, Netflix is trading at 47x earnings for expected EPS growth of 33% in 2025, so the stock is somewhat cheaper vs its expected '25 EPS growth rate.